Nvidia shares moved higher in early Tuesday trading, extending the stock's solid one-month gain to around 24% and overtaking Microsoft (MSFT) as the market's second-most valuable company, following a key update on the pace of Blackwell chip production heading into the coming year.

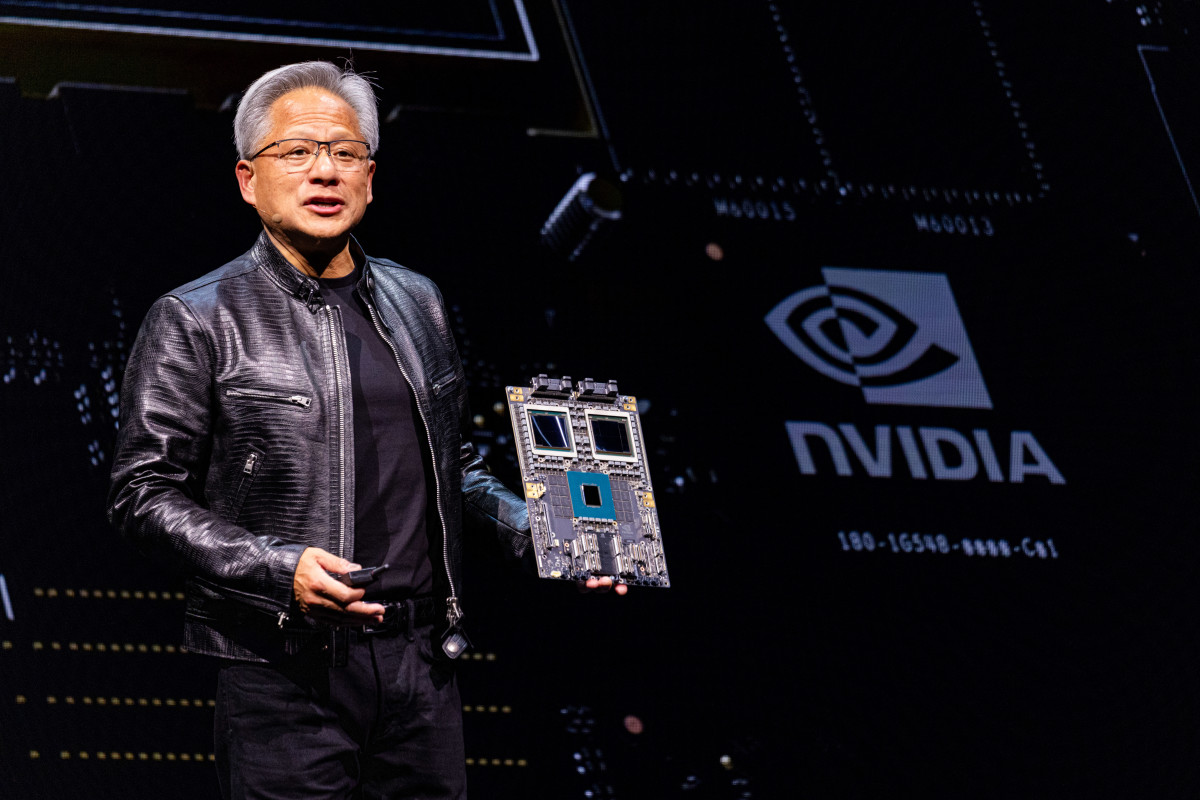

Nvidia (NVDA) , which holds a commanding share of the market for both AI-powering chips and broader processing systems, is looking to ramp production of its new Blackwell architecture in coming months following design delays reported earlier this summer.

Don't miss the move: Subscribe to TheStreet's free daily newsletter

The AI-demand story is also highlighting Nvidia's place in the overall supply chain follow a massive move higher in Super Micro Computer (SMCI) yesterday tied to its robust update on sales of its servers, which include Nvidia chips.

Micron Technology (MU) , a key Nvidia supplier, has also performed well over the past month, and posted its best quarterly revenue growth in a decade in late September while issuing a robust near-term forecast for its high bandwidth memory chips.

Nvidia, for its part, told investors in late August that it saw current-quarter revenue in the region of $32.5 billion despite some delays in the shipment of its new line of Blackwell processors, which stemmed from design changes and supply-chain snarls.

Nvidia: Blackwell output yield improved

Nvidia said it executed a "change to the Blackwell GPU mask to improve production yield," adding that the ramp was "scheduled to begin in the fourth quarter and continue into fiscal 2026."

Finance chief Colette Kress said Blackwell should generate "several billion" in revenue for Nvidia's fiscal fourth quarter, which ends in January, adding that legacy Hopper sales would accelerate over the second half of the year.

That has proved important for investors, who had worried that the Blackwell launch would trigger some cancellation or postponement of Hopper orders as customers waited for the new and more powerful processors and systems to hit the market.

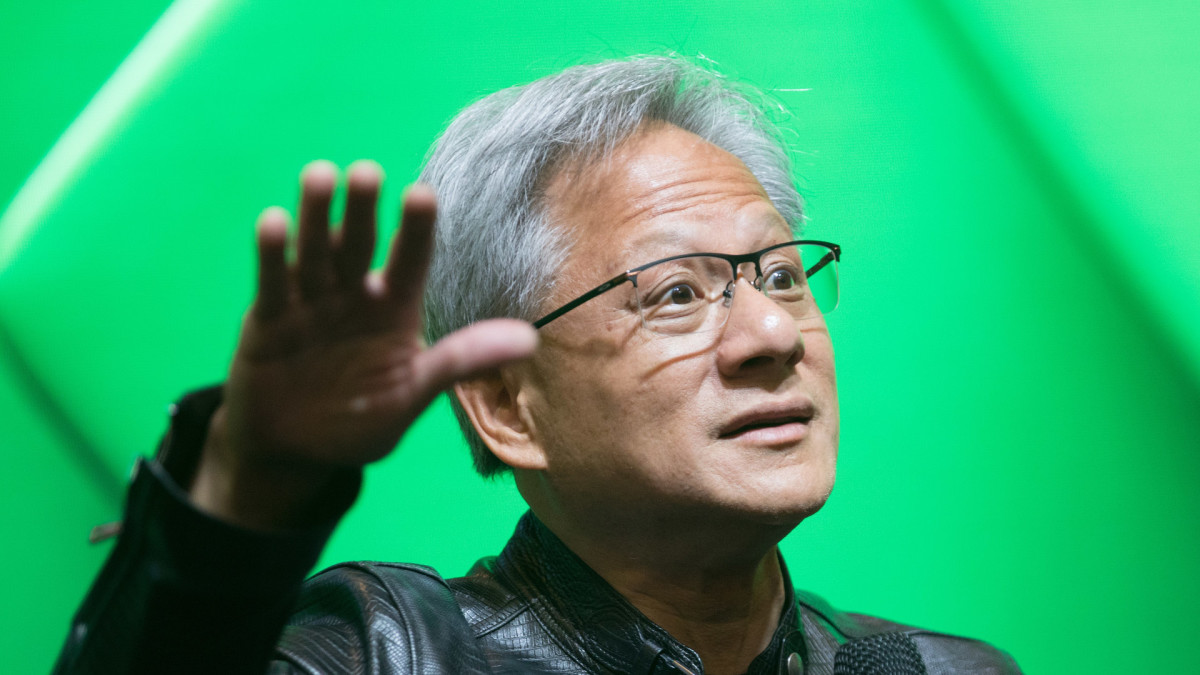

Related: Nvidia CEO's bombshell raises the bar for the stock

Morgan Stanley analysts, in a note published Tuesday, were upbeat on Blackwell's potential impact on the group's top line heading into the final months of the year.

"According to our checks of the GPU-testing supply chain, Blackwell chip output should be around 250,000-300,000 in [the fourth quarter], contributing $5 billion to $10 billion in revenue, which is still tracking [Morgan Stanley lead analyst] Joe Moore's bullish forecast."

The note also suggested that Blackwell production would soon outpace that of Nvidia's legacy Hopper chips, perhaps as early as the start of next year.

"Blackwell chip volume may reach 750,000 to 800,000 units, up almost 3 times from [the fourth quarter]," the investment bank said.

Related: Analysts race to overhaul Micron stock price targets after earnings

"Meanwhile, we expect Hopper volume (including H200 and H20) to be around 1.5 million units in [the fourth quarter], and gradually ramp down to 1 million units in first-quarter 2025," the note added. "Given B200 chip price is around 60%-70% higher than H200, Blackwell revenue should surpass Hopper in 1Q25."

Evidence of the longer-term demand for Blackwell was also in focus Tuesday after Foxconn, the world's biggest contract electronics manufacturer, said it would build a new facility - "the largest GB200 production facility on the planet," according to company executive Benjamin Ting - in Mexico.

Nvidia shares were marked 3.5% higher in premarket trading to indicate an opening bell price of $132.18 each. The stock has added around $610 billion in market value since early September, when reports of an antitrust probe into the semiconductor sector by the Department of Justice were first published.

More AI Stocks:

- Apple stock slides as big iPhone 16 bet sputters

- Analyst revisits Meta stock price target as Facebook parent ramps AI spend

- Analyst reviews BlackRock stock rating after AI partnership with Microsoft

Bloomberg News reported that Nvidia received a DoJ subpoena tied to the probe that compels it to provide information.

The DoJ is looking into allegations that Nvidia prevents its customers from easily switching from one chipmaker to another and penalizes companies when they do. The government is also investigating Nvidia's April acquisition of software group RunAI.

Nvidia said in a statement that it "wins on merit," adding that customers are "free to choose whatever solution is best for them."

Related: The 10 best investing books, according to our stock market pros