Back in 2008, Dustin Moskovitz and Justin Rosenstein had an idea.

The two met at Meta Platforms' (META) Facebook, where Moskovitz, a co-founder of the social media giant, was vice president of engineering.

Related: Analysts reboot C3.ai stock price target on Microsoft deal

Rosenstein was the engineering lead and together they created a productivity tool called Tasks.

The pair left Facebook to start Asana, which officially launched for free out of beta in November 2011 and commercially in April 2012

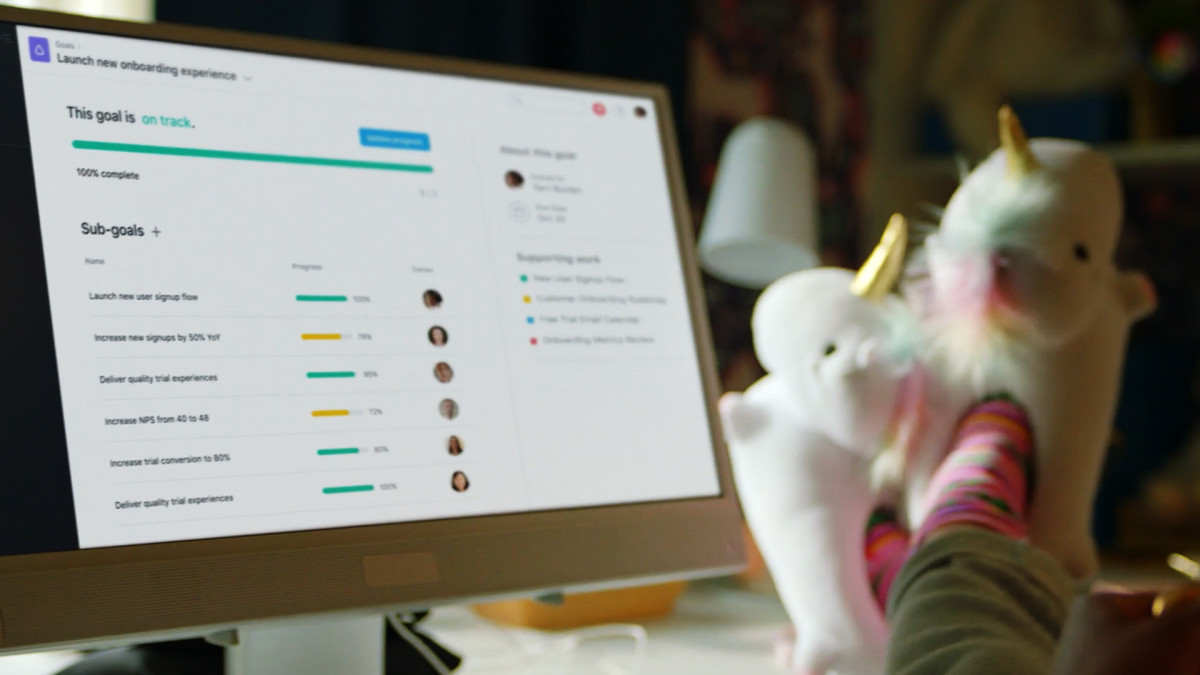

The company went public in 2021, and currently has a market capitalization of $5.04 billion. Asana is a software-as-a-service platform designed for team collaboration and work management.

🚨Last Chance to Grab an Amazing Cyber Week Deal! Get 60% off TheStreet Pro. Act Now Before It’s Gone 😲

Moskovitz is Asana's CEO, while Rosenstein was the company's president for eight years before stepping down in 2019. He still sits on Asana's board.

In October, the company launched AI Studio, a no-code tool that enables users to design and implement AI-powered workflows within the Asana platform.

Asana beat Wall Street's third-quarter expectations and the new tool was a big topic of discussion with analysts.

Asana

Asana CEO cites transformative moment

"This quarter marks a transformative moment for Asana," Moskovitz said during the company's earnings call. "With the launch of AI Studio, we’re officially entering a new era as a multiproduct company."

Related: Analyst revisits Tesla stock price target amid Optimus robotics push

Moskovitz said AI Studio represented more than just a new revenue stream: "It’s an entirely new way to create value for customers as AI transforms how work gets done.

"We believe AI Studio has the potential to eclipse our current revenue scale over time," he said. "The early momentum has been exciting, with significant customer demand across various sectors including media, financial services, manufacturing, healthcare, professional services, and technology.

"We’re seeing customers experience meaningful productivity gains as they integrate AI directly into their everyday workflows, where it can drive measurable impact at scale."

Unlike with stand-alone chatbots, Moskovitz said, teams using AI Studio can seamlessly coordinate work between humans and AI teammates within existing workflows, "all powered by our deep understanding of the relationships between people, work and processes."

"The key thing to understand about AI Studio, he said, is that these are not chatbots. You don’t talk to them. These are workflows with AI agents embedded within them that are automatically initiated in reaction to things people are doing, like filling out forms or changing task statuses."

The earnings call also marked the debut of Chief Financial Officer Sonalee Parekh, who joined the company in September, succeeding Tim Wan.

Parekh's resume also includes positions of CFO at RingCentral and divisional CFO, head of corporate development and investor relations at Hewlett Packard Enterprise (HPE) .

“In my first 90 days I’ve immersed myself into the business and built critical partnerships across the organization,” she told analysts. “As a daily user of Asana, I have experienced first-hand the power of the platform.

"By aligning my team’s work with the overall goals of the company and strengthening the coordination and engagement with my team, I have been able to free up a significant amount of my time from manual work, which is leading to more impactful work."

Regarding AI Studio's benefits, Parekh said that the system is "not just incremental, but also helpful in terms of expansion and stickier customers.

"So not only do you get the upsell, but you also get a stickier customer and higher lifetime value."

Analyst: Asana profit modestly better than expected

Asana earned an adjusted 2 cents a share in the quarter, compared with a loss of 4 cents a year earlier and topping Wall Street’s consensus estimate of a loss of 7 cents.

Revenue totaled $183.9 million, up 10% from a year ago and ahead of analysts’ forecast of $180.6 million.

More AI Stocks:

- Analysts update Salesforce stock price targets ahead of earnings

- Druckenmiller predicted Nvidia's rally, now has new AI target

- The 5 biggest takeaways following Nvidia's earnings

For the fourth quarter, Asana forecast revenue ranging from $187.5 million to $188 million, bracketing the consensus estimate of $187.8 million.

Asana's shares are up nearly 16% year-to-date and off 5.5% from a year ago.

The stock skyrocketed after the results were announced and Asana's shares were up almost 42% at last check.

Investment firms adjusted their price targets following the earnings report.

JMP Securities raised the investment firm's price target on Asana to $25 from $21 and affirmed an outperform rating on the shares, according to The Fly.

Asana reported modestly better-than-expected Q3 results and guidance was also mostly better than feared, JMP said.

While Asana has yet to reaccelerate, with Q3 being its third consecutive quarter of 10% revenue growth, JMP continues to view the company as an opportunity for capital appreciation.

DA Davidson analyst Lucky Schreiner raised the firm's price target on Asana to $20 from $13 and kept a neutral rating on the shares.

The company had a great start with Parekh in her first quarter as CFO, he said. It beat estimates and raised its outlook across the board as investments start to pay dividends and demand trends stabilize, Schreiner said.

Parekh detailed initiatives to grow revenue and expand margins in fiscal 2026, focusing on more efficient utilizing of current resources, he added.

KeyBanc upgraded Asana to sector weight from underweight without a price target after the earnings report.

The "solid, although not exceptional, fundamental quarter" is seeing strong follow-through in the shares, the analyst tells investors in a research note.

The firm said the post-earnings rally, coupled with Asana's artificial intelligence product extensions, stabilizing retention rates, and a new CFO "who can inject efficiency into the model tell us it's time to move on from our underweight rating."

Related: Veteran fund manager delivers alarming S&P 500 forecast