Nvidia shares edged lower in early Monday trading but are still on pace to add more than $350 billion in value this month, as two top Wall Street analysts issued new price target updates ahead of the AI-chip maker's third quarter earnings report next week.

Nvidia (NVDA) , which last week overtook Apple (AAPL) as the world's most valuable company measured by market capitalization, also replaced struggling chipmaker Intel (INTC) in the Dow Jones Industrial Average as its stunning 2024 gain topped 205%.

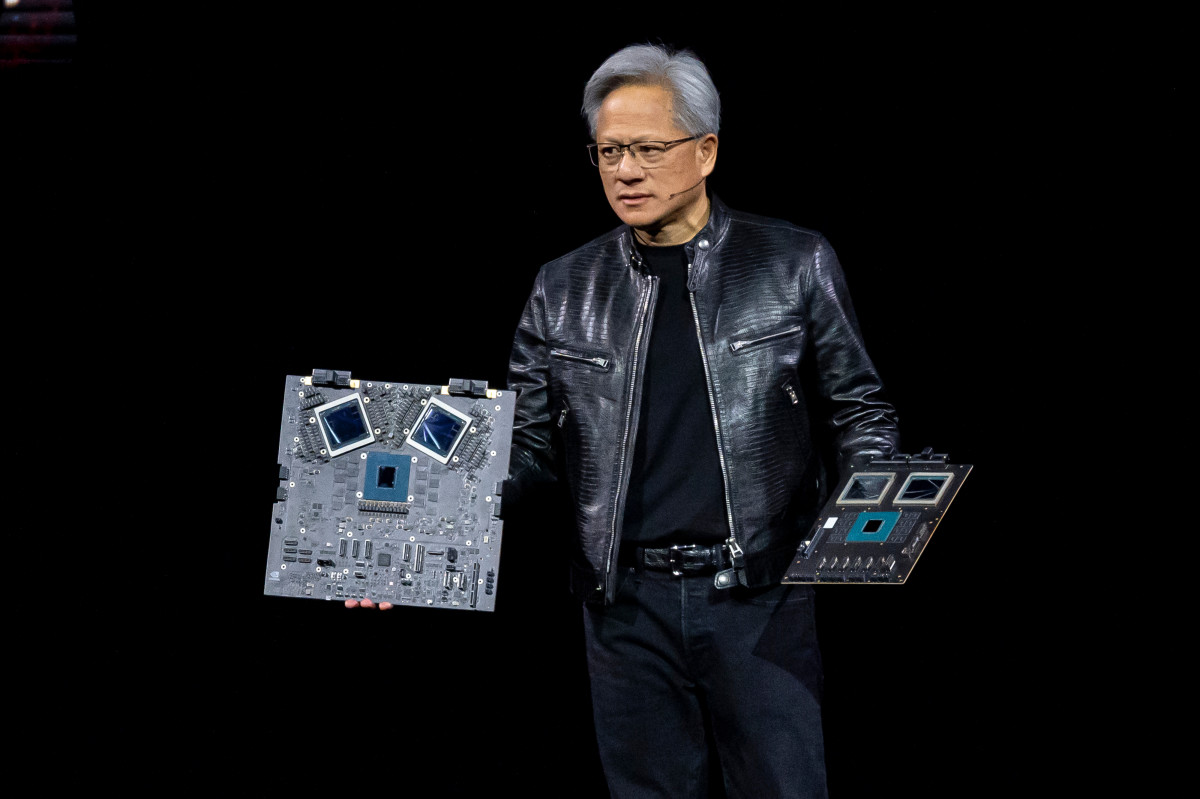

The group is slated to report on Wednesday, Nov. 20, with analysts looking for a massive year-on-year revenue surge of 82%, to just under $33 billion, thanks in part to ongoing demand for its legacy Hopper chips and gains from its newly released line of Blackwell processors.

Related: Top analyst overhauls Tesla stock price target amid post-election surge

Nvidia told investors in late August that Q3 revenue would be in the region of $32.5 billion, more than double the tally of the year-earlier period. However, the company faced some delays in shipping its new line of Blackwell processors amid design changes and supply-chain snarls.

Nvidia's grip on the market for so-called AI accelerators, which power the large datasets and language models used by companies such as Google parent Alphabet (GOOGL) , Microsoft (MSFT) , Amazon (AMZN) and Meta Platforms (META) , likely means it will also guide investors to impress revenue gains over the coming year as well.

UBS analysts see the four biggest hyperscalers, all of which posted third-quarter earnings this week and form the spine of the global AI-investment race, spending $267 billion on capital projects tied to the new technologies next year, a 33.5% increase from this year's forecast.

Demand for AI chips is accelerating

Even Tesla (TSLA) , which is chasing CEO Elon Musk's bold ambitions of autonomous robotaxis and other self-driving electric vehicles, expects to spend around $11 billion this year "largely because of investments in AI compute."

"Our belief is that the total addressable market for AI accelerators will expand by ~$70 billion in 2025, with Nvidia well positioned to capture most of this increase, ceding only a small portion to merchant chip competitors," said Piper Sandler analyst Harsh Kumar in a note published Monday.

Related: Nvidia to reap billions in big tech AI spending

Kumar, who lifted his price target on Nvidia by $35 to $175 a share, said supply constraints would likely mean only modest revenue beats over the October quarter and the three months ending in January, but he expects more AI-powered growth into 2025.

"We anticipate management will highlight extremely strong demand for the H200, as well as the Blackwell and Grace Blackwell architectures," Kumar said.

Last week, in fact, Nvidia CEO Jensen Huang asked SK Hynix of South Korea to speed up deliveries of its high-bandwidth-memory chips, which help AI systems run more efficiently and use less power, in order to help it meet the surge in demand.

AI-chip supply is seen constrained

Morgan Stanley analyst Joseph Moore also sees supply constraints holding back Nvidia from issuing larger upward revisions to its revenue forecasts. But he still sees "several billion" in January-quarter sales for Blackwell as well as modest growth for the Hopper line.

"We are back to fully supply constrained on new products, which could limit upside on current quarter and outlook," said Moore, who lifted his Nvidia price target by $10 to $160 a share in a note published Monday.

More AI Stocks:

- Nvidia to reap billions in big tech AI spending

- Analysts reset ServiceNow stock price targets after earnings, AI update

- Alphabet stock leaps as Google parent crushes Q3 earnings

"The company highlighted on the last earnings call that there would be several billion of Blackwell in the January quarter, and we expect that number to land at close to $5 billion or $6 billion, above the implied number but slightly lower than expectations from a few weeks ago," he said.

"Demand signals show no signs of moderating, and while it's hard to calibrate the exact amount of upside, we expect to maintain recent trends," Moore added.

Nvidia shares were marked 1.2% lower in early Monday trading to change hands at $145.62 each, a move that would still leave the stock with a six month gain of around 61%.

Related: Veteran fund manager sees world of pain coming for stocks