You're not going to find any corn in this silo.

While the word "silo" stems originates from the Greek term for "corn pit," it also has other meanings that you're not going to find down on the farm.

Related: AMD bets on huge market to win AI chip battle with Nvidia

The word can mean operating in isolation or refer to the underground chamber where guided missiles are kept ready to be fired.

And in the multi-trillion artificial intelligence battle zone, it looks like Advanced Micro Devices (AMD) just pressed the button.

AMD, which is scheduled to report second-quarter earnings in a few weeks, has been competing with chipmaking colossus Nvidia (NVDA) , which briefly surpassed Microsoft (MSFT) as the world's most valuable company.

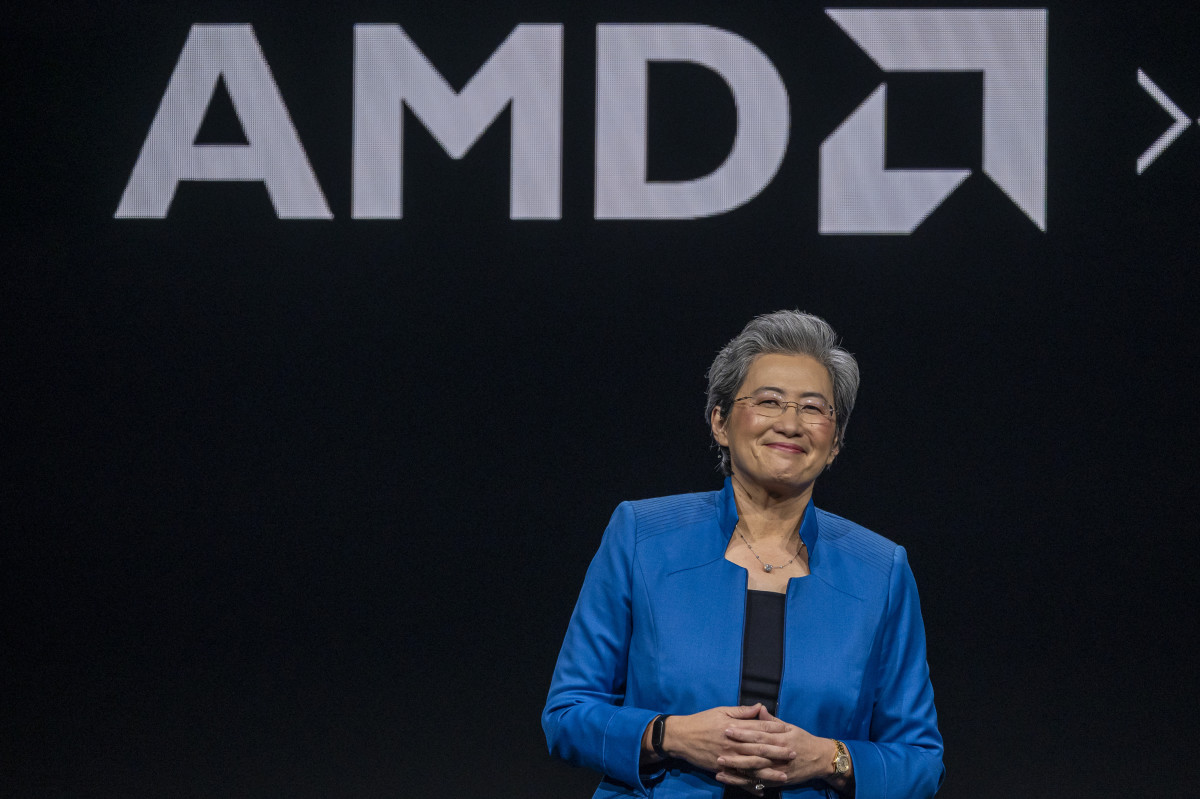

"This is an incredibly exciting time for the industry as the widespread deployment of AI is driving demand for significantly more compute across a broad range of markets," Lisa Su, president and CEO told analysts back in April.

AMD is expanding AI footprint

"Under this backdrop, we are executing very well as we ramp our data center business and enable AI capabilities across our product portfolio," Su said.

There's a lot to be excited about with AI--starting with the money.

Related: Analysts reboot AMD stock price targets on AI market outlook

The value of the generative-AI, or GenAI, market is projected to grow to $1.3 trillion over the next 10 years, according to a report from Bloomberg Intelligence. AI-related hardware could reach $640 billion by 2032 from less than $40 billion in 2022.

The market analyst firm Canalys predicted a rapid rise in AI-capable PC shipments, reaching 19% in this year and surging to 60% by 2027, with a strong focus on the commercial sector.

Companies are going to need all sorts of firepower to take on their competitors, and with that in mind, AMD announced an agreement to acquire Silo AI, described as the largest private AI lab in Europe, for about $650 million in cash.

Helsinki, Finland-based Silo AI specializes in end-to-end AI-driven solutions that help customers integrate the tech into their products and services.

Acquiring Silo AI will help AMD improve the development and deployment of AMD-powered AI models and help potential customers build complex AI models with the company's chips, the company said.

According to Reuters, the acquisition is AMD's latest move in a series of moves to expand its presence in the AI landscape.

Last year, the company acquired AI software firms Mipsology and Nod.ai and has invested more than $125 million across a dozen AI companies over the last 12 months.

Analysts reacted positively to AMD's latest move.

Wells Fargo analyst Aaron Rakers raised the firm's price target on AMD to $205 from $190 and kept an overweight rating on the shares.

Related: Analyst resets Nvidia stock price target in chip-sector overhaul

Rakers said that he views AMD's acquisition of Silo AI as a positive tactical and strategic move focused on deepening AMD's internal open-source AI software expertise, the analyst tells investors in a research note.

Analysts cite 'improving software position'

Roth MKM raised the firm's price target on AMD to $200 from $180 and kept a buy rating on the shares.

The firm believes AMD's recent AI software acquisition and the multiple additional acquisitions that came previously can drive increasing adoption of open-source AI software tools and help close the gap with leading proprietary AI frameworks.

More AI Stocks:

- Analyst adjusts Nvidia stock rating on valuation

- Analyst revises Facebook parent stock price target in AI arms race

- Google falling behind climate goals thanks to AI ramp up

Roth analysts said they think the company's improving software position will increase traction for its Instinct AI processor family, which replaced AMD's FirePro S brand in 2016.

After AMD announced the acquisition, analysts at Stifel said that the set of AI tools reminds them of Nvidia's recently launched Nemo Inference Microservices, or NIMs, a collection of cloud-native microservices that simplify and accelerate the deployment of generative AI models across a variety of environments,

The firm views the acquisition positively and sees it as another proof point that providing an AI stack, which includes various layers of software, will increasingly drive competitive differentiation.

Roth kept a buy rating and a $200 price target on AMD shares.

TheStreet Pro’s Stephen Guilfoyle recently shared his thoughts on the semiconductor sector, telling readers that he is on long AMD, Nvidia, and memory storage company Micron Technology (MU) .

“Basically, my idea was to invest in high-end cloud and then AI-capable GPUs, and the memory that they'll need to accomplish all that will be required of them," he said in his July 9 column.

"I correctly saw Nvidia as the runaway name in the space (not a difficult call) and bet on AMD as what I thought would be runner-up in the category. AMD might be number two, but the gap is far larger than I had expected," he said.

Guilfoyle said he has enjoyed investing in companies run by Lisa Su and Jensen Huang, Nvidia's president and CEO, "as both of them have made me look smarter than I am over the years."

"I do not have the same warm and fuzzy feelings for Sanjay Mehrotra as I do those other CEOs as I have both won and lost a few bets on his performance over the years," he said of Micron's top executive.

Related: Veteran fund manager sees world of pain coming for stocks