All good things must come to an end, and Computex Taipei 2024 was no exception.

The massive computer and technology trade ran from June 4 to 7 and attracted nearly 86,000 ITC buyers and professionals.

Related: AMD fires latest shot at Nvidia in AI-chip war

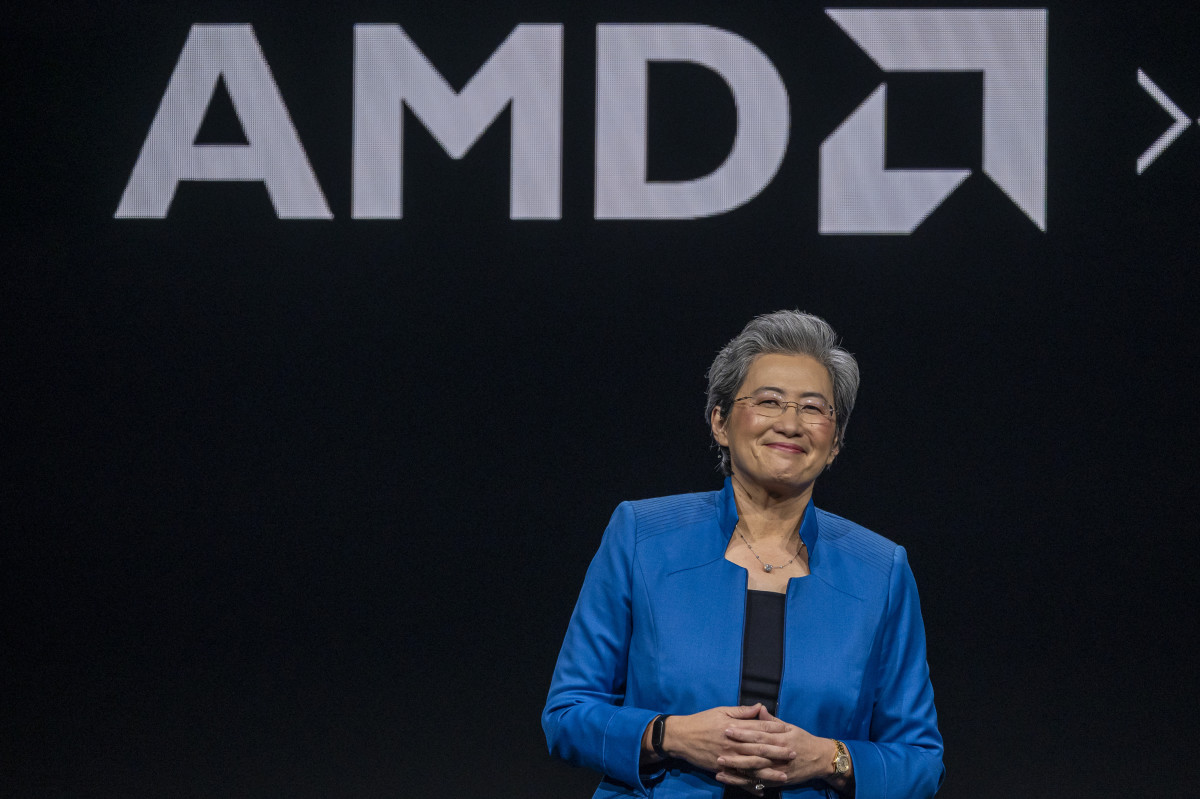

One of those attendees was Lisa Su, president, CEO, and chair of Advanced Micro Devices AMD. On June 8, she took to X, formerly Twitter, to say farewell.

"Wrapped up the week in Tainan at the Southern Semiconductor Forum - highlight was a chat with high school kids interested in semiconductors and AI!!" she wrote. "Thank you for a fantastic week!

During her keynote address, Su showcased the growing momentum of the AMD Instinct accelerator family.

AMD also introduced its Ryzen AI 300 Series processors with a neural processing unit for next-generation AI personal computers and its next-gen AMD Ryzen 9000 Series processors for desktops.

TheStreet/Shutterstock/David Becker/Stringer/Getty Images

AMD analyst dubious about AI expectations

"Built for the future, AMD Ryzen AI 300 Series processors are the next step in modern computing, delivering next-generation improvements in performance, AI experiences, and graphics," the company said on its website.

The future is what AMD is fighting for as the company looks to stake a claim in the artificial intelligence market, which, by some estimates, could grow to $1.3 trillion over the next decade.

Related: Analysts reset Nvidia stock price targets amid split, Dow entry talk

Nvidia (NVDA) , which recently crossed the $3 trillion market-capitalization threshold, is the reigning AI heavyweight champion.

On Monday, Nvidia's stock began trading with its new 10-for-1 stock-split adjustment.

Meanwhile, earth imaging company Planet Labs PBC (PL) announced it is collaborating with NVIDIA on its onboard processing capabilities for its high-resolution Pelican-2 satellite.

Analysts had differing views on AMD's current position in the market.

On Monday, Morgan Stanley analysts downgraded AMD to equal weight from overweight, keeping the price target of $176 unchanged.

The firm likes the AMD story but said investor expectations for the artificial intelligence business still seem too high.

Morgan Stanley sees limited upward revision potential for AMD's AI exposure from here and prefers Nvidia and Broadcom (AVGO) among large-cap AI semi-stocks.

AMD looks expensive relative to other large-cap AI plays that Morgan Stanley believes will benefit more from upward revisions to AI forecasts, the firm told investors in a research note.

Meanwhile, Susquehanna analyst Christopher Rolland raised the firm's price target on AMD to $200 from $185 and kept a positive rating on the shares.

The analyst tells investors in a research note that server checks are improving and support a stronger second half of 2024.

Rolland said many in the supply chain suggest builds could now increase by double-digit percent year-over-year.

AMD to take 'modest server share'

Revenue in the server market is projected to reach $95.65 billion this year, according to Statista.

AMD is expected to take a modest server share through the second half of 2024, and requests from cloud service providers for new Application-Specific Integrated Circuit (ASIC) projects are accelerating. The analyst said some design houses receive new proposals every few weeks.

More AI Stocks:

- Apple's AI launch at WWDC could hinge on something it hates to do

- Analyst revamps Microsoft stock price target despite controversy

- Analysts race to reset HPE stock price targets as AI powers earnings

In April, AMD announced the AMD Alveo MA35D media accelerator featuring two 5nm, ASIC-based video processing units (VPUs) supporting the AV1 compression standard and purpose-built to power a new era of live interactive streaming services at scale.

"With over 70% of the global video market being dominated by live content1, a new class of low-latency, high-volume interactive streaming applications are emerging, such as watch parties, live shopping, online auctions, and social streaming," AMD said.

Susquehanna analysts also raised their price target on Nvidia to $1,450 from $1,200 while maintaining a positive rating on the shares.

The firm said that its discussions and checks across the supply chain quelled its fears of an "artificial intelligence "air pocket" in Nvidia's transition from Hopper to Blackwell in the second half of 2024.

Analysts said they now have confidence in a "sustained and smooth transition."

Last week, Raymond James analyst Srini Pajjuri said he believed that the traditional server market is due for a refresh, given the aging installed base.

AMD expects share gains in servers to continue driven by its upcoming Turin, the company’s name for AMD’s Zen 5-based EPYC server processors, Pajjuri said.

The company has a roughly 33% share in servers and sees the Enterprise segment as the biggest opportunity although Intel’s incumbency presents a significant challenge, the analyst added.

Related: Single Best Trade: Wall Street veteran picks Palantir stock