Nvidia shares moved higher in early Monday trading, and could soon test their March all-time high, as analysts rush to alter their price targets on the world's leading AI-chip maker ahead of its highly anticipated first quarter earnings report later this week.

Nvidia (NVDA) , which fired the starting gun on the market's current AI revolution last year with a stunning revenue forecast tied to a surge in demand for its benchmark H100 processors, has added more than $1.5 trillion in market value over the past 12 months and is one of the top-performing stocks of 2024 with an 88% gain.

Analysts expect the chipmaker, which also provides semiconductors for the gaming and automotive industries, to post net income of $13.2 billion, or $5.63 a share, for the three months ended in April.

That's a fivefold increase from the year-earlier period and is likely to reflect a gross profit margin of around 77%, 10 percentage points wider than the same period last year

Group revenues, meanwhile, are estimated at $24.6 billion, triple last year's first quarter tally, with quarterly sales expected to top the $30 billion mark by the end of its current financial year, which ends in January.

Nvidia: Data-center revenue surging

Data-center revenue, the group's biggest top-line contributor, is forecast to come in at $21.26 billion, a 400% increase from last year.

Gaming revenue is estimated at 20% higher to $2.68 billion while automotive revenue is projected largely flat at $296.4 million.

"Once again, a beat/raise is widely anticipated, with investor focus likely to remain on medium-term sustainability of accelerating AI-infrastructure investment," said Stifel analyst Ruben Roy, who lifted his Nvidia price target by $175 to $1,085 per share.

Related: Nvidia earnings will be crucial to stock market zeitgeist this week

"Our supply-chain checks continue to indicate a robust demand environment for H100/H200 even as excitement around Blackwell continues to grow," he added, referring to the group's new line of AI graphics-processing units, which are expected to hit the market later in the year.

Roy carries a 'buy' rating on the stock.

Nvidia pricing power in focus

Barclays analyst Blayne Curtis, who added $250 to his Nvidia price target, taking it to $1,100 a share, also sees pricing power from the group's H100 and H200 GPU offerings boosting near-term sales.

"All in, checks continue to point to [more than] $1 billion in upside in April and $2 billion in July," Curtis and his team wrote. "We believe the company can capture incremental revenue upside due to pricing on H200, which will start shipping in the July quarter."

"Looking forward, the next major step up in revenue will be from the ramp of the GB200,' said Curtis, who carries a 'neutral' rating on the stock.

Related: Nvidia shares get boost from key supplier ahead of earnings

"The company spoke very positively of the total mix moving towards the complete GB200 solution for hyperscalers, and we don't believe this mix shift is fully appreciated," he added.

The Blackwell GB200, a more expensive series of AI-focused processors, performs AI tasks at more than twice the speed of Nvidia's current H100 and H200 chips while using less energy and providing more bespoke flexibility

Nvidia Blackwell platform to boost outlook

Analysts see the potential for an average selling price around 40% higher than the current range for H100 chips, which go for between $30,000 and $40,000 each.

Baird analyst Tristan Gerra in fact insists there is "no match to Nvidia's products offering this year and next, which, combined with shortening lead times should play well into the second half of the year from a market share standpoint."

Gerra lifted his Nvidia price target by $150 to $1,200, while raising his GPU unit shipment forecast for this year and next. He carries an 'outperform' rating on the stock.

More AI Stocks:

- World's biggest hedge fund boosts its stake in Nvidia stock

- Analysts update Dell stock price targets on Tesla-server win

- Microsoft delivers a blow to Nvidia

Morgan Stanley analyst Joseph Moore, who remains overweight Nvidia with a $795 price target, said recently that the Blackwell launch puts more distance between the tech giant and its chipmaking contenders.

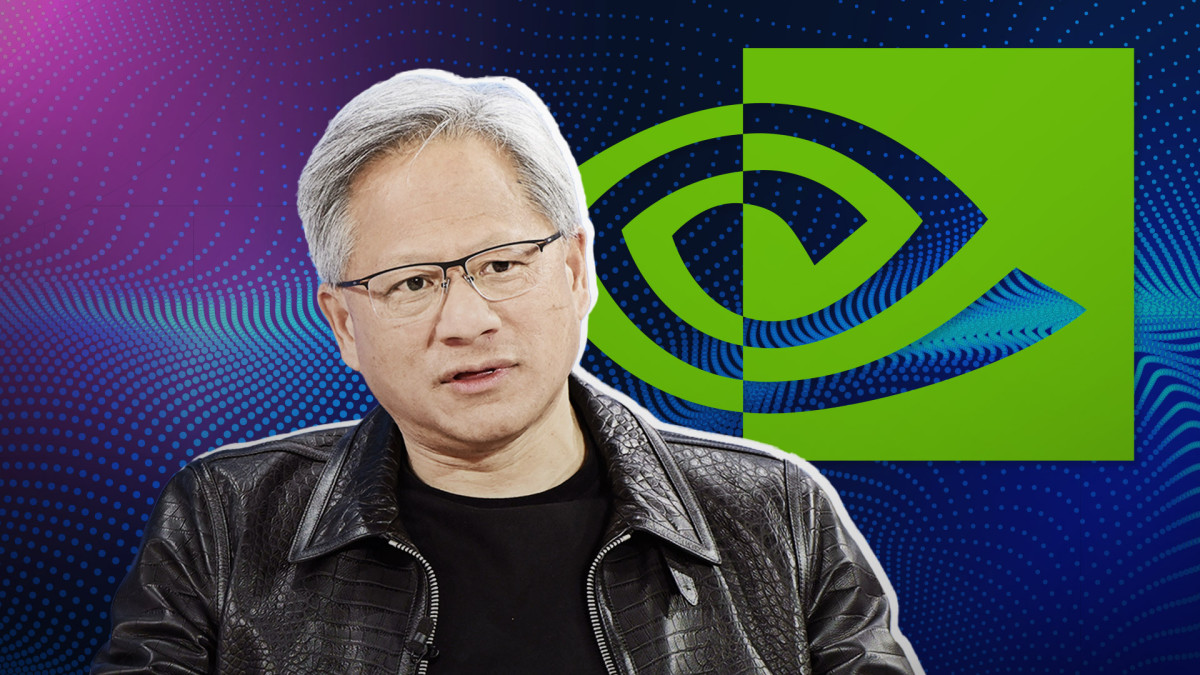

Nvidia CEO Jensen Huang has described Blackwell as "the name of a platform ... not a chip" and the group is selling it as part of a larger stack of servers and chips that comprise a system called the NVL72.

Related: Analysts overhaul Nvidia stock price targets ahead of earnings

"Enthusiasm for NVL72 is core to a growing enthusiasm among investors for next year's growth," Moore and his team wrote in an update published Monday.

"Each of the last 2 quarters Nvidia has beat initial revenue guidance by [about] $2 billion and guided for an incremental about $2 billion; we expect something similar later this week."

Nvidia shares were marked 2.65% higher in early afternoon trading Monday to change hands at $949.07 each, a move that would extend the stock's one-month gain to around 19.4%.

Related: Single Best Trade: Wall Street veteran picks Palantir stock