Nvidia shares opened at an all-time high Thursday, powering through the $1,000 mark for the first time on record, after the chipmaker posted stronger-than-expected first quarter earnings and said AI demand was showing no signs of slowing into the second half of the year.

Nvidia (NVDA) blasted Wall Street forecasts late Wednesday with a bottom line of $6.12 a share on record revenue of $26 billion as demand for its benchmark H100 and H200 AI Hopper chips appeared set to accelerate from the already torrid pace recorded over the past year.

Data center sales, which include the group's key AI offerings, surged more than fivefold from a year earlier to a record $22.6 billion, while group gross margin expanded to 78.9%

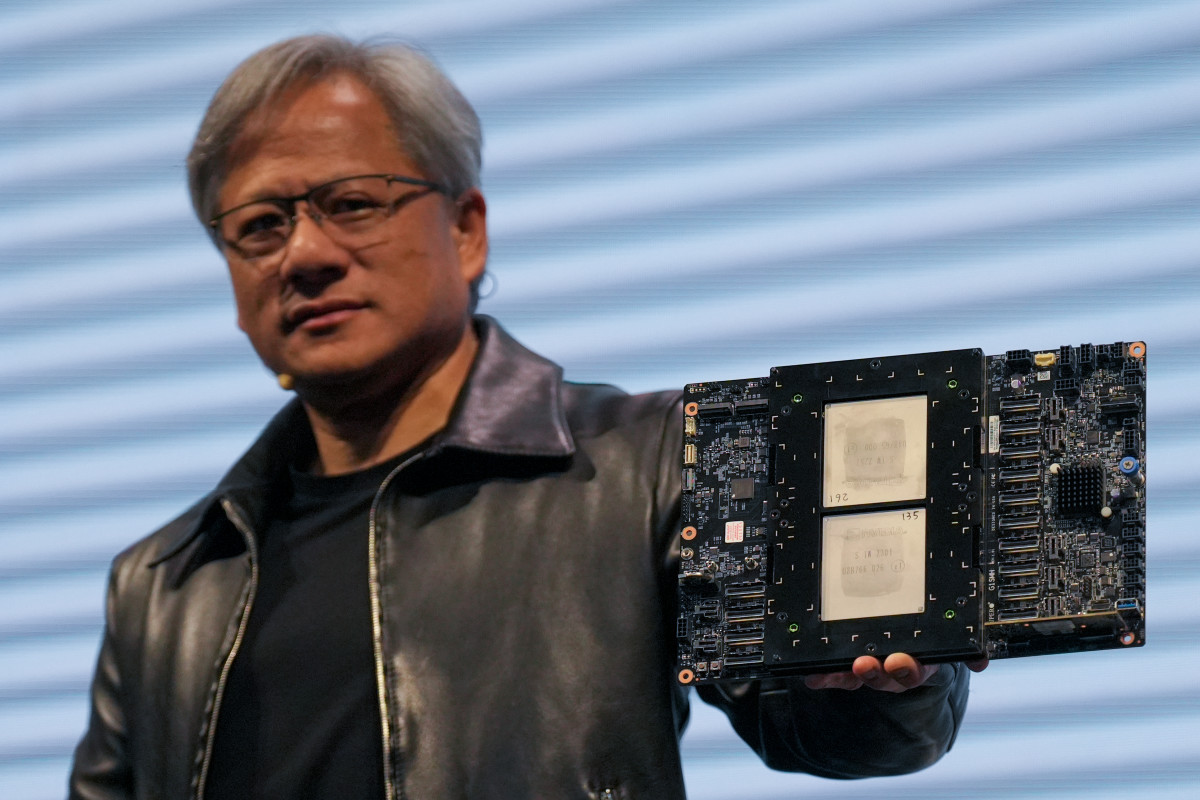

Perhaps more importantly, Nvidia said current-quarter revenue would rise to around $28 billion, with a 2% margin for error, even as it said its new Blackwell system of processors and software wouldn't start shipping until the back half of the year.

Analysts had worried that a gap between the current H100 chips and the new Blackwell offering would create a kind of air pocket in revenue as customers dumped orders for the older chips and waited for the newer system.

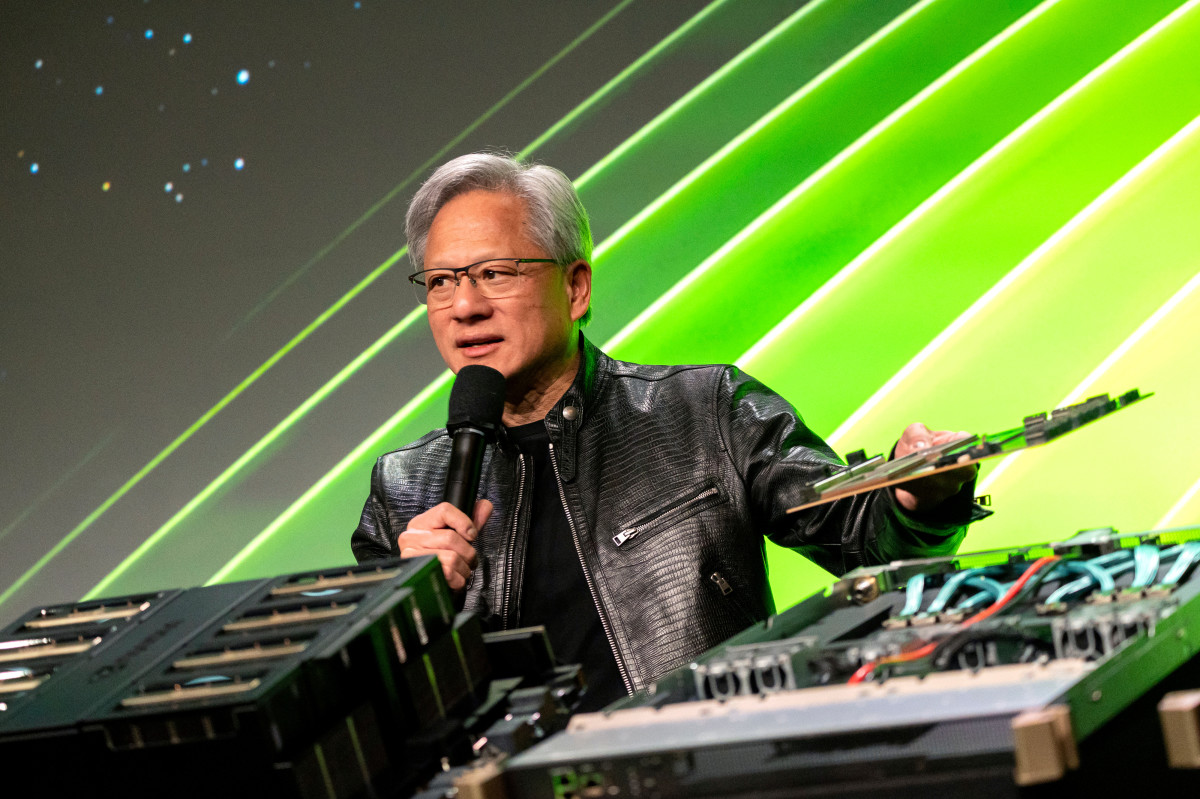

Nvidia CEO Jensen Huang, however, told investors on a conference call late Wednesday that clients can "easily transition from H100 to H200 to B100," adding that "Blackwell systems have been designed to be backwards compatible."

Blackwell revenue forecast

"We will see a lot of Blackwell revenue this year," Huang said. "We've been in production for a little bit of time (and) shipments will start in Q2 and ramp in Q3. Customers should have data centers stood up in Q4."

Cantor Fitzgerald analyst C.J. Muse said following last night's earnings report that Huang's Blackwell comments were a crucial takeaway from the call. He lifted his price target on Nvidia to $1,400, a $200 increase and the highest on Wall Street.

"The other key takeaways include Blackwell on track for revenues in the second half of the year (in production now at [Taiwan Semiconductor (TSM) ], then to be followed by sampling and then shipping), coupled with demand for Hopper continuing to exceed supply despite the reduction in lead times," said Muse, who carries an 'overweight' rating on the stock.

Related: Nvidia stock hinges on 5 key things in its earnings report

"The key point – there will be no air pocket in data-center revenues with clear line of sight for sequential revenue growth through the October/January quarters," he added.

Bernstein analyst Stacy Rasgon, who added $300 to his Nvidia price target, taking it to $1,300 per share, said Huang's Blackwell commentary "should assuage near-term air-pocket fears.

Rating the stock outperform, he adds that Nvidia stock remains relatively inexpensive "with a narrative that is clearly nowhere near its end, and likely nowhere near its peak."

Morgan Stanley analyst Joseph Moore, who took his Nvidia price target $160 higher to $1,160 a share while affirming his buy rating, also noted the group's ability to avoid gaps in demand ahead of the Blackwell debut.

Demand for Nvidia chips strong

"The 'shock and awe' upside quarter this time last year saw the company guide revenue to $10 billion, and the company is now guiding to $28 billion," he said.

"That's happening during a quarter where there could have easily been a pause in demand as H200 ramps in the current quarter and Blackwell volume starts in the quarter after that," he added.

"Demand side signals from customers and front line sales seem considerably more optimistic than supply chain or lead time would indicate," Moore said.

Related: Analysts race to revamp Nvidia price targets ahead of earnings

Nvidia's overall efficiency was also in focus, with Bank of America analyst Vivek Arya noting that the group generates more than 50 cents in free cash flow for every dollar in sales, allowing for potentially higher shareholder returns.

Nvidia boosted its regular dividend to 10 cents a share from 4 cents, payable June 28 to holders of record June 11, and unveiled plans for a 10-for-1 stock split, payable June 7 to holders of record June 6.

Third Bridge analyst: 1 issue Nvidia must address

Overall, the median price target on Wall Street rose around $150 after last night's earnings to $1,250 a share, a 32% premium to the stock's Wednesday closing price.

"Nvidia is such a unique growth property that investors will continue to support the company’s premium valuation multiples," said Benchmark analyst Cody Acree. He lifted his price target on Nvidia by $250, to $1,350 a share, following last night's release.

Related: Nvidia’s stock surges following latest earnings report

"Obviously, Nvidia is the unquestioned leader in accelerated computing, generative AI and inferencing, and has substantially grown its portfolio to service the needs of its industrywide customer and application base," he added.

More AI Stocks:

- World's biggest hedge fund boosts its stake in Nvidia stock

- Analysts update Dell stock price targets on Tesla-server win

- Microsoft delivers a blow to Nvidia

That leaves one near-term concern left to tackle, according to Third Bridge analyst Lucas Keh, who notes that Nvidia's flagship H100 processors "continue to be consumed as fast as they can be built."

“The biggest question that remains is how long this runway is," Keh said. "When the majority of AI workloads in the cloud move over from training to inference, Nvidia’s dominant market share position will be tested.

"Most use cases in inference do not require the depth/amount of compute provided by Nvidia’s top GPUs; hence the price tag that comes with this makes alternatives like (Advanced Micro Devices (AMD) ) attractive," he added.

"Third Bridge experts believe that Nvidia will still be able to maintain a foothold in inference and assume almost 40% of their revenue last year was inference-based.”

Nvidia shares were marked 9.5% higher in early Thursday trading to change hands at $1,038.20 each, a move that would nudge the stock's market value past $2.5 trillion.

Related: Single Best Trade: Wall Street veteran picks Palantir stock