Memory Lane is getting mighty crowded these days.

Memory is essential for artificial intelligence, enabling AI systems to efficiently process and learn from large data volumes.

Related: Analyst revisits Micron stock price target after post-earnings slump

As Citi noted back in February, “memory isn’t what it used to be."

"AI demand in the memory industry is fundamentally altering the sector’s product landscape," the firm said. "AI data processing requires parallel and simultaneous computation of large data, leading to the need to modify products to minimize data bottleneck issues."

Micron Technology (MU) is a big name in the memory chip business.

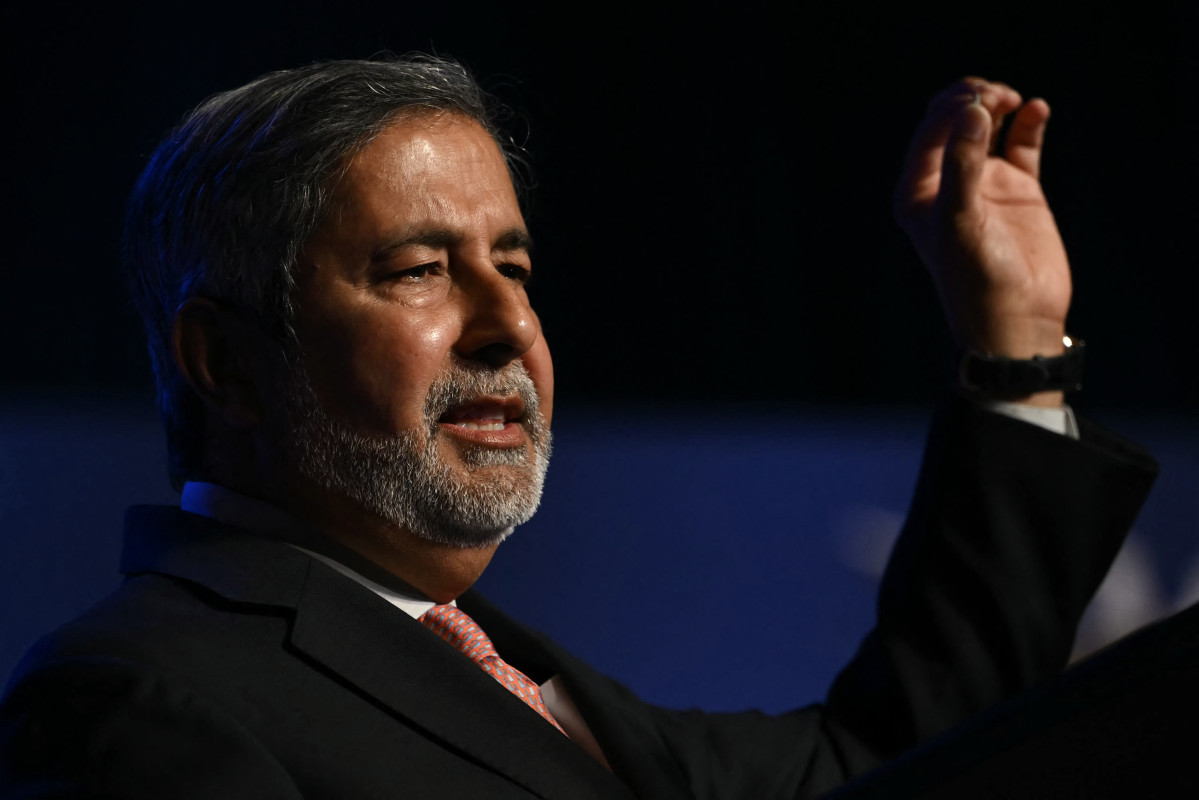

During the KeyBanc Capital Markets Technology Leadership Forum on Aug. 5, Mark Murphy, Micron’s chief financial officer, said the Boise, Idaho-based chip maker is in the strongest position it's ever been in with its technology leadership and product portfolio.

“As far as our markets in data center,” he added, “first data center demand remains very robust driven by AI server units and a recovery in traditional server units.”

Murphy noted that automotive, industrial, and retail consumer markers have weakened in China and “buying patterns are weak or uneven at best, depending on the market," adding that Micron forecast shipments to be flat sequentially in the November quarter for both DRAM memory chips and NAND flash memory.

Micron shares losing ground

There is significant uplift in in memory content with AI-enabled devices, he said, with a smartphone needing about 50% to 100% more DRAM than non-AI device and 40% to 80% with a PC.

Micron shares lost ground after posting a muted revenue forecast in late June.

Related: Analyst revisits Micron stock price target after presentation

The Boise, Idaho-based company told investors that current-quarter sales would rise 90% from the same period last year to around $7.6 billion, thanks in part to demand for its new HBM3E chips that are now being built into both Nvidia's (NVDA) H200 processors and its newly developed Blackwell systems.

Nvidia is scheduled to report results for the second quarter on Wednesday.

However, Wall Street was not impressed, given the high valuations and searing stock price gains that AI-related companies have enjoyed so far this year.

In June, Micron posted third-quarter earnings of 62 cents per share, beating Wall Street’s call for 62 cents per share. Revenue totaled $6.81 billion, edging out the consensus estimates of $6.67 billion in sales.

"Robust AI-driven demand for data center products is causing tightness on our leading-edge nodes," Sanjay Mehrotra, president and CEO, told analysts on June 28. "Consequently, we expect continued price increases throughout calendar 2024 despite only steady near-term demand in PCs and smartphones."

"As we look ahead to 2025, demand for AI PCs and AI smartphones and continued growth of AI in the data center creates a favorable setup that gives us confidence that we can deliver a substantial revenue record in fiscal 2025, with significantly improved profitability underpinned by our ongoing portfolio shift to higher-margin products," he added.

At last check, Micron's stock price was $98.34. However, shares are up 15.2% year-to-date and 54% higher than a year ago.

Analysts have been adjusting their price targets for the company's stock recently.

On Aug. 26, Needham lowered its Micron stock price target to $140 from $150 while keeping a buy rating on the shares.

Analyst cites flat shipments

Micron reiterated comments at Needham's recent 5th Annual Virtual Semiconductor and SemiCap 1x1 Conference that bit shipments across DRAM and NAND would be roughly flat sequentially in the first quarter and that gross margin would increase by about 200 basis points, the firm said in a research note.

Needham said the bit shipment commentary is incrementally more cautious than guidance given on the Q3 earnings call for bit shipments to strengthen modestly in Q1 from flat for DRAM and up slightly for NAND in Q4, creating a risk to November-quarter consensus estimates.

More AI Stocks:

- Analyst revisits Microsoft stock price target after AI reporting change

- Analyst resets Nvidia stock price target before earnings

- Analysts revise Palo Alto Networks stock price targets after earnings

The firm said that Micron's management is deliberately avoiding aggressive pricing deals due to moderating client demand, particularly as customers built up inventory earlier in the year.

"As a result, we now believe there is risk to November consensus estimates," analysts stated, adding that this has led to a downward revision in their forward estimates and price target.

On Aug. 22, Susquehanna lowered the firm's Micron price target to $175 from $185 and kept a positive rating on the shares.

The firm updated estimates following the company's recent commentary that the November quarter DRAM/NAND bit shipment tracking to flattish quarter-over-quarter while also incorporating its most updated pricing assumptions and arguing that the memory is currently in a "mid-cycle" correction in the middle of a longer up-cycle.

On Aug. 13, Citi trimmed estimates on Micron Technology, saying a “little bit of inventory” has been built up in the PC and wireless supply chains.

It appears Micron will increase inventory, which adds risk to near-term estimates, the firm said.

However, Citi believes the DRAM upturn continues with upside from Samsung and Hynix.

Citi said DRAM pricing is set to increase 12% in Q3 and 6% in Q4. It added that the DRAM upturn will extend through 2025 and reiterated a buy rating on Micron shares with a $175 price target.

Related: Veteran fund manager sees world of pain coming for stocks