After a year defined by AI breakthroughs and robust tech earnings, the Nasdaq 100’s surge has made many investors question how much higher it can go. But one analyst sees the potential for even more gains.

Evercore ISI unveiled an assertive target for the Invesco QQQ Trust (QQQ) and the VanEck Semiconductor ETF (SMH) , two prominent exchange-traded funds representing the tech sector's explosive growth.

💻Free Newsletter From TheStreet - TheStreet 💻

With the QQQ ETF up nearly 20% this year as of Oct. 15, Evercore says the rally is far from over. Evercore's analyst said that it set a price target for the world's fifth-largest ETF by assets under management at $570, a 16.3% increase from its current $490, as its "UniQQQuely bullish 'failed' head and shoulders" on the chart.

The VanEck Semiconductor ETF has surged 41.3% this year. Evercore sees further upside here, too, placing a $300 target. The ETF traded at $247 on Oct. 15, so the new target anticipates an additional 17.7% gain.

Evercore said SMH was performing strongly, trading above key technical indicators: its 50-day, 100-day, and 200-day moving averages. This typically signals a bullish trend, suggesting sustained upward momentum over both short- and long-term periods.

Related: Analyst resets Broadcom stock price target, citing AI outlook

"Buy Moore," Evercore said.

The phrase alludes to Moore's Law, which states that the number of transistors on a microchip doubles roughly every two years while the cost of computing halves.

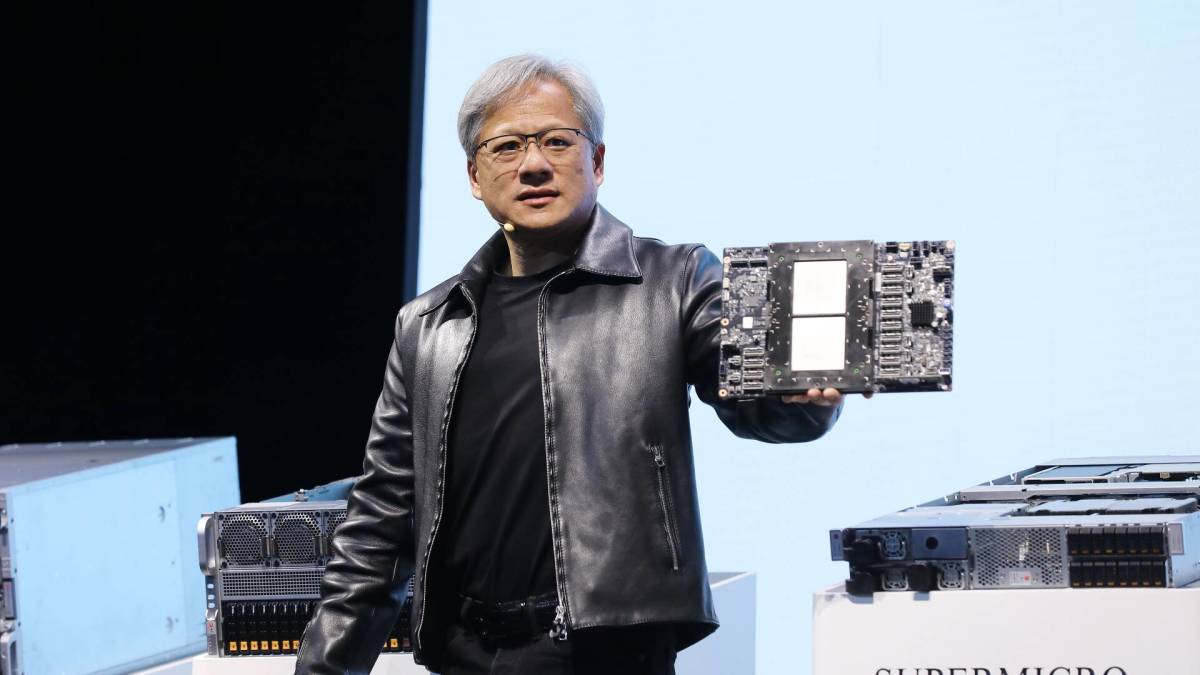

It's a key principle in the chip industry — though Nvidia CEO Jensen Huang recently argued that Moore's Law is no longer applicable in today’s semiconductor industry. That's primarily because the pace at which transistor density doubles and costs decrease has slowed significantly.

Nvidia drives Nasdaq 100 returns

Nvidia (NVDA) has been a major driving force for both QQQ and SMH. SMH lists Nvidia as its top holding, accounting for 20.9% of its portfolio, while QQQ ranks the company as its second-largest holding, with an allocation of 8.32%.

Nvidia has seen record revenue over the past quarters, driven by explosive demand for its artificial-intelligence-oriented graphics-processing units.

The company’s latest earnings report, in August, shows that it earned 68 cents a share in the fiscal second quarter, topping the 64-cent consensus Wall Street estimate. Revenue reached $30.04 billion, exceeding the estimated $28.7 billion.

Related: Analyst revamps Nvidia stock price target after investor meetings

Nvidia's data-center segment sales more than doubled (up 154%) year-over-year to $26.3 billion, above the forecast $25.15 billion, and grew 16% from the previous quarter.

The company projected third-quarter revenue of $32.5 billion, plus or minus 2%, surpassing analysts' average estimate of $31.77 billion, according to LSEG data.

Nvidia plans to ship its Blackwell GPUs to clients in Q4, with a consumer release expected in 2025.

Blackwell, a platform Nvidia introduced in March, enables organizations to run real-time generative AI on models with trillions of parameters. It enables large language models trained on extensive datasets to produce human-like responses. (Generative AI produces original content from existing text, photos, video, and audio.)

“In the fourth quarter, we expect to ship several billion dollars in Blackwell revenue,” Nvidia Chief Financial Officer Colette Kress said during the August earnings call.

“Blackwell is in full production,” Huang said in an interview with CNBC in early October. “The demand for Blackwell is insane. Everybody wants to have the most, and everybody wants to be first.”

Evercore ISI calls Nvidia “the straw that stirs the drink” and forecasts the stock could climb to $200.

Other Nasdaq holdings are top performers

Meanwhile, QQQ and SMH have other heavyweight holdings that have performed well this year.

QQQ’s biggest holding is Apple (AAPL) , occupying 8.7%. Apple shares have climbed 21% year-to-date.

Apple shares rose 1% to $233.85 on Oct. 15, briefly hitting a record high of $237.49, as the company unveiled its latest iPad Mini, which will launch on Oct. 23. The new Mini supports AI features introduced with last month’s iPhone 16.

More AI Stocks:

- Analysts update Meta stock price target with Q3 earnings in focus

- Veteran trader who called Palantir rally unveils new price target

- Open AI is burning cash (and losing billions!)

Taiwan Semiconductor (TSM) is the second-biggest holding in SMH. The company is Nvidia’s biggest supplier. TSM stock is up 80% year-to-date.

Taiwan Semiconductor will report full third-quarter earnings on Oct. 17 and update its outlook. In July, it forecast third-quarter revenue between $22.4 billion and $23.2 billion.

Related: Veteran fund manager sees world of pain coming for stocks