/Amphenol%20Corp_%20logo%20on%20phone%20and%20stock%20data-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Valued at a market cap of $168.8 billion, Amphenol Corporation (APH) designs, manufactures, and markets electrical, electronic, and fiber-optic connectors, interconnect systems, antennas, sensors, and related cable products. The Wallingford, Connecticut-based company serves diverse end markets, including automotive, broadband communications, information technology and data communications, commercial aerospace, defense, mobile devices, and mobile networks. It is expected to announce its fiscal Q4 earnings for 2025 on Wednesday, Jan. 28.

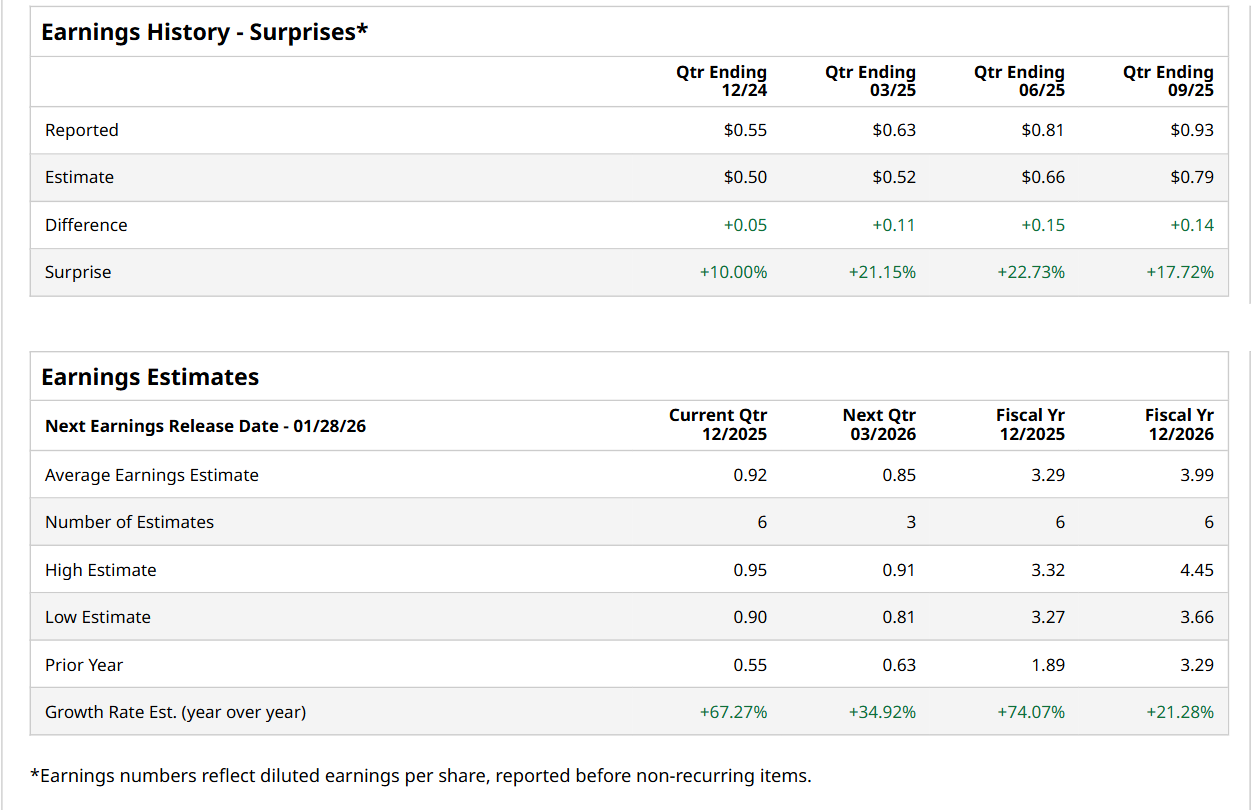

Ahead of this event, analysts expect this tech company to report a profit of $0.92 per share, up 67.3% from $0.55 per share in the year-ago quarter. The company has topped Wall Street’s earnings estimates in each of the last four quarters. In Q3, APH’s EPS of $0.93 exceeded the forecasted figure by 17.7%

For the current fiscal year, ending in December, analysts expect APH to report a profit of $3.29 per share, up 74.1% from $1.89 per share in fiscal 2024. Furthermore, its EPS is expected to grow 21.3% year-over-year to $3.99 in fiscal 2026.

Shares of APH have skyrocketed 92.5% over the past 52 weeks, significantly outperforming both the S&P 500 Index's ($SPX) 14.8% return and the State Street Technology Select Sector SPDR ETF’s (XLK) 21.7% uptick over the same time period.

Shares of APH soared 4.4% on Dec. 19 after Truist Financial Corporation (TFC) analyst William Stein raised his price target on the stock to $180 from $147, while maintaining a “Buy” rating. The move signaled strong confidence in Amphenol’s performance and growth outlook. This action followed a series of upward adjustments from various other analysts as well, highlighting broadly positive sentiment toward the company.

Wall Street analysts are highly optimistic about APH’s stock, with an overall "Strong Buy" rating. Among 17 analysts covering the stock, 13 recommend "Strong Buy," and four suggest "Hold.” The mean price target for APH is $152.31, indicating a 10.4% potential upside from the current levels.