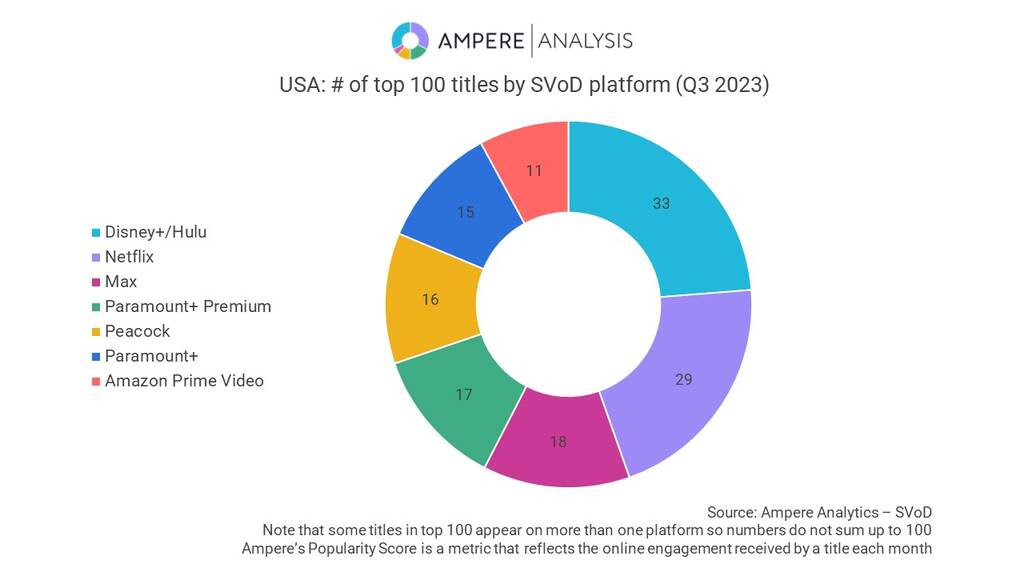

LONDON—Now that Disney has bought out Comcast’s share of Hulu, plans to combine Disney+ and Hulu Video on Demand (VoD) service will result in the streaming service offering one-third of the 100 most popular titles in the U.S. based on the latest data from Ampere Analysis. Ampere’s estimates show that a planned combined app that will bring the services together early next year would have the greatest share of the top 100 most popular titles, putting it behind only Amazon based on Ampere Popularity data from September 2023.

Combined, the Disney+/Hulu app will offer 9,000 distinct movies and TV seasons, Ampere’s latest title-level analysis of the content offer suggests—even if the approximately 300 Comcast-owned titles are removed from the service. This would position Disney+ and Hulu’s total content offering behind only Amazon Prime Video’s 10,892 titles and ahead of Netflix’s 8391 (as of Q3 2023).

According to the way it measures viewer engagement, Ampere says Disney+ held 17 of the top 100 performing SVoD titles in the U.S. in Q3 2023, led by its movie library. When combined with Hulu, that figure jumps to 33, giving the joint entity the largest overall share of top titles. In comparison, Netflix has 29 titles and Max 18.

Disney+’s content strategy relies on its strong Children & Family content portfolio and tentpole Sci-Fi & Fantasy releases from major franchises, according to Amperem which adds that these would represent 81% of the top 100 most popular titles on the combined platform. Hulu’s content library would complement Disney+’s as it includes popular titles from genres currently under-served on Disney+, particularly Crime & Thriller, Romance, and Horror, the researcher said.

Disney+ already includes some of the Hulu library in non-U.S. markets under the Star label, so that a combined content mix would align with the strategy internationally, Ampere added.

As of October 2023, Hulu has more subscribers than Disney+ in the U.S. and according to Ampere’s consumer survey, 44% of U.S. Hulu subscribers already have access to Disney+, largely due to bundles offering both platforms and ESPN. This provides an opportunity for Disney+ to convert the remaining majority of Hulu subscribers who don’t currently subscribe, Ampere said.

Ampere’s consumer survey also shows that 43% of U.S. SVoD users agree with feeling “overwhelmed” with the number of services they have access to, so offering one service that includes top titles from recognizable IP like Marvel and “Star Wars,” and Hulu’s vast content library will offer a wider appeal among subscribers, Ampere said.

“With a combined app offering Disney+ and Hulu due to launch in the US in early 2024, its compelling new streaming content offer will surely shake up the status quo,” said Joshua Rustage, Analyst at Ampere Analysis. “The combined Disney+ and Hulu catalogue will provide one of the most well-rounded and popular offerings in a single platform, upping the content stakes at a time when many are pulling back on content investment. Rivals will have to ensure their offerings remain competitive as the battle for viewing time intensifies, especially as the need to pull in advertising dollars is now also central to the streaming mix.”