Many of us remember our first credit card.

Whether it was a specially branded one for your favorite store at the time, like JC Penney or LL Bean, or a starter card your parents insisted you treat with the utmost of care and respect back in college, chances are, when we think about that card it harkens us back to simpler times.

Getting it probably felt like a big responsibility, like getting a driver's license or a first job. And since it was more than likely that our first card didn't have the handy tricks many cards to today — like routine scheduled auto payments or seamless online app user experiences — we may have even had to mail in our monthly bills using a check.

Related: Crippling interest payments force Americans into worst credit bind in 50 years

But the credit card industry has come far since then. People have made entire hobbies (and for some, even jobs) out of optimizing and maximizing credit cards for every purchase made. Travelers, for example, may prefer Capital One's (COF) Venture Rewards Credit Card, which allows holders to earn airline miles with purchases. Streaming junkies may prefer the American Express (AXP) Blue Cash Preferred card, which earns up to 6% back on streaming and related services.

Popular luxury card nixes a favorite perk

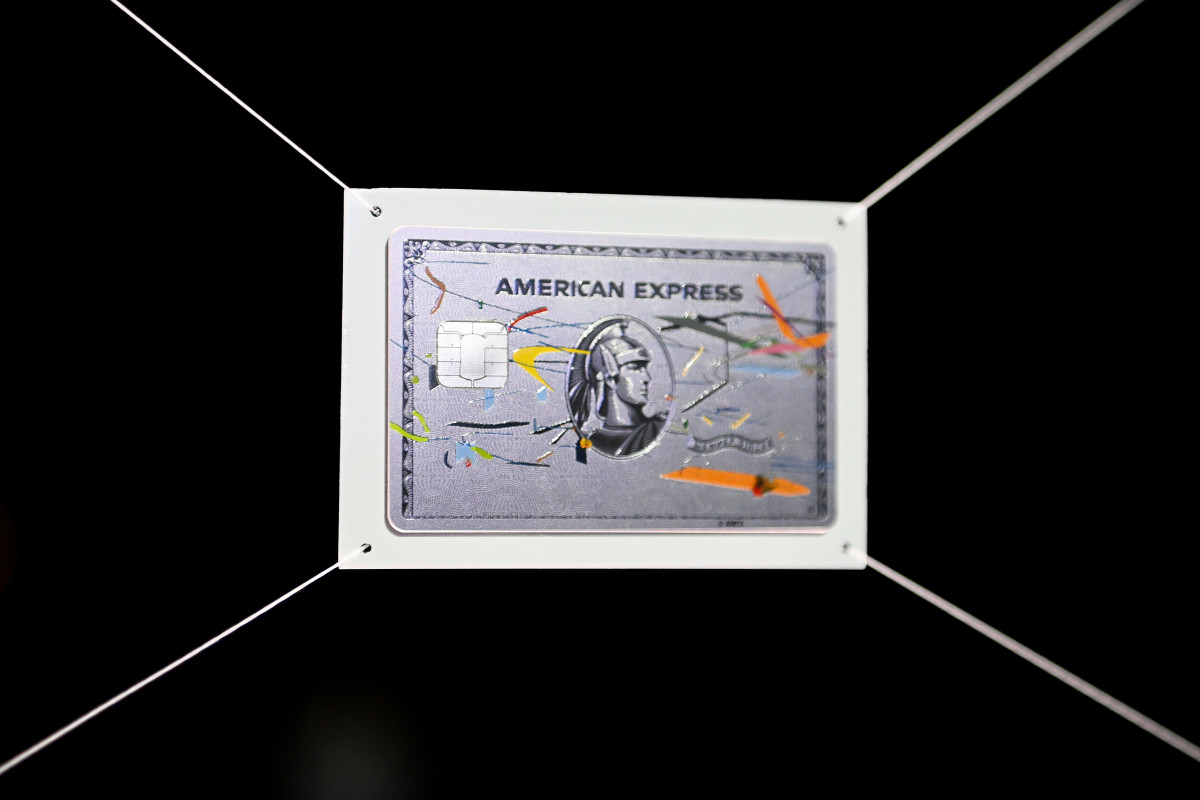

But one card reigns supreme when it comes to notoriety and street cred. It's a recognizable cultural symbol for luxury and wealth and offers its holders access to some of the most sought-after perks in the world: the American Express Platinum.

The Amex Platinum first entered the scene in 1984, around the start of the golden age of consumer credit. Made of stainless steel metal, it's one of the heaviest publicly available credit cards, and it comes with the weighty annual fee of $695 per year (which is waived if you're in the military). And though it's not as exclusive as its more sophisticated Black Card counterpart or the JP Morgan Reserve card, it comes with a bevy of perks that influence millions of users to pony up the nearly $700 a year for access.

Some of the Amex Platinum benefits include:

- 5 rewards points per dollar on up to $500,000 in travel booked through American Express Travel

- Up to $200 a year for airline credit and fees

- $189 annual credit for Clear at airports

- Reimbursement for application to TSA Precheck or Global Entry

- Up to $200 for Uber (and automatic enrollment in Uber VIP status)

- Up to $200 for annual hotel credit

- Up to $300 for Equinox gym

- $300 SoulCycle credit

- Up to $240 in streaming or entertainment credit

- Up to $100 in annual credit to Saks Fifth Avenue

- Monthly membership credit to Walmart+

- Access to airport American Express Global Lounges

- Hotel upgrades

- Cruise and car rental privileges and savings

- Lost or damaged cell phone reimbursement up to $800

- Premium Global Assist Hotline if traveling more than 100 miles from home

The list of perks is by no means exhaustive and changes somewhat regularly. Though users will soon say goodbye to one perk.

As of May 8, 2024, the Amex Platinum cardholders will no longer be able to claim SiriusXM as a part of their digital or streaming entertainment credit.

"We are updating the partners participating in the $240 Digital Entertainment Credit benefit for which eligible purchases made by Basic and Additional Card Members on the Account can earn up to $20 in statement credits per month, for a total of up to $240 per calendar year in statement credits across all Cards on the Account," American Express wrote in a statement.

"Effective May 8, 2024, SiriusXM will be removed from the benefit and purchases at SiriusXM on or after May 8, will no longer be eligible for the benefit."

Which means cardholders who subscribe to SiriusXM have until May 8 to decide whether they want to continue with the service and pay out of pocket.

The list of partners that remain in the Platinum program are Disney+, ESPN, HULU, NYT, Peacock, and WSJ, according to American Express.

Related: Veteran fund manager picks favorite stocks for 2024