Advanced Micro Devices' prospects in the fast-developing market for AI technologies are center stage as the company's latest earnings update resets expectations.

AMD, which is hoping that its new lineup of faster and more efficient AI chips will help it close the gap on market leader Nvidia (NVDA) , has outperformed the broader market since it boosted its full-year profit forecast in late July, rising 15.5% against a 6.3% advance for the Nasdaq benchmark.

💰💸 Don’t miss the move: SIGN UP for TheStreet’s FREE Daily newsletter 💰💸

However, it continues to trail Nvidia in both market performance and tech investment zeitgeist and needs to see an accelerated uptake of its newly launched MI325X chip and the MI350 chip planned for next year to raise its revenue prospects to a level commensurate with its larger rival.

Tuesday's third quarter earnings report could prove a step in that direction, with analysts looking for a bottom-line increase of 31.4% from last year's level to 92 cents a share, with revenue rising 15.7% to $6.71 billion.

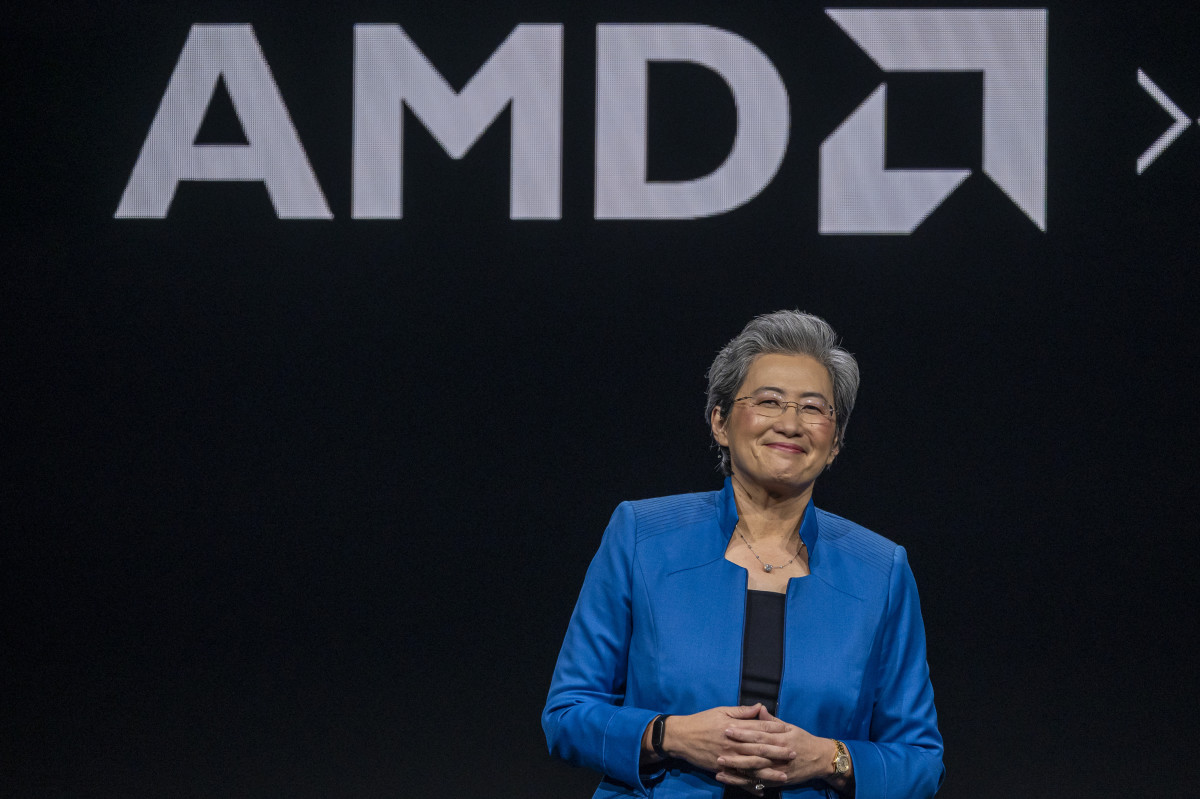

Investors, however, will be looking for Chief Executive Lisa Su to update on the group's full-year AI revenue prospects, which were pegged at $4.5 billion following its second quarter earnings report in late July. They'll also tune into the progress of finding hyperscaler customers for its newly launched chips.

TheStreet/Shutterstock/David Becker/Stringer/Getty Images

AMD's AI-revenue outlook in focus

AMD's (AMD) broader data-center revenue, which is likely to rise to $12.8 billion this year, will still make up only around 12% of the projected $110.4 billion tally for Nvidia.

"AMD is making steady progress in data-center [graphics-processing units,] and our base case is for management to raise its prior outlook from $4.5 billion to over $5 billion," said Raymond James analyst Srini Pajjuri.

He also cited comments from Facebook parent Meta Platforms (META) that suggest it's using only MI300 chips for its Llama 3.1 open-source artificial intelligence system to model live traffic.

Related: Analyst adjusts AMD stock price target after AI event

"Raymond James' Internet team estimates that Meta AI has 50 million [daily active users] and expects it to grow to 175 million in 2025, which should be a nice tailwind for AMD," he added.

Pajjuri sees AMD guiding for revenue in the region of $7.6 billion for the final three months of the year, with around $1.8 billion in MI300 sales.

CFRA senior equity analyst Angelo Zino also sees potential in AMD's growth in the server CPU market, where it has a 34% share, following the launch of its fifth-generation Turin product earlier this month.

AMD vs. Nvidia vs. Intel

He also likes AMD's place in the market for AI-powered PCs, with its Ryzen AI Pro chip, as well as its lineup of networking products that will start shipping next year.

"AMD provided great insights [at its October AI event in San Francisco] and we think it is making great strides in becoming a total AI platform provider, but we believe making a notable dent into Nvidia's share remains unlikely," Zino said.

UBS analyst Timothy Arcuri, however, sees AMD gaining share from a different rival, the troubled chipmaker Intel (INTC) , as it looks into the coming financial year.

Related: Intel's new chips take the AI fight to Nvidia, AMD

"We think AMD is in a prime position to continue to gain share in 2025, not just as a consequence of (its new Turin product) in many cases being a more attractive option for cloud and enterprise customers than Intel's, but also due to the 'risk of doing business' with Intel now being heightened given its recent challenges," he and his team wrote.

More AI Stocks:

- Analysts update Meta stock price target with Q3 earnings in focus

- Veteran trader who called Palantir rally unveils new price target

- Open AI is burning cash (and losing billions!)

AMD shares were marked 0.6% higher in premarket trading to indicate an opening bell price of $160.88 each, a move that would nudge the stock into positive territory for the past six months.

Related: Veteran fund manager sees world of pain coming for stocks