Big Tech has been back in play for investors, and that’s got Amazon (AMZN) stock sitting on the cusp of a potential breakout.

The e-retailing giant's shares have been trading quite well lately, as tech continues to lead the way higher in 2023.

It helps that stocks like Tesla (TSLA) and Nvidia (NVDA) also sport massive year-to-date gains, giving tech stocks momentum. And Apple (AAPL), Microsoft (MSFT) and others have been hitting multiweek highs in recent trading.

It’s my opinion that companies with strong balance sheets have been acting as safe-haven assets for investors looking to flee other equities amid the regional banking crisis.

Don't Miss: Bank Stocks Remain Pressured. XLF Chart Support Is a Line in the Sand.

When we look at Amazon stock, the shares were under notable pressure just last week. But a sharp reversal on March 13 put the stock on watch for a potentially bullish move.

Let’s check the charts.

Trading Amazon Stock

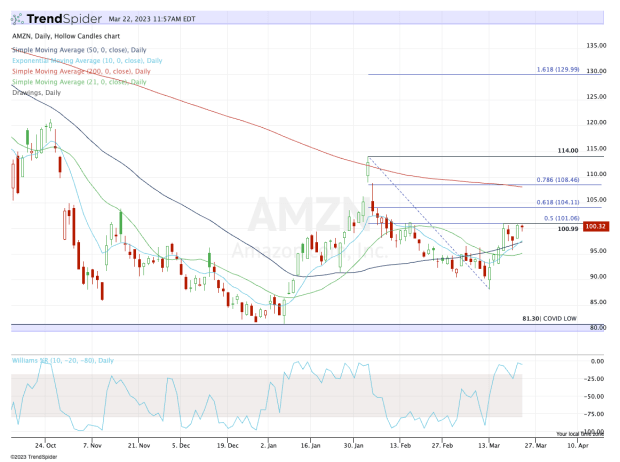

Chart courtesy of TrendSpider.com

Among the many big-cap tech names like those listed above, Amazon may not have the most impressive chart. Yet the shares continue to hold strong right near $100.

Admittedly, the $100 to $102 area is a massive zone when we zoom out to the weekly charts, but that only adds to the potential significance of a breakout here.

Notice how the shares continue to trade just below yesterday’s high and last week’s high, both near $101.

If Amazon can clear this level and close above this mark, it opens the door to $104, $108 and $114, respectively.

Don’t Miss: Can AMD Stock Break Out Over Major Resistance?

If we look at some of the larger upside levels above that, the one that sticks out the most is the $120 to $123 area. So that can act as the target should Amazon stock truly break out over the $102 zone.

Take note: This potential breakout may largely hinge on the Federal Reserve and its decision to raise rates.

If the Fed sparks a continued rally in tech stocks, Amazon stock will likely break out. However, if it sparks selling pressure over the next few days and weeks, I believe there is very little chance that Amazon will outperform and continue higher.

Should it pull back, $95 to $97 is the first key zone to hold. Below that could open the door back down to $90, followed by last week’s low near $88.