In investors' minds, Alphabet (GOOGL) (GOOG) continues to lag Microsoft (MSFT) in more ways than one.

Earlier this year, OpenAI’s ChatGPT platform burst onto the scene, garnering millions of users and a multibillion-dollar investment from Microsoft.

An embarrassing AI-related gaffe didn’t help the optics that Alphabet was trailing in the AI race.

Fast forward to this week and Alphabet again finds itself on the losing side of the megacap matchup: Microsoft stock is enjoying a strong post-earnings pop to 52-week highs and Alphabet wavers around flat on the day.

Don't Miss: Microsoft Stock Pops on Earnings. Is $320 the Next Level?

That’s even after earnings of $1.17 a share topped estimates by 10 cents and revenue of $69.8 billion beat analysts’ expectations by $1 billion. Not to mention management tacked on another $70 billion to the company’s buyback plan.

Despite the positive news for the longs, Alphabet shares are struggling. Let’s have a look at the chart.

Trading Alphabet Stock After Earnings

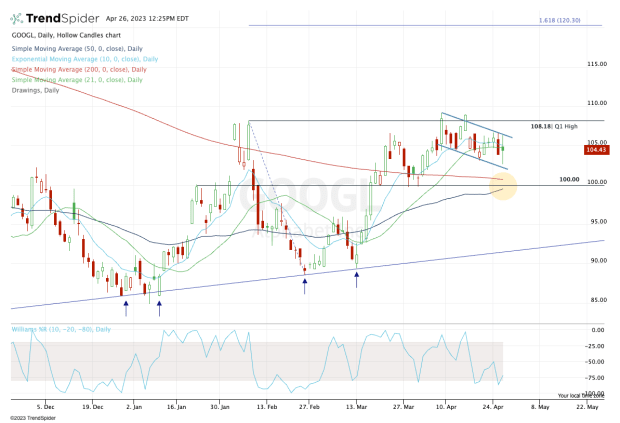

Chart courtesy of TrendSpider.com

So far today, Alphabet stock looks decisively…undecided.

The shares are wavering around the 10-day and 20-day moving averages and pinballing around the $105 level, trapped in a consolidation channel.

Some investors would classify this channel as a bull-flag pattern — and rightfully so. But it needs to continue holding channel support and the $102.50 to $103 area for that to remain true.

Ideally, Alphabet stock will be able to rally over last week’s high of $106.63. That opens the door back to the first-quarter high and this month’s high at $108.18 and $109.17, respectively.

Don't Miss: McDonald's Reports and the Stock Presents a Buy-the-Dip Opportunity

Mostly, though, the bulls are looking for the shares to resume their recent rally and clear these levels, potentially paving the way for the $120 level.

Not only is that the 161.8% extension but it’s also a prior key level from 2022.

On the downside, a deeper post-earnings dip could thrust the $100 level back into play and the stock’s response will be key in that scenario.

Not only is that a current support zone, but it’s also where we find the 50-day and 200-day moving averages.

A break of this area could put the low- to mid-$90s in play.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.