/Allstate%20Corp%20magnified%20logo-%20by%20ll_studio%20via%20Shutterstock.jpg)

Northbrook, Illinois-based The Allstate Corporation (ALL) provides property and casualty, and other insurance products and services. It is valued at a market cap of $53.6 billion.

This insurance company has lagged behind the broader market over the past 52 weeks. Shares of ALL have gained 9.1% over this time frame, while the broader S&P 500 Index ($SPX) has soared 14.4%. Moreover, on a YTD basis, the stock is down marginally, compared to SPX’s 1.4% return.

However, zooming in further, ALL has outpaced the State Street SPDR S&P Insurance ETF (KIE), which rose 1.2% over the past 52 weeks and declined 3.7% on a YTD basis.

On Feb. 4, ALL delivered mixed Q4 results, and its shares soared 3.9% in the following trading session. The company’s total revenue increased 5.1% year-over-year to $17.3 billion, but missed consensus estimates. Nonetheless, on the earnings front, its adjusted EPS grew by a notable 86.6% from the year-ago quarter to $14.31, handily topping analyst expectations of $9.82.

For fiscal 2026, ending in December, analysts expect ALL’s EPS to decline 28.7% year over year to $24.85. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

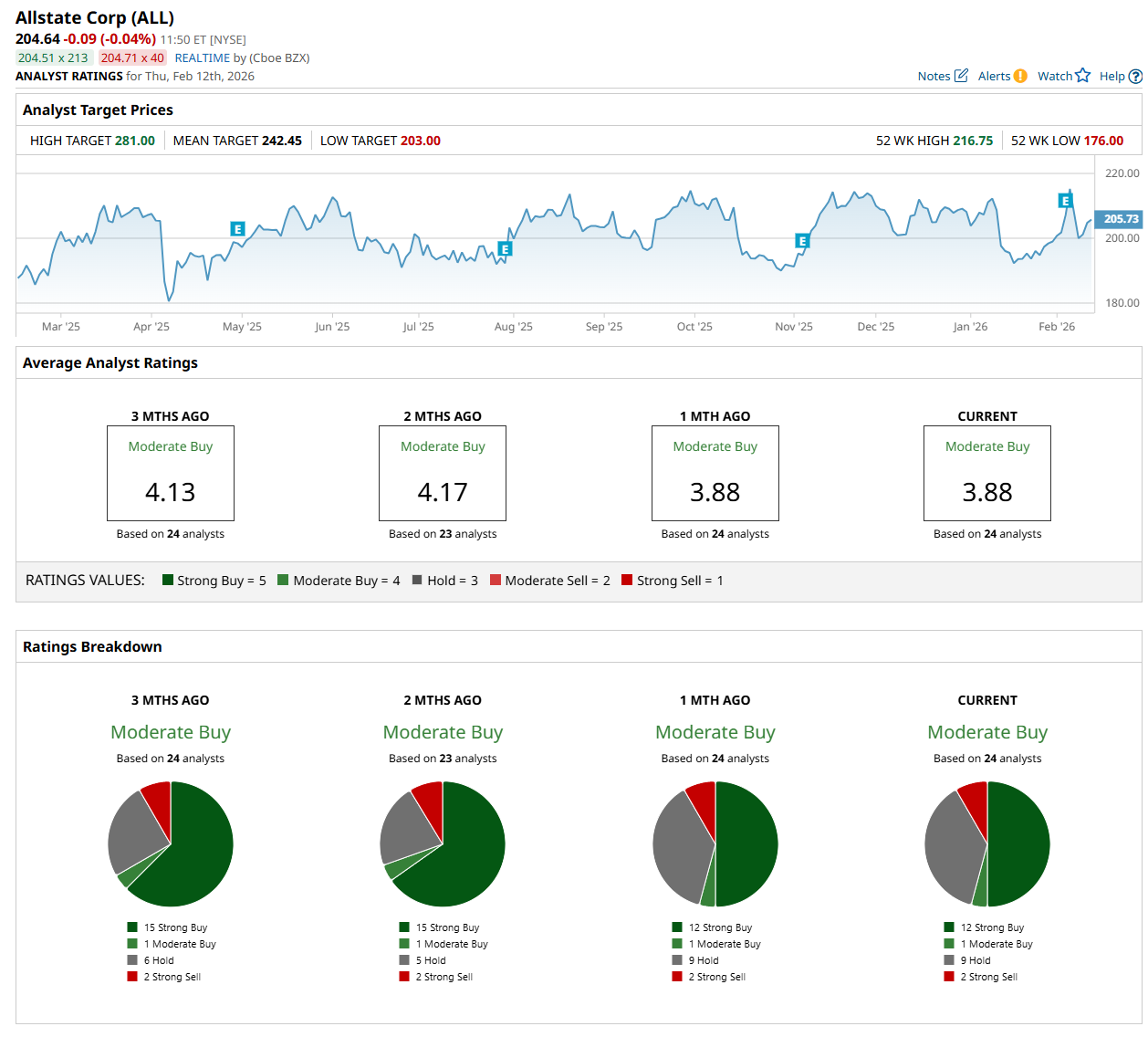

Among the 24 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 12 “Strong Buy,” one “Moderate Buy,” nine "Hold,” and two “Strong Sell” ratings.

The configuration is less bullish than two months ago, with 15 analysts suggesting a “Strong Buy” rating.

On Feb. 11, Keefe Bruyette analyst Meyer Shields maintained an "Outperform" rating on ALL and raised its price target to $260, indicating a 27.1% potential upside from the current levels.

The mean price target of $242.45 represents an 18.5% premium to its current price, while its Street-high price target of $281 suggests an ambitious 37.3% potential upside from the current levels.