Alibaba Group Holdings, Inc (NYSE:BABA) was soaring over 11% higher on Wednesday, defying the S&P 500, which was trading about 1% lower.

The rally comes on investor hopes the Chinese government will continue to ease pressure on its tech companies increased after its National Press and Publication Administration approved 60 video games for computers and smartphones. The country may be easing its antitrust campaigns as an attempt to save its deteriorating economic outlook.

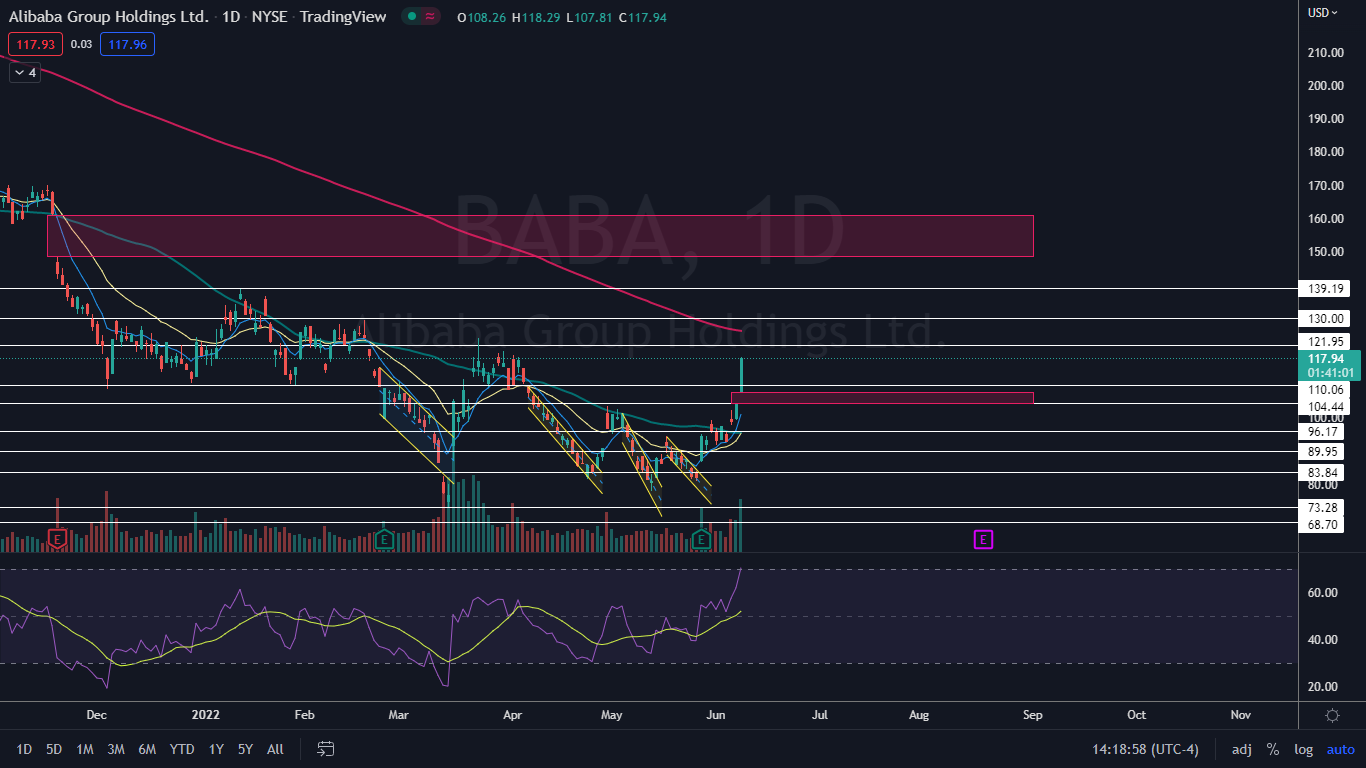

From a technical standpoint, Alibaba looked set to trade higher because on Tuesday the stock closed at its high-of-day and printed a bullish Marubozu candlestick on the daily chart. Alibaba is also trading in a confirmed uptrend.

An uptrend occurs when a stock consistently makes a series of higher highs and higher lows on the chart.

The higher highs indicate the bulls are in control while the intermittent higher lows indicate consolidation periods.

Traders can use moving averages to help identify an uptrend, with rising lower timeframe moving averages (such as the eight-day or 21-day exponential moving averages) indicating the stock is in a steep shorter-term uptrend.

Rising rising longer-term moving averages (such as the 200-day simple moving average) indicate a long-term uptrend.

A stock often signals when the higher high is in by printing a reversal candlestick such as a doji, bearish engulfing or hanging man candlestick. Likewise, the higher low could be signaled when a doji, morning star or hammer candlestick is printed. The higher highs and higher lows often take place at resistance and support levels.

In an uptrend, the "trend is your friend" until it’s not and in an uptrend there are ways for both bullish and bearish traders to participate in the stock:

- Bullish traders who are already holding a position in a stock can feel confident the uptrend will continue unless the stock makes a lower low. Traders looking to take a position in a stock trading in an uptrend can usually find the safest entry on the higher low.

- Bearish traders can enter the trade on the higher high and exit on the pullback. These traders can also enter when the uptrend breaks and the stock makes a lower low, indicating a reversal into a downtrend may be in the cards.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

The Alibaba Chart: Alibaba’s uptrend began on May 12, when the stock reversed course from the $78.01 level. The most recent higher low within the pattern was printed on Monday at $93.02 and the most recent confirmed higher high was formed at the $99.32 level on May 31.

- On Tuesday, Alibaba was working to print a bullish kicker candlestick pattern by closing near its high-of-day after gapping up. The candlestick indicates higher prices are likely to come on Thursday.

- Eventually Alibaba will need to retrace to at least print its next higher low within the uptrend. A gap exists between $104.32 and $107.81, and it would be ideal if Alibaba retraced to fill the gap and printed a reversal candlestick at or slightly above that level.

- If Alibaba trades higher again on Tuesday, the stock’s relative strength index (RSI) will enter into overbought territory, which could indicate Alibaba will begin to run into sellers. When a stock’s RSI reaches or nears the 70% level it becomes overbought, and Alibaba’s RSI is rising above that level.

- Bearish traders watching for a short-term scalp trade will want to see the stock print a bearish reversal candlestick, which may occur on a volume climax on lower timeframes.

- Alibaba has resistance above at $121.95 and $130 and support below at $110.06 and $104.44.