Charlotte, North Carolina-based Albemarle Corporation (ALB) develops, manufactures, and markets engineered specialty chemicals worldwide. With a market cap of $11.4 billion, Albemarle operates through Energy Storage, Specialties, and Ketjen segments.

Specialty chemical giant Albemarle has notably underperformed the broader market over the past year. ALB stock prices have gained 12.9% on a YTD basis and declined 2.8% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 14.4% gains in 2025 and 12.7% returns over the past year.

Narrowing the focus, ALB has outpaced the sector-focused Materials Select Sector SPDR Fund’s (XLB) 2% uptick in 2025 and 10% plunge over the past 52 weeks.

Albemarle’s stock prices observed a marginal dip in the trading session following the release of its mixed Q3 results on Nov. 5. While its specialties segment’s volumes dropped by 1%, its energy storage and Ketjen volumes increased by 8% each. However, its overall results were severely impacted by unfavorable pricing. ALB’s topline came in at $1.3 billion, down 3.5% year-over-year, but 1.2% above the Street expectations. Meanwhile, it reported a negative adjusted EPS of $0.19, but it surpassed the consensus estimates by 79.4%.

For the full fiscal 2025, ending in December, Albemarle is expected to deliver an adjusted loss of $1.59 per share, up from the loss of $2.34 per share reported in the year-ago quarter. The company has a mixed earnings surprise history. While it missed the Street’s bottom-line expectations once over the past four quarters, it has surpassed the projections on three other occasions.

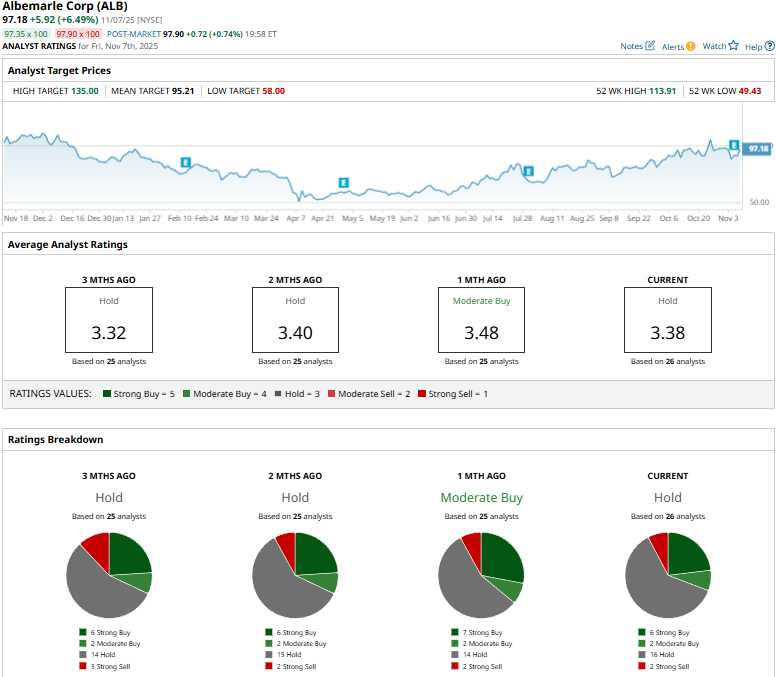

Among the 28 analysts covering the ALB stock, the consensus rating is a “Hold.” That’s based on six “Strong Buys,” two “Moderate Buys,” 16 “Holds,” and two “Strong Sells.”

This configuration is slightly pessimistic compared to a month ago, when seven analysts gave “Strong Buy” recommendations.

On Nov. 7, Truist Securities analyst Peter Osterland maintained a “Hold” rating on ALB and raised the price target from $87 to $91.

As of writing, ALB is trading above its mean price target of $95.21. Meanwhile, the street-high target of $135 suggests a 38.9% upside potential from current price levels.