When it comes to sharing inheritance, Gen Z was found to be the least willing to redistribute wealth among family members who didn’t get their fair share. Since almost half of the generation struggles to cover their bills, they feel more wary about splitting their bequeathed estate further.

Just like this woman, who, after turning 18, received a sizable sum and properties from her grandparents but strictly refused to share them with her struggling family. After being treated poorly by them her whole life, she was set on finally enjoying her freedom and not wasting it away.

Scroll down to find the full story and a conversation with financial planner Justin Rush, who kindly agreed to tell us more about sharing inheritance with family.

Younger people are more doubtful about sharing their inherited wealth with family members

Image credits: Tima Miroshnichenko / Pexels (not the actual photo)

This 18-year-old also refused to split the sizable inheritance with her family because they always treated her poorly

Image credits: Nataliya Vaitkevich / Pexels (not the actual photo)

Image credits: Liza Summer / Pexels (not the actual photo)

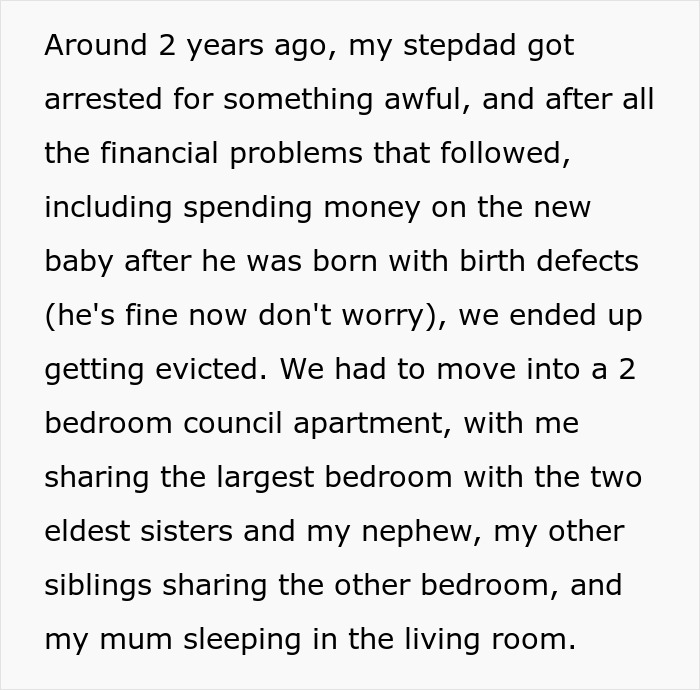

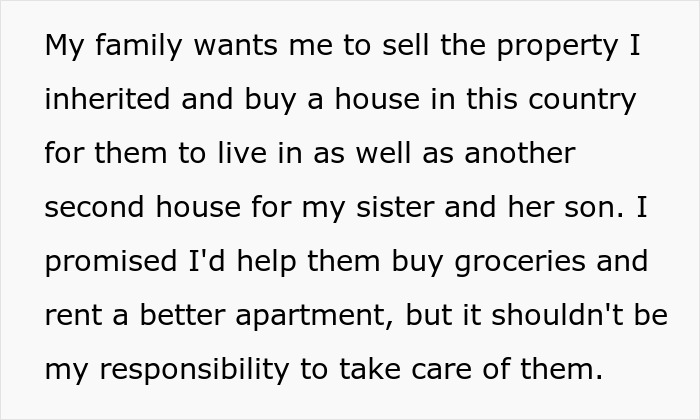

Image credits: CountTimely3205

Image credits: Tima Miroshnichenko / Pexels (not the actual photo)

“They’re going to be less likely to want to share inheritance, especially if that’s money that they may need to cover bills”

Financial planner Justin Rush tells Bored Panda that it’s not really surprising that Gen Z was found to be the least willing to share their inheritance. “I think when you start looking at statistics, you start seeing how many people are living paycheck to paycheck, whether it’s because of inflation and rising prices or wages not keeping up.

I think when people are in that situation, they’re going to be less likely to want to share inheritance, especially if that’s money that they may need to cover bills for the upcoming weeks or months to put themselves in a little bit of a better financial position than they may be in today.” He believes that it’s simply out of necessity to set themselves up for a more comfortable life as they look towards the future and their retirement years.

According to Rush, the level of willingness to share inheritance often comes down to the specific relationships that families have and the amount of money that is in the will. “In our line of work, we’ve personally seen many situations with families that have fought over inheritances, that have fought because things weren’t even or weren’t equal. And we’ve seen many close-knit families that were torn apart because of inheritance, because of money, and because of some of that greed that can come out when some of these large amounts of money come into play.

On the flip side, we’ve seen the opposite as well, right? We’ve seen families that are very equitable. We’ve seen siblings who have redistributed some of the inherited funds to make sure that things were even. I think a lot of that just comes down to the specific relationships and the family.”

Image credits: Karolina Kaboompics / Pexels (not the actual photo)

“It’s up to the person who left the inheritance to determine what their wishes are and who they may want their assets and money to go to”

“When it comes to not sharing an inheritance or not wanting to redistribute that to other family members or other siblings, it’s certainly a very touchy topic. I think that at the end of the day, it’s up to the person who left the inheritance to determine what their wishes are and who they may want their assets and money to go to,” Rush says.

He believes that it’s not up to the person who receives the estate to then redistribute it accordingly. “That’s kind of part of that broader estate planning process where older couples and even younger couples that may have amassed a large number of assets or money should have a very well thought out and well-written plan that distributes those assets how they want and to whom they want them to go.”

“That itself can really help with resolving conflict down the road,” he adds. “If there’s a very clear plan in place about who they wanted this money to go to or who they wanted to get a house or a vacation home, that clear communication can help the families down the road.”

As far as communicating the unwillingness to share inheritance goes, Rush suggests simply being open and having that conversation. He believes that it can really prevent conflict from arising and ensure that relationships don’t fall apart.

“The whole topic of estate planning, wealth transfer, and inheritance—there’s a lot of moving pieces and it’s certainly a very intricate conversation to have,” Rush admits. “We encourage our clients to be open about the wealth that they may have accumulated.

And I know money and finances can be a very taboo topic in our society, but I think having that open conversation can be really, really helpful and really healthy to make sure that these families stay close-knit and stay stronger together as they go through difficult times of losing loved ones, which is already a very hard thing to go through. It only makes it harder when some of this fighting starts happening over money, assets, and estates.

The author addressed some confusion in the comments

Most readers were on the original poster’s side

Meanwhile, the minority thought she should’ve helped the family