/Airbnb%20Inc%20logo%20with%20red%20background%20by-%20viewimage%20via%20Shutterstock.jpg)

Valued at a market cap of $86.2 billion, Airbnb, Inc. (ABNB) is an online marketplace that connects hosts offering accommodations and unique stays with guests seeking lodging and travel experiences. The San Francisco, California-based company is scheduled to announce its fiscal Q4 earnings for 2025 in the near future.

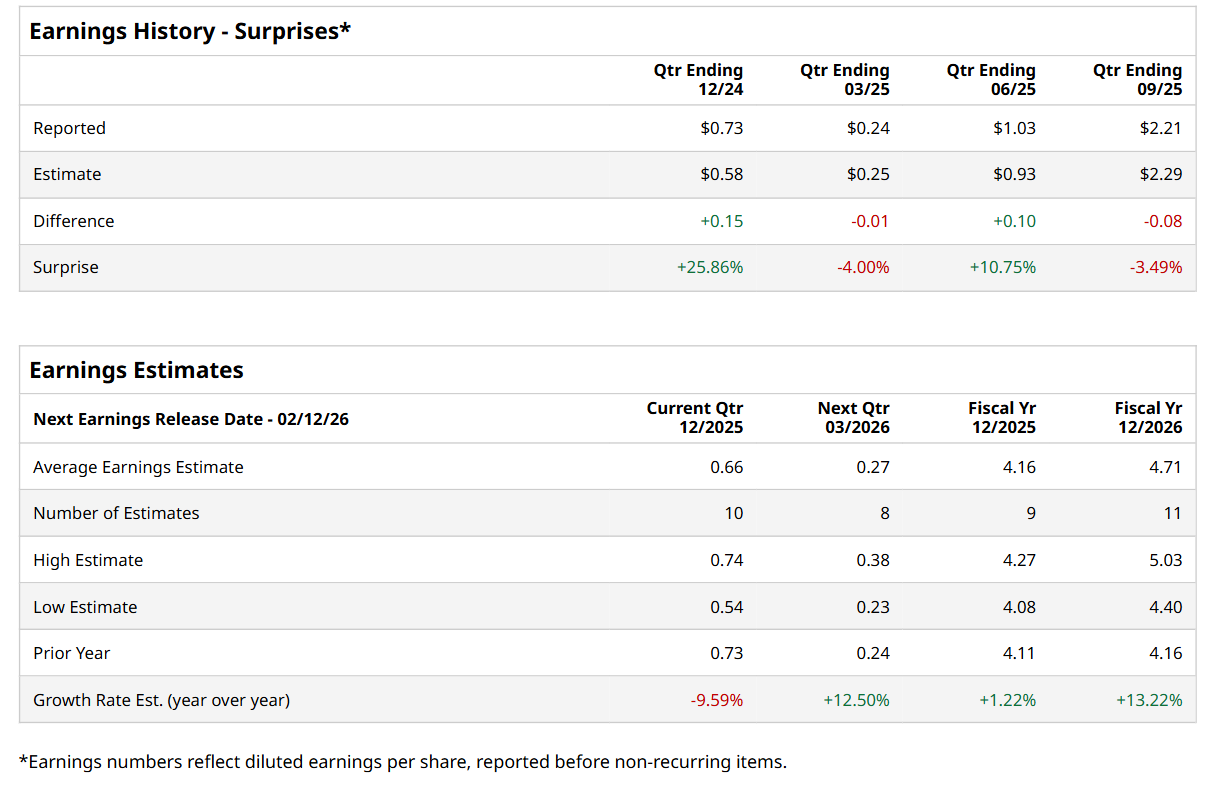

Ahead of this event, analysts expect this travel services provider to report a profit of $0.66 per share, down 9.6% from $0.73 per share in the year-ago quarter. The company has topped Wall Street’s bottom-line estimates in two of the last four quarters, while missing on two other occasions. In Q3, its EPS of $2.21 fell short of the consensus estimates by 3.5%.

For the current fiscal year, ending in December, analysts expect Airbnb to report a profit of $4.16 per share, up 1.2% from $4.11 per share in fiscal 2024. Furthermore, its EPS is expected to grow 13.2% year-over-year to $4.71 in fiscal 2026.

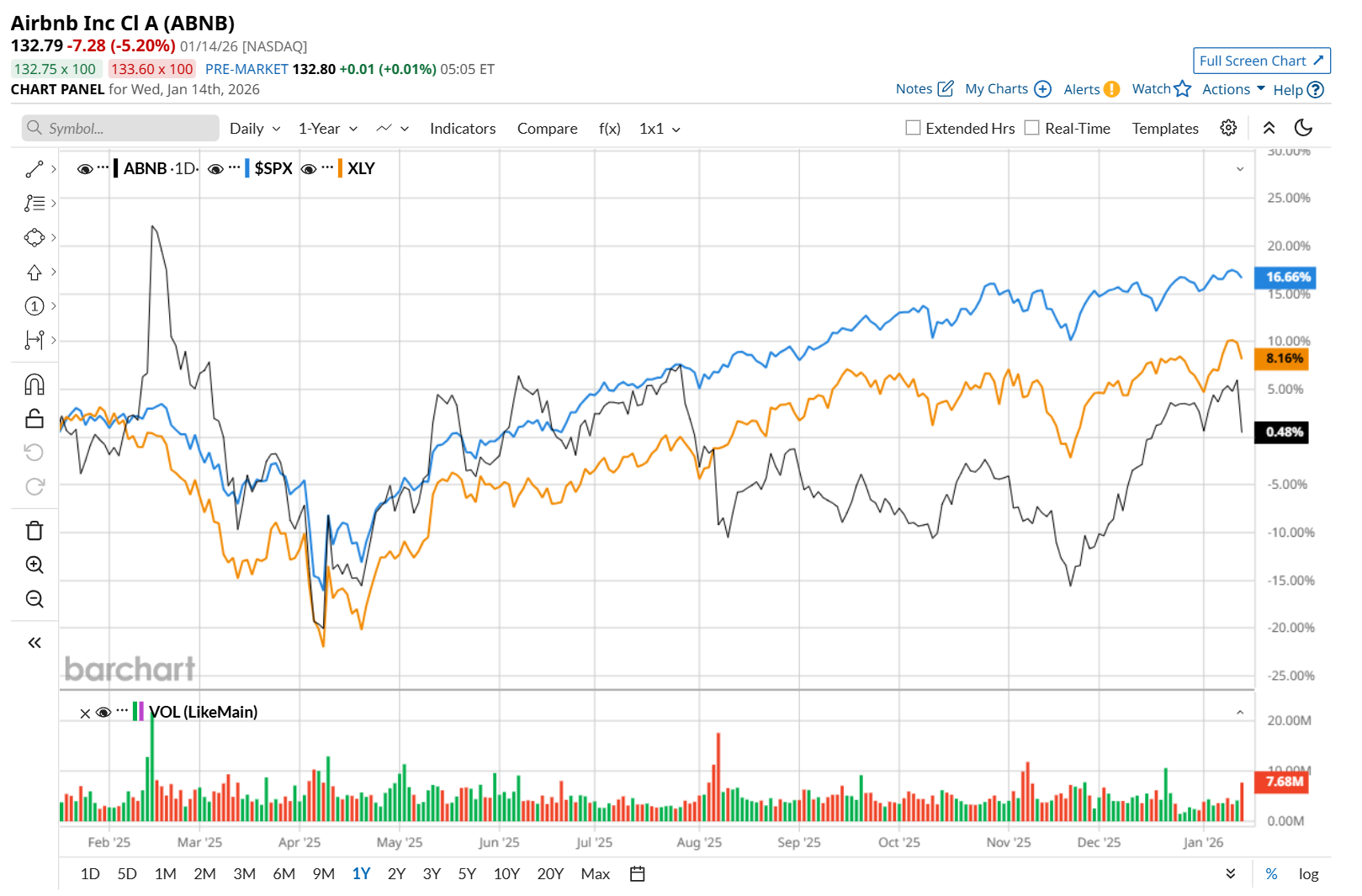

Airbnb has gained 4.1% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 18.6% return and the State Street Consumer Discretionary Select Sector SPDR ETF’s (XLY) 10.3% uptick over the same time period.

On Nov. 6, ABNB delivered its Q3 results, and its shares closed up marginally in the following trading session. The company’s revenue grew 9.7% year-over-year to $4.1 billion, meeting analyst estimates. Other key business metrics also remained strong, with Gross Booking Value (GBV) rising 13.9% to $22.9 billion and Nights and Seats Booked increasing 8.8%, driven by strong U.S. demand and new features like Reserve Now, Pay Later. However, its net income per share improved 3.8% from the year-ago quarter to $2.21, but missed consensus expectations of $2.29.

Wall Street analysts are moderately optimistic about ABNB’s stock, with a "Moderate Buy" rating overall. Among 40 analysts covering the stock, 12 recommend "Strong Buy," three indicate "Moderate Buy,” 22 suggest "Hold,” one advises a "Moderate Sell,” and two suggest "Strong Sell.” The mean price target for ABNB is $145.94, indicating a 9.9% potential upside from the current levels.