Kohl’s (KSS) stock has been all over the place, and lately that hasn’t been a good thing.

Earlier this year, retail stocks were bucking the pain in the overall market. While in March and April Walmart (WMT), Costco (COST), Kohl’s and others were volatile, the stocks were trading at or near new highs.

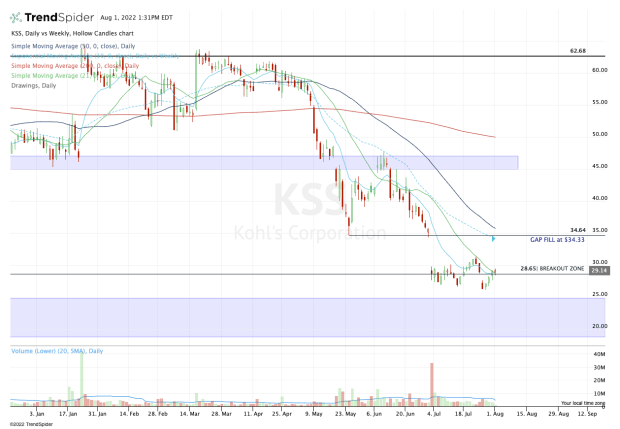

That’s evident on the chart below, with Kohl’s stock trading into resistance in the low-$60s.

But the shares fell apart in the second quarter — alongside the selloff in retail — leaving Kohl's investors in pain.

At one point, Kohl’s was attracting plenty of attention from private equity firms and activists, including Sycamore Partners, Simon Property Group (SPG) and Brookfield Asset Management.

Ultimately, reports spoke of the company entering talks with Franchise Group (FRG) to be acquired for $60 a share. The bid was reduced to $53 a share before being scrapped.

After the failed sale, the retailer is trying to win over customers with a new plan — one that involves Levi Strauss (LEVI).

The question is: Will it also win over investors?

Trading Kohl’s Stock

Chart courtesy of TrendSpider.com

The stock has been finding its footing around the prior breakout level near $28.50. The price action hasn’t been pretty and the stock did not find support at this level to the penny.

No other way to put it: The price action has been sloppy.

Now the stock is trying to push higher and is contending with the 10-day and 21-day moving averages.

If it can continue higher, keep an eye on the July high at $31.30. If the stock can clear this level and stay above it, we’ll have a monthly-up rotation, potentially putting the $34 to $34.50 area in play.

This zone is key. Not only is it where we find the 10-week and 50-day moving averages, but it’s also where prior support failed and where the gap-fill is (at $34.33).

On the downside, traders should keep an eye on $28.50. Not only is that the aforementioned breakout level from 2020, but should the shares break below this mark, it will also put Kohl’s stock below the 10-day and 21-day moving averages.

That opens the door back down to last week’s and last month’s low at $26.07. Below that and the prior consolidation zone between $19 and $24 is back in play.