Financial giants have made a conspicuous bearish move on Advanced Micro Devices. Our analysis of options history for Advanced Micro Devices (NASDAQ:AMD) revealed 40 unusual trades.

Delving into the details, we found 37% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 9 were puts, with a value of $561,778, and 31 were calls, valued at $8,526,816.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $25.0 to $200.0 for Advanced Micro Devices over the recent three months.

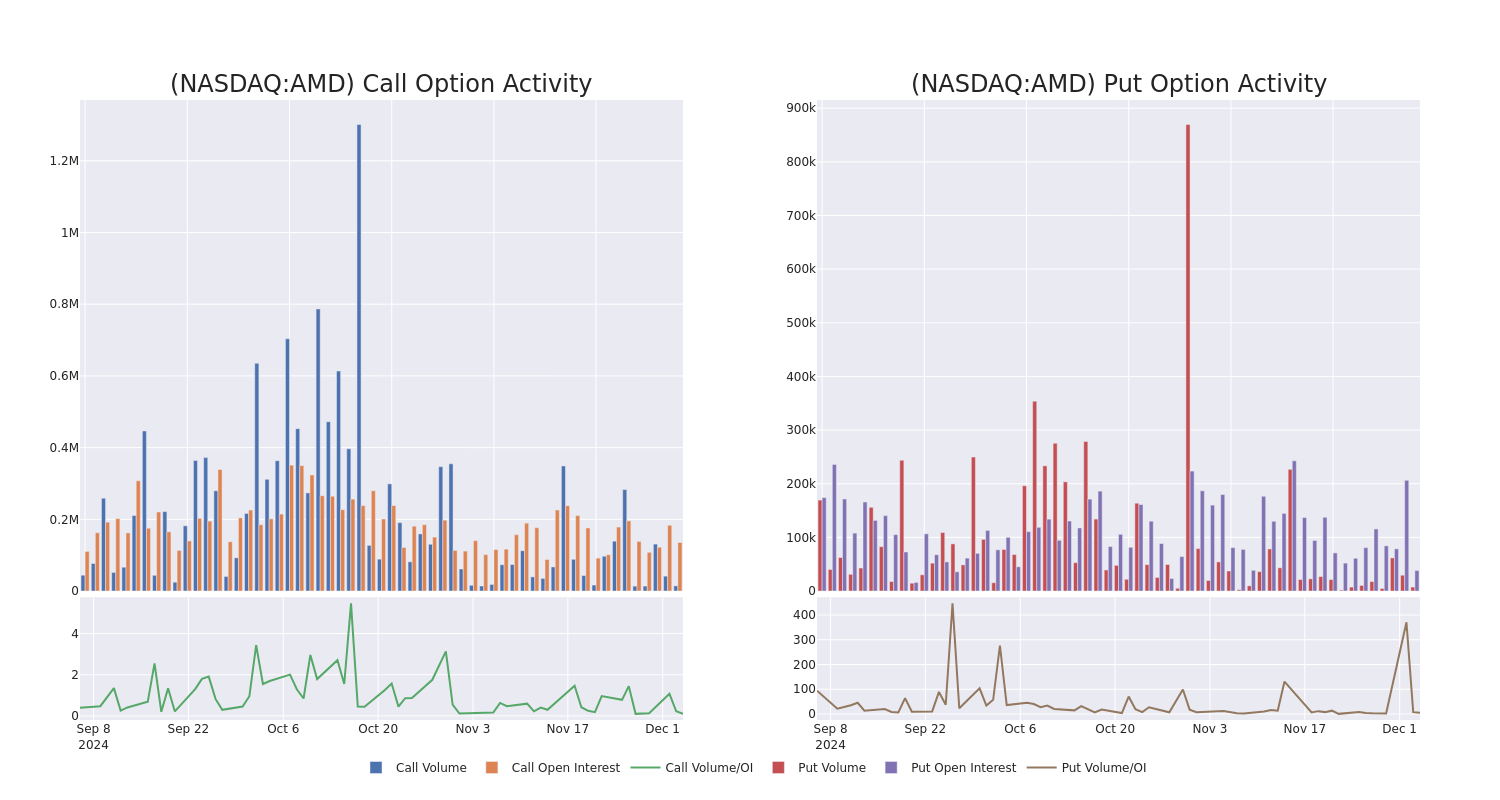

Volume & Open Interest Development

In today's trading context, the average open interest for options of Advanced Micro Devices stands at 5608.1, with a total volume reaching 21,867.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Advanced Micro Devices, situated within the strike price corridor from $25.0 to $200.0, throughout the last 30 days.

Advanced Micro Devices Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMD | CALL | TRADE | BULLISH | 05/16/25 | $119.05 | $118.5 | $118.83 | $25.00 | $1.1M | 2.5K | 1.6K |

| AMD | CALL | TRADE | NEUTRAL | 05/16/25 | $118.75 | $118.2 | $118.52 | $25.00 | $1.1M | 2.5K | 1.3K |

| AMD | CALL | TRADE | NEUTRAL | 05/16/25 | $118.7 | $117.8 | $118.23 | $25.00 | $1.1M | 2.5K | 948 |

| AMD | CALL | TRADE | BULLISH | 05/16/25 | $118.35 | $117.75 | $118.13 | $25.00 | $1.1M | 2.5K | 1.1K |

| AMD | CALL | TRADE | BULLISH | 05/16/25 | $118.05 | $117.45 | $117.85 | $25.00 | $1.1M | 2.5K | 255 |

About Advanced Micro Devices

Advanced Micro Devices designs a variety of digital semiconductors for markets such as PCs, gaming consoles, data centers, industrial, and automotive applications. AMD's traditional strength was in central processing units and graphics processing units used in PCs and data centers. Additionally, the firm supplies the chips found in prominent game consoles such as the Sony PlayStation and Microsoft Xbox. In 2022, the firm acquired field-programmable gate array leader Xilinx to diversify its business and augment its opportunities in key end markets such as data center and automotive.

Following our analysis of the options activities associated with Advanced Micro Devices, we pivot to a closer look at the company's own performance.

Advanced Micro Devices's Current Market Status

- Trading volume stands at 12,485,887, with AMD's price up by 0.51%, positioned at $142.7.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 55 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Advanced Micro Devices, Benzinga Pro gives you real-time options trades alerts.