Shares of rideshare giant Uber (UBER) -) ripped higher Monday on the news that the stock, effective Dec. 18, will be included in the S&P 500, the index that tracks the performance of 500 of the largest publicly traded companies in the U.S.

The stock rose around 5% on the news, hitting a new 52-week-high of $60.92 per share before dipping slightly to a share price of around $59.

Shares of Uber are up nearly 140% for the year.

Related: Uber Eats announces 'industry first' change its customers will love

Wedbush Securities analyst Dan Ives, in response to news of the company's inclusion in the S&P, boosted his price target to $67 per share and reiterated his "bullish" stance on the stock.

The company, according to Ives, is on track to generate $5 billion in free cash flow in 2024. Given Uber's recent cash flow improvements, Ives expects the company to begin a share repurchasing program sometime over the next few quarters.

Oppenheimer analysts, echoing Ives' prediction of a pending stock buyback, boosted their price target to $75 per share from $65.

To be eligible for inclusion in the S&P 500, companies must have positive earnings in the most recent quarter and over the previous four quarters in total, in addition to a market cap above $14.5 billion.

Uber, with a market cap of around $120 billion, earned more than $1 billion in profit over the last four quarters. The company reported GAAP profitability for the first time in its history during the second quarter of 2023.

Uber reported $221 million in net income for the third quarter, with revenue of $9.3 billion. The company reported a 21% year-over-year growth in gross bookings and an 11% growth in revenue.

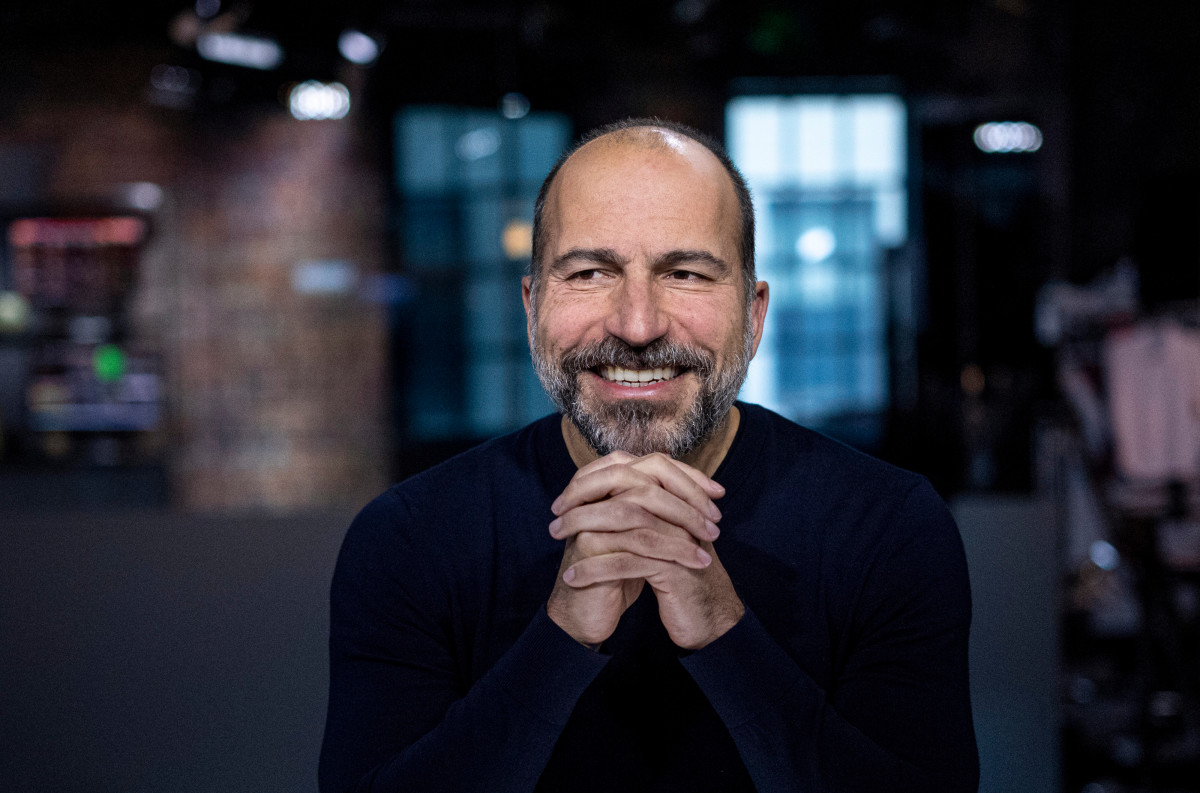

“Our relentless focus on improving the product experience for both consumers and drivers continued to power profitable growth, with trip growth accelerating to 25%,” Uber CEO Dara Khosrowshahi said in a statement at the time. “Uber’s core business is stronger than ever as we enter the busiest period of the year.”

Related: New report highlights a major speedbump to mass electric vehicle adoption

Get exclusive access to portfolio managers’ stock picks and proven investing strategies with Real Money Pro. Get started now.