Is your child currently enrolled or heading to college soon?

"Of all the things we have to deal with our kids, if you had to say what's the most important aspect of you and your kid and your concerns about your kids, it's going to be health care", says Jamie Hargrove, an attorney, CPA, and estate planning expert.

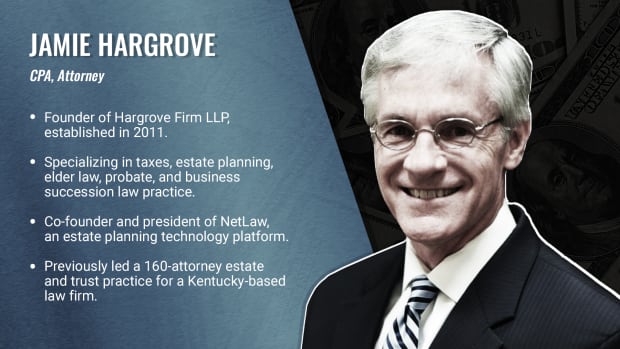

Hargrove sat down with Retirement Daily's Robert Powell to explain everything you need to know regarding health care and tax advice for parents with college students.

Read the full Q&A below or watch the video above.

Recommended Read: College Guide: Tax and Legal Matters Every Parent Should Know

Health Care for College Students

Robert Powell asks: What are some legal and tax matters to keep in mind if your child or children are at college? Here to talk with me about that is Jamie Hargrove from Hargrove Firm. Jamie, we've got a laundry list of things to cover, including health care proxies, HIPAA releases, living wills, financial powers of attorney, various credits, and student loan interest deductions. Where to begin?

Jamie Hargrove: Well, probably where to begin is with health care. Of all the things we have to deal with with our kids, if you had to say what's the most important aspect of you and your kid and your concerns about your kids, it's going to be health care, right? Yes, financial issues are a problem, and tax credits and all those things are important. But what's at the center of everything is the health of our kids. And here's what happens when their kid just graduated, he or she now in most cases has just turned age 18, and now they're off to college. And maybe they're down the street or maybe they're across the country.

But regardless, when they turn 18, they can go into the military. They are an adult. And think of it this way. If you're 55 years old, you wouldn't want your mom and dad, who are 75 years old, calling your doctor and inquiring about your medical care, right? I mean, you'd say, Jamie, that's crazy. I don't want my parents involved in my health care if I'm 50 years old. Well, and legally, they can't, right? Everybody gets that. Well, when you're age 18, guess what? You have the same exact situation. The difference is you just transitioned from the point where your parents did have that control and now they have zero control.

TurboTax Live experts look out for you. Expert help your way: get help as you go, or hand your taxes off. You can talk live to tax experts online for unlimited answers and advice OR, have a dedicated tax expert do your taxes for you, so you can be confident in your tax return. Enjoy up to an additional $20 off when you get started with TurboTax Live.

So what's that mean? That means that if they're at a fraternity or sorority party or just a party on campus, they're on the second floor. They fall out the window, they get broken, all kinds of broken things. And they're at the hospital. And you get this call at 2:00 in the morning and the doctor or the folks at the hospital are saying, hey, your daughter is in the hospital. She had a fall from the second floor of the fraternity building. You're immediately asking all these questions. And, of course, they're saying, I'm sorry, we can't give you any more information than what we've just given you because this is an adult. This adult has not shared anything, your kid's unconscious, so they couldn't give any approval for talking to you. There have been no legal documents signed or submitted. And so you're just all of a sudden, you're really mad at that hospital and those health care providers.

HIPAA Statement Explained

But the reality is, by law, HIPAA, you've heard it. You signed a little HIPAA statement when you went to your doctor recently. That's a federal government document saying who can make your decisions. And it very well may be that your loved one, your college student will be able to make decisions and say, I want you to call mom and talk to mom and dad about this, right? But again, if they're unconscious and otherwise unable, then you're in a predicament. So probably the most important document is to talk to your college-age kid about this issue and get their permission and then get documents completed where they make it very clear that you have the ability to have authorization and talk to their medical professionals about their health care. And even if they can't make their decision that they're saying, mom, dad, I want you to make those decisions for me.

So critical documents. And again, most of the time, most of these college students don't have it, but they should.

Robert Powell: All right, Jamie, I want to thank you again, as always, for sharing your knowledge and wisdom with our readers and viewers. It's greatly appreciated.

Editor's Note: The content was reviewed for tax accuracy by a TurboTax CPA expert.