C3.ai (NYSE:AI) is set to give its latest quarterly earnings report on Monday, 2024-12-09. Here's what investors need to know before the announcement.

Analysts estimate that C3.ai will report an earnings per share (EPS) of $-0.16.

C3.ai bulls will hope to hear the company announce they've not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

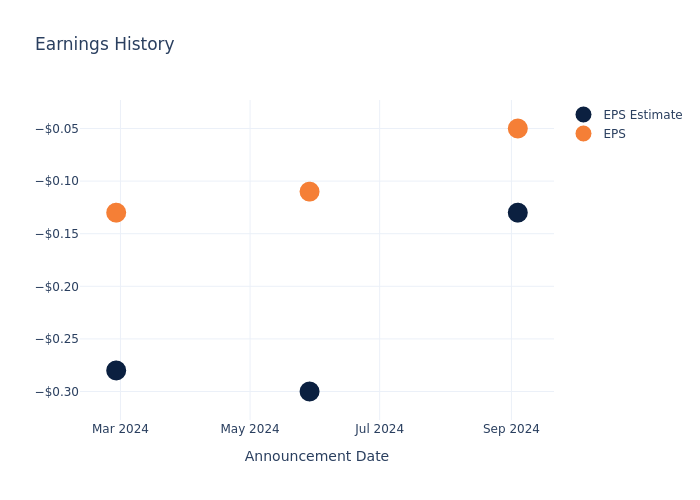

Performance in Previous Earnings

In the previous earnings release, the company beat EPS by $0.08, leading to a 8.21% drop in the share price the following trading session.

Here's a look at C3.ai's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | -0.13 | -0.30 | -0.28 | -0.18 |

| EPS Actual | -0.05 | -0.11 | -0.13 | -0.13 |

| Price Change % | -8.0% | 19.0% | 25.0% | -11.0% |

C3.ai Share Price Analysis

Shares of C3.ai were trading at $37.49 as of December 05. Over the last 52-week period, shares are up 33.18%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analysts' Perspectives on C3.ai

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on C3.ai.

Analysts have given C3.ai a total of 1 ratings, with the consensus rating being Neutral. The average one-year price target is $35.0, indicating a potential 6.64% downside.

Understanding Analyst Ratings Among Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of Freshworks, InterDigital and SoundHound AI, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- For Freshworks, analysts project an Outperform trajectory, with an average 1-year price target of $17.11, indicating a potential 54.36% downside.

- InterDigital received a Buy consensus from analysts, with an average 1-year price target of $160.0, implying a potential 326.78% upside.

- The consensus outlook from analysts is an Buy trajectory for SoundHound AI, with an average 1-year price target of $7.92, indicating a potential 78.87% downside.

Insights: Peer Analysis

Within the peer analysis summary, vital metrics for Freshworks, InterDigital and SoundHound AI are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| C3.ai | Neutral | 20.52% | $52.17M | -7.19% |

| Freshworks | Outperform | 21.51% | $156.77M | -2.66% |

| InterDigital | Buy | -8.16% | $101.21M | 4.82% |

| SoundHound AI | Buy | 89.13% | $12.19M | -8.37% |

Key Takeaway:

C3.ai ranks at the bottom for Revenue Growth and Gross Profit, while it is in the middle for Return on Equity.

All You Need to Know About C3.ai

C3.ai Inc is an enterprise artificial intelligence company. The company provides software-as-a-service applications that enable customers to rapidly develop, deploy, and operate large-scale Enterprise AI applications across any infrastructure. It provides solutions under three divisions namely, The C3 AI Platform, which is an end-to-end application development and runtime environment for designing, developing, and deploying AI applications: C3 AI Applications, which is a portfolio of pre-built, extensible, industry-specific, and application-specific Enterprise AI applications: and C3 Generative AI, which combines the utility of large language models. Geographically the company derives revenue from North America, Europe, the Middle East and Africa, Asia Pacific, and the Rest of the World.

C3.ai: Financial Performance Dissected

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: Over the 3 months period, C3.ai showcased positive performance, achieving a revenue growth rate of 20.52% as of 31 July, 2024. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: C3.ai's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of -72.04%, the company may face hurdles in effective cost management.

Return on Equity (ROE): C3.ai's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of -7.19%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): C3.ai's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of -6.0%, the company may face hurdles in achieving optimal financial returns.

Debt Management: With a below-average debt-to-equity ratio of 0.0, C3.ai adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for C3.ai visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.