Are deathbed gifts ever a good financial decision?

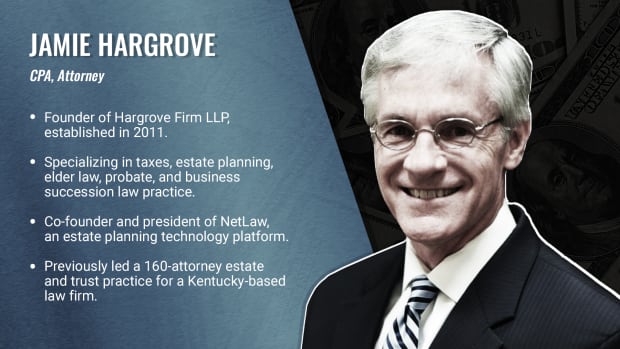

"While there are always exceptions, the truth is that in the vast majority of cases it is a bad idea to transfer assets out of a person’s name just before death", says Jamie Hargrove, an attorney, CPA, and estate planning expert.

Hargrove says, "Consequently, even though an estate is 'taxable', there really are no taxes due. There are a few states that still have an inheritance tax and, of course, in very large estates you may be subject to federal estate tax. Those situations, however, are the exception, not the rule, and even in those situations, the laws are drafted in such a way as to eliminate any benefits from last-minute deathbed planning options."

Related: Why NOT to Use Deathbed Gifts: Understanding Your Options When Estate Planning

Hargrove sat down with Retirement Daily's Robert Powell to explain why deathbed gifts are usually a bad idea. Hargrove provided other estate planning strategies including step-up basis rules, taxable estates, probate, the benefits of keeping your assets, and what to do if you already transferred them over.

Read the full Q&A below or watch the video above.

Deathbed Tax Planning Basics

Robert Powell Asks: Jamie, why are deathbed gifts such a bad idea?

Jamie Hargrove: Well, they're not always a bad idea, but most of the time they're a bad idea. So the estate tax exemption, at the end of 2025, that number will drop to $13 million, today's number, plus whatever the inflation adjustments are between now and the end of 2025.

That assumes that Congress and the president don't get together and do something to keep that from just that law sunsetting. So unless everybody gets together and says, we want to keep it and the belief is that won't happen, then you're looking at about a $13 million estate tax exemption. But still even at $13 million, most of us don't need to worry about the estate taxes. So the idea I need to get rid of something just before I die to save estate taxes is not a good idea. Even in the estate tax world, it doesn't help you anyway.

Deathbed and Probate Explained

So why do you want to hang on to assets? Because some might say, well, at least if I get rid of it, I can avoid probate. Well, there are better ways to avoid probate. So let me give you an example of why it's a bad idea. So let's say that I've got a family farm, the family farm's worth a couple of $100,000. Right, but I inherited the farm many years ago, 30 years ago, when it was worth hardly anything. Nothing hardly got allocated to the land itself. Everything was to the buildings and the barns. They've been depreciated. So I effectively have a zero basis.

Now if I give that $200,000 to my, let's say I've got two kids, and I give it to my two kids on my deathbed just two days before I die. And then they sell the property weeks later, months later, years later, whenever they sell it, and let's say they sell it for $200,000. Then in that situation, they're going to pay capital gains on a $200,000 gain. So even if they're in a state that pays no state income taxes, they're looking at 20% capital gains. They're going to pay $40,000 in capital gains taxes.

TurboTax Live experts look out for you. Expert help your way: get help as you go, or hand your taxes off. You can talk live to tax experts online for unlimited answers and advice OR, have a dedicated tax expert do your taxes for you, so you can be confident in your tax return. Enjoy up to an additional $20 off when you get started with TurboTax Live.

Taxable Estates Explained

Now, the same scenario. I'm on my deathbed. I've got a $200,000 farm. I've got two kids, I've got a deed here that I can sign and just give to the kids before I die. But I don't get around to doing it. Thank goodness I didn't get around to doing it because now the farm is still in my name when I die. Because it's in my name, it's actually taxed in my taxable estate. But that's OK because I have this huge exemption against estate taxes. Most states don't have an inheritance tax, hardly any at this level. And so there really are no negative consequences to having that farm in my estate. The good news is because it's in my taxable estate, even though I don't pay taxes, I get a step up in income tax basis.

What does that mean? That means that the zero tax basis on that farm now adjusts to 200,000. So now my two kids inherit a farm that has a tax basis of $200,000. They now sell it shortly after I die or two years after I died. It doesn't matter when they sell it, but assuming they sell it for $200,000, they pay zero taxes. And they just saved $40,000 in capital gains tax.

Accidentally Transferred Assets, Now What?

Robert Powell: So what if someone made an oops and the assets were already transferred? What then?

Jamie Hargrove: Good question. So many times, let's say I'm living on my farm. I've got a little house on that little farm, but it's rural, in the rural area. But I got a house on it and I give that away. Well, it sounds like bad news, but the fact is, I'm still living on the property. So what you can do is you may just ask some questions if you're the accountant or the advisor financial planner. Find out if there is any retained interest. So maybe I didn't live on the property because if you make a gift and you continue to retain an interest in that property, that retained interest actually pulls it back into your estate.

Now, years ago, when the estate tax exemption was $600,000, that was bad news. Today, it's actually good news. We actually look for those retained interests. So maybe I don't have a house on the farm, but I still have some hay or some cattle. And I'm actually getting the income from some of those crops or some of that activity. If I'm getting some of that income when I die, that's a retained interest. It actually pulls it back into my estate. I can still take the position. It's an asset in my estate. It gets a step up on an income tax basis (to the date of death value).

Robert Powell: All right, Jamie, I want to thank you for sharing your knowledge and wisdom with our readers and viewers. It's greatly appreciated.

Jamie Hargrove: Appreciate the opportunity. Great to catch up.

Editor's Note: The content was reviewed for tax accuracy by a TurboTax CPA expert.