Casey's General Stores (NASDAQ:CASY) is set to give its latest quarterly earnings report on Monday, 2024-12-09. Here's what investors need to know before the announcement.

Analysts estimate that Casey's General Stores will report an earnings per share (EPS) of $4.26.

The market awaits Casey's General Stores's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

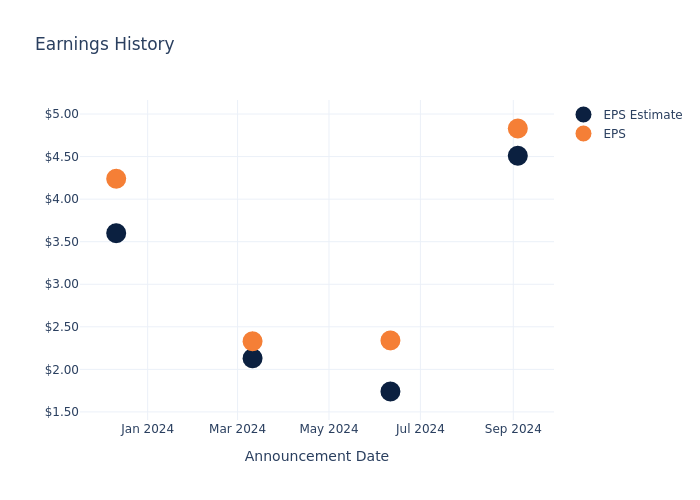

Performance in Previous Earnings

The company's EPS beat by $0.32 in the last quarter, leading to a 7.4% increase in the share price on the following day.

Here's a look at Casey's General Stores's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 4.51 | 1.74 | 2.13 | 3.60 |

| EPS Actual | 4.83 | 2.34 | 2.33 | 4.24 |

| Price Change % | 7.000000000000001% | 17.0% | -2.0% | -0.0% |

Analysts' Take on Casey's General Stores

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Casey's General Stores.

Analysts have provided Casey's General Stores with 6 ratings, resulting in a consensus rating of Buy. The average one-year price target stands at $412.67, suggesting a potential 1.76% downside.

Comparing Ratings with Competitors

The analysis below examines the analyst ratings and average 1-year price targets of Sprouts Farmers Market, Maplebear and Albertsons Companies, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- As per analysts' assessments, Sprouts Farmers Market is favoring an Neutral trajectory, with an average 1-year price target of $131.3, suggesting a potential 68.74% downside.

- The prevailing sentiment among analysts is an Outperform trajectory for Maplebear, with an average 1-year price target of $49.82, implying a potential 88.14% downside.

- The consensus outlook from analysts is an Neutral trajectory for Albertsons Companies, with an average 1-year price target of $23.19, indicating a potential 94.48% downside.

Summary of Peers Analysis

In the peer analysis summary, key metrics for Sprouts Farmers Market, Maplebear and Albertsons Companies are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Casey's General Stores | Buy | 5.91% | $955.26M | 5.83% |

| Sprouts Farmers Market | Neutral | 13.57% | $740.92M | 7.01% |

| Maplebear | Outperform | 11.52% | $641M | 3.92% |

| Albertsons Companies | Neutral | 1.43% | $5.12B | 4.90% |

Key Takeaway:

Casey's General Stores ranks highest in Revenue Growth among its peers. It also leads in Gross Profit and Return on Equity. Overall, Casey's General Stores outperforms its peers across key financial metrics.

Delving into Casey's General Stores's Background

Casey's serves as the nation's third-largest convenience store chain with its more than 2,600 locations primarily positioned in the Midwest United States. About half of Casey's stores are located in rural towns with populations under 5,000. While fueling stations serve as a key traffic driver, about two thirds of the company's gross profit stems from in-store sales of grocery items, prepared meals, and general merchandise. Casey's owns more than 90% of its stores and operates most of its warehousing and distribution processes internally.

Casey's General Stores's Economic Impact: An Analysis

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Casey's General Stores's remarkable performance in 3 months is evident. As of 31 July, 2024, the company achieved an impressive revenue growth rate of 5.91%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Staples sector.

Net Margin: Casey's General Stores's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 4.4%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Casey's General Stores's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 5.83% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Casey's General Stores's ROA excels beyond industry benchmarks, reaching 2.81%. This signifies efficient management of assets and strong financial health.

Debt Management: Casey's General Stores's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.51.

To track all earnings releases for Casey's General Stores visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.