Analysts' ratings for Lumen Technologies (NYSE:LUMN) over the last quarter vary from bullish to bearish, as provided by 4 analysts.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 4 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 2 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

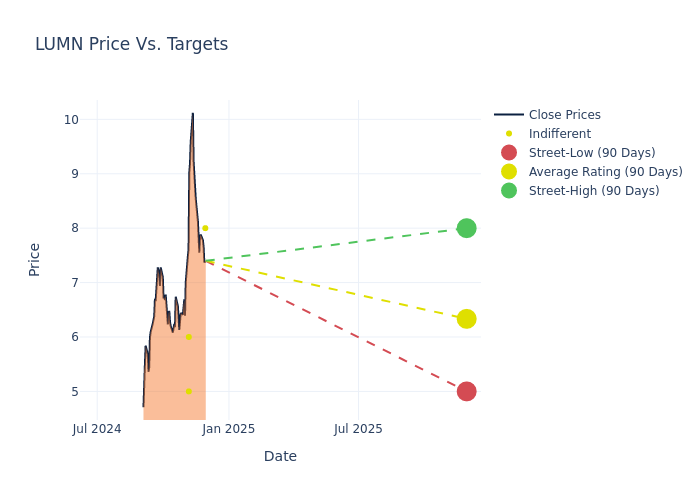

Analysts have recently evaluated Lumen Technologies and provided 12-month price targets. The average target is $5.88, accompanied by a high estimate of $8.00 and a low estimate of $4.50. This upward trend is evident, with the current average reflecting a 6.91% increase from the previous average price target of $5.50.

Understanding Analyst Ratings: A Comprehensive Breakdown

The perception of Lumen Technologies by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Michael Rollins | Citigroup | Raises | Neutral | $8.00 | $6.50 |

| Gregory Williams | TD Cowen | Lowers | Hold | $6.00 | $7.00 |

| James Schneider | Goldman Sachs | Raises | Neutral | $5.00 | $4.50 |

| James Schneider | Goldman Sachs | Raises | Neutral | $4.50 | $4.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Lumen Technologies. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Lumen Technologies compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Lumen Technologies's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

For valuable insights into Lumen Technologies's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Lumen Technologies analyst ratings.

Delving into Lumen Technologies's Background

With 450,000 route miles of fiber, Lumen Technologies is one of the United States' largest telecommunications carriers serving global enterprises. Its merger with Level 3 in 2017 and divestiture of much of its incumbent local exchange carrier, or ILEC, business in 2022 has shifted the company's operations away from its legacy consumer business and toward enterprises (now about 75% of revenue). Lumen offers businesses a full menu of communications services, providing colocation and data center services, data transportation, and end-user phone and internet service. On the consumer side, Lumen provides broadband and phone service across 37 states, where it has 4.5 million broadband customers.

Lumen Technologies's Economic Impact: An Analysis

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: Lumen Technologies's revenue growth over a period of 3 months has faced challenges. As of 30 September, 2024, the company experienced a revenue decline of approximately -11.54%. This indicates a decrease in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Communication Services sector.

Net Margin: Lumen Technologies's net margin excels beyond industry benchmarks, reaching -4.59%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Lumen Technologies's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of -36.63%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Lumen Technologies's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -0.44% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Lumen Technologies's debt-to-equity ratio is notably higher than the industry average. With a ratio of 55.03, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Analyst Ratings: Simplified

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.