Nvidia (NVDA) easily beat analyst estimates in its fiscal third-quarter report.

Revenue of $35.1 billion was up 94% from the year-earlier quarter and 17% from the second quarter. Earnings per share of 78 cents more than doubled (up 111%) from a year earlier.

💰💸 Don’t miss the move: SIGN UP for TheStreet’s FREE Daily newsletter 💰💸

And the revenue for the period exceeded Nvidia's total revenue in fiscal 2023.

Related: Goldman Sachs analyst leads Nvidia price target overhauls after earnings

Fiscal fourth-quarter guidance, meanwhile, was decent, too. Revenue is projected at $37.5 billion, plus or minus 2%, which would be up about 70% from a year earlier. The gross profit margin was pegged at roughly 73%.

But the shares didn't move much, ending the week down slightly and down 7.1% since they hit a record $152.89 on Nov. 21, a day after its earnings report.

The shares are still up 187% for 2024, third-best among stocks in the Standard & Poor's 500 index after Vistra Corp. (VST) and data analytics company Palantir (PLTR) .

And, of course, Nvidia is the world's most valuable company, with a market capitalization of $3.476 trillion, just ahead of Apple's (AAPL) $3.475 trillion.

Analysts remain bullish on the stock and ignored the price action after the earnings came out. Price targets range as high as $220.

Here are five things to think about Nvidia since the earnings report.

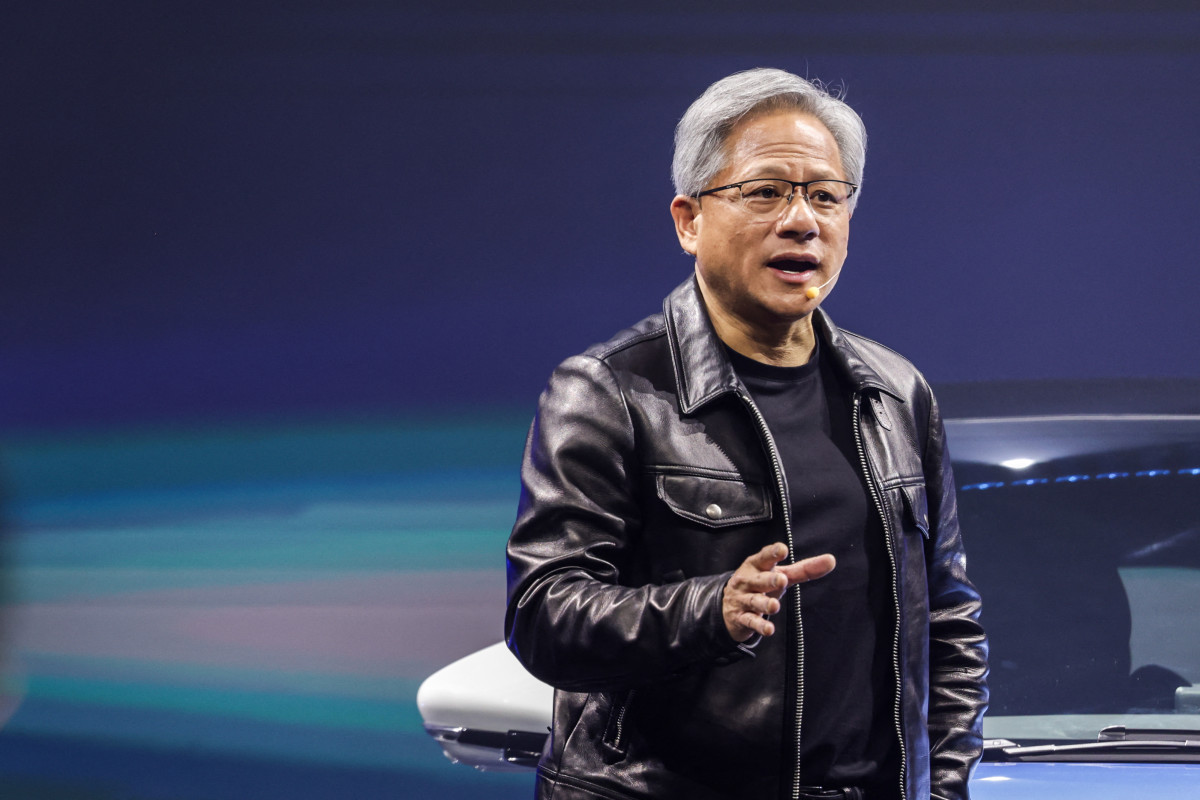

What happened to the stock price? The earnings report was fine, but the results and the fourth-quarter guidance did not take investors' breath away. Still, Nvidia remains the dominant player in the development of computer chips, related hardware and the software systems to make artificial intelligence work. AI is basically Nvidia's data-center business, and data center is 78% of Nvidia's total revenue. Its market share is estimated at 80%, and no competitor is close to matching Nvidia's size and capabilities.

Is Nvidia growing too fast? Colette Kress, Nvidia's chief financial officer, says the company is "supply-constrained." That's a different way of saying it's growing as fast it can. The problem is demand for its graphic processing units is growing much faster right now. Companies such as Microsoft (MSFT) , Meta Platforms (META) , Google-parent Alphabet (GOOGL) and Tesla (TSLA) want as many Hopper GPUs (the current generation GPUs) and the new, state-of-art Blackwell units (with 208 billion transistors per unit) as they can get their hands on. Nvidia concedes that perhaps as much as 40% of sales go to four customers it doesn't name. The hope is that supply will grow more quickly over the next year. The Hopper units cost $20,000 to $40,000. The Blackwell units are priced around $60,000.

More Tech Stocks:

- Analysts revise Intuitive Machines stock price target after earnings

- Stanley Druckenmiller makes big bet on high-tech healthcare

- Analysts revamp Cisco stock price targets after earnings

Can't Nvidia just build more factories? Not exactly. It designs its products and contracts with Taiwan Semiconductor TSM to make them. TSM has foundries mostly in Taiwan. It also has foundries in Singapore, Washington State and Phoenix, Ariz. It is building two more in Arizona.

What's the key to making the chips work? Suppliers provide connectors and other products that all get tied together in a GPU. It also develops the software to make it all work. If the software were a stand-alone business, it might be generating $1 billion to $2 billion a year in revenue.

Related: Google analysts sent scrambling by startling break-up news

How did Nvidia start? By making chips used for games. As the graphics for games got more complex, it developed the hardware and software to thrill gamers. That led to AI. Its first GPU was the GeForce 256, released in 1999, used in games. It had only 17 million transistors. Nvidia concentrates on four segments: data centers, gaming, professional visualization, and automotive.

Is there something we all must learn about artificial intelligence? Yes. Know what "inference" means. An AI computer is loaded with huge amounts of data. The machine is then trained to organize the data to enable it to make sense of new data it hasn't seen before. As humans do. The process is called inference.

Related: Veteran fund manager sees world of pain coming for stocks