Cryptocurrency trading platform Coinbase Global Inc (NASDAQ:COIN) reported first-quarter financial results Tuesday. Analysts shared their takes on the company as shares hit new 52-week lows after the print.

The Coinbase Analysts: Bank of America analyst Jason Kupferberg has a Buy rating on Coinbase shares and lowered the price target from $273 to $185.

JMP analyst Devin Ryan has a Market Outperform rating and lowered the price target from $394 to $250.

Needham analyst John Todaro has a Buy rating and lowered the price target from $360 to $173.

Raymond James analyst Patrick O’Shaugnessy has an Underperform rating and no price target.

Related Link: Why Coinbase Stock Will Bounce Off Its All-Time Low

The Coinbase Takeaways: Volatility in the cryptocurrency market impacted the first quarter for Coinbase, Kupferberg said. New product offerings from the company have the analyst excited for the long-term outlook.

“We continue to think COIN remains well positioned to roll out new products that till generate top line growth and diversify revenues," the BofA analyst said.

The analyst highlights that 5.8 million users have used the staking product from Coinbase, a product that typically has higher retention levels than users who are only trading cryptocurrency.

JMP's Ryan called it a “challenging environment” for Coinbase in the first quarter. The analyst noted the soft quarter was mixed with declines in both institutional and retail.

“Management remains committed to revenue diversification and growth despite the tough market condition,” Ryan said. “We remain bullish on the long-term outlook for Coinbase given our ongoing expectation that the crypto economy will continue to develop at a rapid pace.”

Needham's Todaro cut the price target for Coinbase by more than half after what he termed a “disappointing” first-quarter report. The analyst lowered estimates on the company, but said he does see some potential growth ahead.

“We, however, continue to see longer term growth opportunities for the company and remain excited about blockchain rewards, and cloud subscription services,” Todaro said.

The big question for Raymond James' O’Shaughnessy is whether this is a typical crypto winter or a bubble that could settle prices of cryptocurrencies into “more normalized levels.”

“While management strongly believes the former will prove to be true, we suspect there is more than a bit of truth to the latter,” the analyst said.

Increased crypto regulation down the road could outweigh any pros that crypto has, he said.

The analyst sees the potential for EBITDA to turn negative for the company and said he's impressed with long-term growth prospects.

COIN Price Action: Coinbase shares were down 25.92% at $54.07 Wednesday afternoon, according to Benzinga Pro.

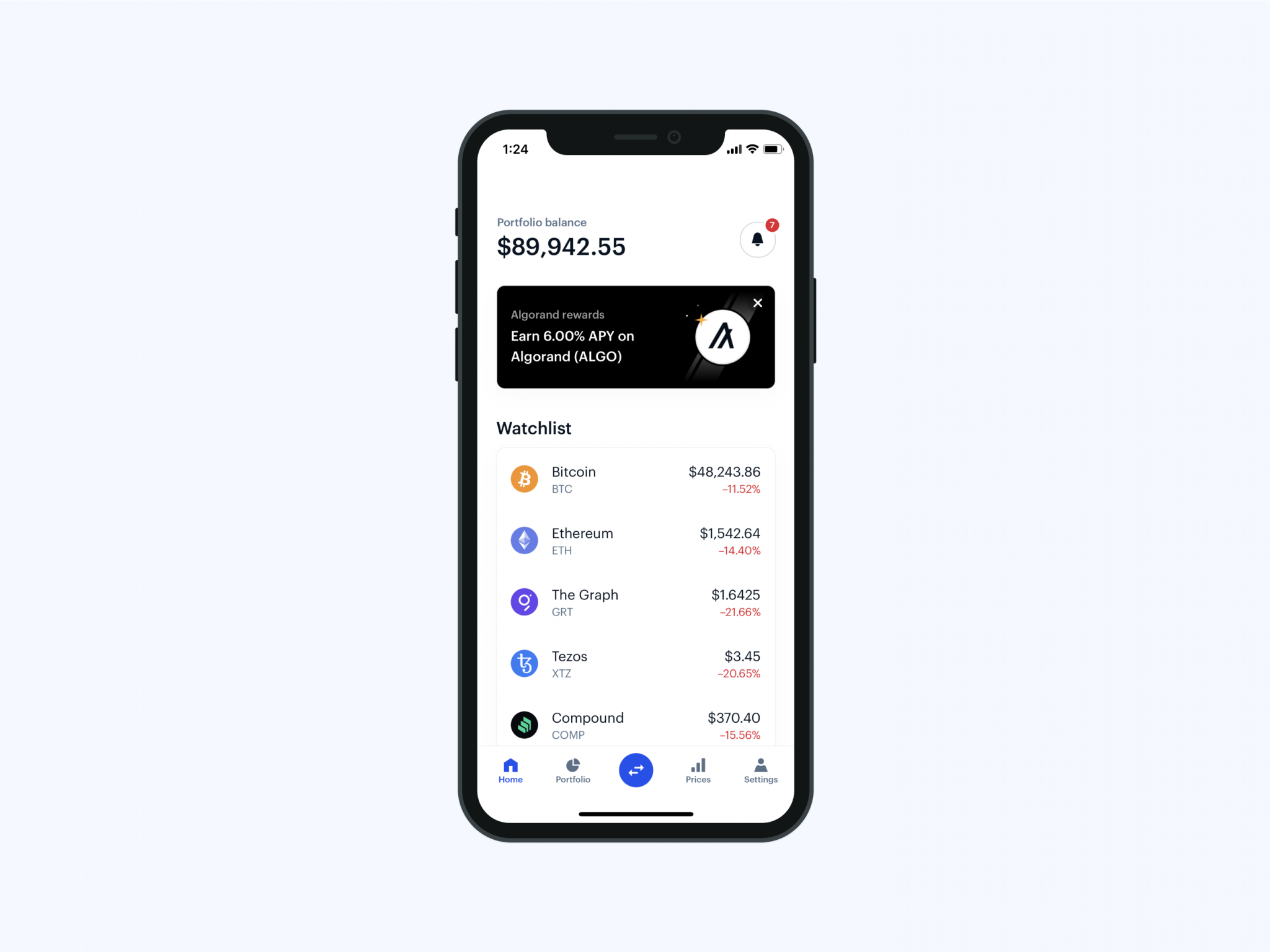

Photo courtesy of Coinbase.