Jodi Hayes, a Walnut Creek, California resident, was horrified to discover that 35 strangers had been fraudulently added as authorised users to her Chase credit card, each given the capability to charge up to $19,000. What started as a relaxing holiday on a cruise ship quickly became a financial nightmare, highlighting the increasing dangers of identity theft and credit card fraud in today's digital world.

The Shocking Discovery on Holiday

While on holiday in August 2024, Hayes received a notification through the U.S. Postal Service's "informed delivery" service, alerting her that numerous credit cards were being sent to her address. Unbeknownst to her, 35 individuals had been added to her credit card account, each authorised to make purchases or withdraw cash.

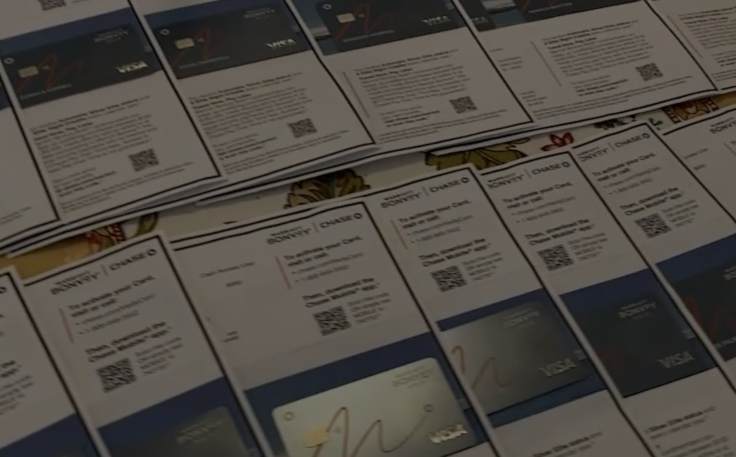

"This fiasco ruined the end of our vacation," Hayes said, recounting the moment she realised the severity of the situation. Upon returning home, she found 35 credit cards in her mailbox, all under different names, none of which she recognised. Each card allowed for $19,000 in charges or a $950 cash-back option, leaving Hayes vulnerable to massive financial damage.

From the cruise ship, Hayes immediately contacted her credit card company, Marriott Bonvoy Chase, only to be met with a less-than-reassuring response. The bank initially downplayed the situation, suggesting it could be a simple glitch, and assured her they would "sort it out." However, Hayes was left feeling unsupported. "I wanted them to send an email asking, 'Did you authorise all these people to be on your credit card?'" she said. Hayes was frustrated by the lack of immediate action or investigation.

Chase Bank's Response

Chase Bank eventually responded, issuing an official statement regarding the incident: "We monitor customer accounts for suspicious activity and promptly contact them if something unusual is detected. In this instance, our vigilant customer alerted us first. We closed the unauthorised cards, issued a new account and card, and apologised for the inconvenience caused during her vacation." Although the situation was resolved, the lack of initial urgency left Hayes feeling vulnerable and helpless during the ordeal.

The Rise of Identity Theft

Jodi Hayes' case is one of many reflecting the growing threat of identity theft in an increasingly connected world. Identity theft occurs when criminals steal personal information, such as Social Security numbers, credit card details, or even healthcare information, to assume a person's identity and commit financial fraud.

The US Department of Justice (DOJ) reported that in 2021 alone, 23.9 million people were victims of identity theft, with total losses exceeding $16.4 billion. Many of these individuals became aware of the theft when they found new accounts had been opened in their names, as was the case with Hayes.

The problem isn't confined to the US. In the UK, identity theft is on the rise, with an estimated £5.6 billion in losses annually, according to a 2023 report from FICO (Fair Isaac Corporation). Around 1.9 million British consumers (4.3%) admitted that their identities had been stolen and used to open financial accounts, leading to significant financial losses and stress for the victims.

How to Protect Yourself from Identity Theft

The increasing number of identity theft cases highlights the need for individuals to take proactive steps to protect themselves from becoming victims. Here are some best practices to safeguard your personal information:

- Use Informed Delivery Services: In the US, the Postal Service offers an "informed delivery" service that allows you to track the mail arriving at your home. This service can alert you to suspicious mail, such as credit cards you did not apply for, as in Hayes' case.

- Set Up a Lockbox for Mail: If you're travelling or away for an extended period, consider setting up a secure lockbox to prevent thieves from stealing sensitive documents or credit cards.

- Freeze Your Credit: One of the most effective ways to prevent identity theft is by freezing your credit with major credit bureaus. This prevents anyone from opening new accounts in your name without your consent.

- Set Up Fraud Alerts: Contact credit agencies and request fraud alerts on your accounts. This will notify you if any suspicious activity is detected.

- Use Multi-Factor Authentication: When banking or shopping online, always enable multi-factor authentication (MFA) to add an extra layer of security to your accounts. This ensures that even if a criminal gains access to your password, they cannot access your account without an additional verification step.

What to Do If You're a Victim of Identity Theft

If you suspect you are a victim of identity theft, take immediate action. In the US, you should first contact your bank to freeze your credit cards and set up fraud alerts. You should also report the theft to the Federal Trade Commission (FTC) through their online platform, IdentityTheft.gov, or by calling 1-877-438-4338.

In the UK, victims should contact their bank and report the fraud to Action Fraud, the country's national fraud and cybercrime reporting centre. Protective registration through CIFAS (Credit Industry Fraud Avoidance System) can also be a helpful precautionary measure to prevent future identity theft.

The Emotional Toll of Identity Theft

For victims like Jodi Hayes, the emotional strain of identity theft can be overwhelming. The shock of discovering that criminals have gained access to your financial accounts can cause immense stress, and resolving the issue is often long and arduous. Hayes noted that even after her account was secured, the experience left her feeling anxious and unsure about the security of her personal information.

Identity theft is not only a financial burden but also a profoundly personal violation. The rise in data breaches and cybercrime means everyone must remain vigilant in protecting their personal information.