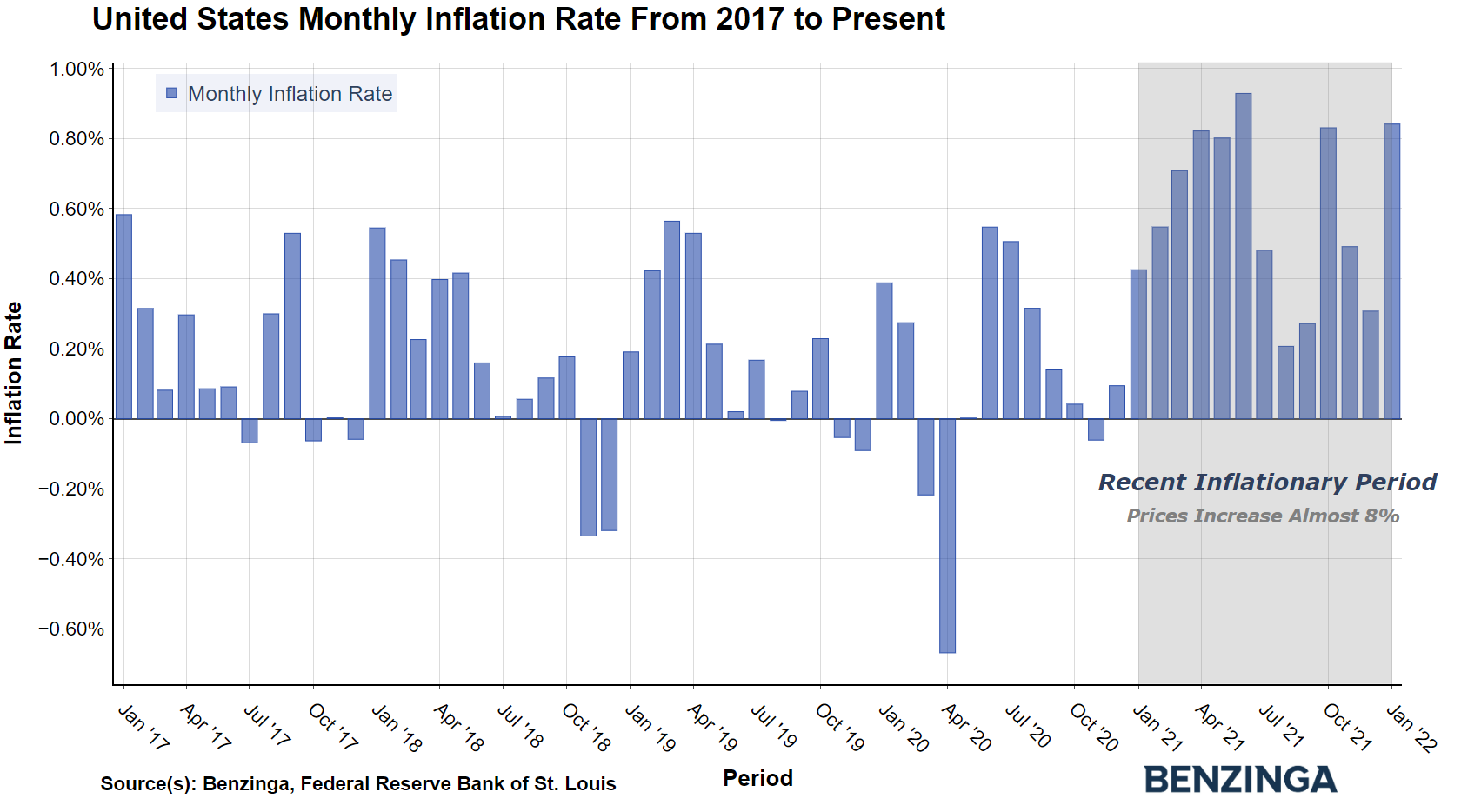

The Labor Department reported the consumer price index (CPI) jumped 8.5% year-over-year in March, the highest monthly inflation growth in more than 40 years. The three largest contributors to that inflation surge were gasoline, shelter and food, three expenses the average American can't do without.

Prices Surging: Russia's invasion of Ukraine fueled spikes in food and energy prices in the month of March. The Federal Reserve began raising rates in March to combat inflation, but many experts and economists believe the Fed will need to be even more aggressive with its tightening if it expects to get inflation in check.

Rising interest rates also squeeze the average American in the form of higher mortgage and credit card rates. Meanwhile, there is no end in sight to the Ukraine conflict, suggesting energy and food prices will remain elevated for the foreseeable future.

Related Link: Sell Stocks And Raise Cash: Can The Market Overcome Putin And Powell?

How To Play It: Americans looking for ways to hedge against inflation in their everyday lives have several options for investing in an environment of persistently elevated inflation. While the SPDR S&P 500 ETF Trust (NYSE:SPY) is down 3.3% year-to-date, the Energy Select Sector SPDR Fund (NYSE:XLE) is up an impressive 39.1% so far in 2022. Higher crude oil prices means higher margins and more demand for U.S. oil and natural gas stocks.

Financial sector stocks, particularly banks and insurance companies, benefit from rising interest rates, as long as the economy avoids a recession. Despite the prospect for sharply rising interest rates, the Financial Select Sector SPDR Fund (NYSE:XLF) is up just 0.2% year-to-date, potentially providing an excellent buying opportunity.

The Real Estate Select Sector SPDR Fund (NYSE:XLRE) is down 5.8% so far in 2022, underperforming the broad market significantly. Part of the reason real estate is underperforming may be concerns over the potential negative impact of rising mortgage rates on the U.S. housing market. Yet real estate was an excellent investment during the previous era of U.S. hyperinflation in the 1970s.

Benzinga's Take: Certain investments tend to perform well during periods of hyperinflation and certain investments perform well during periods of elevated interest rates.

However, very few assets perform well during periods in which prices and interest rates are surging at the same time, a reality which may very well make investing extremely difficult for the time being.