Dividend stocks provide a stable and predictable source of income, especially in a volatile market. Dividend Kings, in particular, are frequently considered superior to stocks with high dividend yields, which most investors find appealing.

These companies have not only paid consistent dividends, but also increased them consecutively for at least 50 years, demonstrating resilience in a variety of economic conditions. Most passive income investors favor them because of their consistent and growing payouts. Companies earning this title typically have strong balance sheets, consistent cash flow, and long-term business models that allow them to pay and increase dividends.

Here are three such Dividend Kings to include in your portfolio for reliable income.

Dividend King #1: Emerson Electric

Established in 1890, Emerson Electric (EMR) is a global industrial technology and automation company. It offers industrial automation, process control, and software solutions to industries including oil and gas, chemicals, power, and manufacturing. It also provides commercial and residential solutions for heating, cooling, and food preservation in homes and commercial buildings. For the past 68 years, Emerson has been a top Dividend King, consistently paying and increasing dividends.

Valued at $67.6 billion, EMR stock has fallen 3.3% year-to-date, compared to the S&P 500 Index ($SPX) gain of 1.8%

Emerson’s earnings have grown steadily, thanks to strong cash flow generation. In the most recent first quarter of fiscal 2025, adjusted earnings increased by 13% to $1.38 per share. In addition, the company generated $694 million in free cash flow, up from $367 million the previous year, and paid out $300 million in dividends. The company intends to generate $3.2 billion to $3.3 billion in free cash flow in fiscal 2025 and return $3.2 billion to shareholders through share repurchases and dividends.

Emerson has a forward dividend yield of 1.76% and a forward payout ratio of 32.4%, which suggests that current dividend payments are sustainable, with ample room for dividend growth. Emerson’s growth strategy entails strategic acquisitions and divestitures to strengthen its focus on automation and software solutions. Notably, the company proposed acquiring the remaining shares of Aspen Technology in order to strengthen its industrial software capabilities. Analysts predict that Emerson’s earnings will increase by 8.4% in fiscal 2025, and another 9.1% in fiscal 2026.

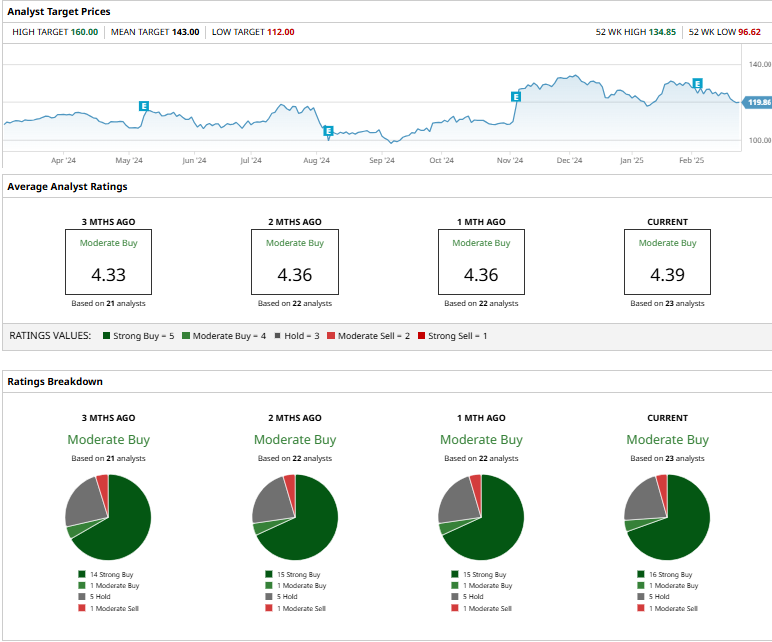

Overall, Wall Street rates Emerson stock as a "Moderate Buy.” Of the 23 analysts covering EMR, 16 have rated it a “Strong Buy,” one suggests a “Moderate Buy,” five rate it a “Hold,” and one says it is a “Moderate Sell.” The mean target price is $143, which is 20% above current levels. Its high target price of $160 implies potential upside of 33% over the next 12 months.

Dividend King #2: Abbvie

AbbVie (ABBV) is a global biotech company that develops and markets innovative medicines in immunology, oncology, neuroscience, aesthetics, eye care, and other areas. While Abbvie is best known for its blockbuster immunology drug Humira, its upcoming patent expiration has raised investor concerns. However, the company’s aggressive portfolio diversification strategy, which includes an immunology, oncology, and neuroscience drugs pipeline, may help it continue to thrive. Abbvie has consistently paid and increased dividends for the past 53 years, cementing its reputation as a dependable dividend payer. Valued at $358 billion, AbbVie stock is down 14% year-to-date.

AbbVie’s financial health is bolstered by its strong earnings growth. The fourth quarter and full year 2024 earnings, however, were impacted by in-process research and development that it took on as part of the Arena Pharmaceuticals acquisition and milestone expenses, which amounted to 10.4% of net revenue. Adjusted earnings per share (EPS) in 2024 fell by 8.9% to $10.12. Looking ahead, the company expects adjusted EPS to be between $12.12 and $12.32 in 2025, up from $12.04 in 2024, reflecting confidence in long-term growth. Similarly, analysts covering AbbVie stock forecast earnings to grow by 21.2% in 2025 and 12.6% in 2026.

Skyrizi and Rinvoq, AbbVie’s newer immunology drugs, have contributed significantly to the company’s positive outlook. Skyrizi’s sales in 2024 were $11.7 billion, up 50.9% year on year, while Rinvoq’s were $5.9 billion, up 50.4%. AbbVie has a forward dividend yield of 3.2%, which is higher than the healthcare sector average of 1.6%. The forward payout ratio of 47.2% is sustainable, leaving room for dividend growth. Overall, on Wall Street, AbbVie stock is a “Moderate Buy.” Out of the 26 analysts covering the stock, 16 have a “Strong Buy,” two suggest a “Moderate Buy,” and eight recommend a “Hold” rating. The mean target price for ABBV is $207.20, which is 1.5% above its current levels. Its high price estimate of $239 implies potential upside of 17.1% over the next 12 months.

Dividend King #3: Coca-Cola

Coca-Cola (KO) is a multinational beverage giant that manufactures and markets a wide range of non-alcoholic beverages, including carbonated soft drinks, juices, bottled water, sports drinks, and energy drinks. Coca-Cola has an impressive track record of 62 consecutive years of dividend increases, demonstrating its commitment to returning capital to shareholders.

Valued at $304.5 billion, KO stock is up 13.7% year-to-date.

In the most recent fourth quarter, adjusted comparable EPS rose 12% to $0.55 per share. For the full year, comparable EPS increased by 7% to $2.88 per share. The company generated a free cash flow of $4.7 billion in the year and paid out $8.4 billion in dividends. Coca-Cola is adapting to changing consumer preferences by diversifying its portfolio beyond traditional soft drinks. In 2025, the company expects to generate $9.5 billion in free cash flow while growing EPS by 2% to 3%. Analysts expect earnings to rise 2.8% in 2025, followed by 7.78% in 2026.

Coca-Cola’s forward dividend yield of 2.9% is significantly higher than the consumer staples sector average of 1.9%. Furthermore, its forward payout ratio of 63.9% indicates the company can maintain its dividend payments, with the possibility of future increases.

Overall, Wall Street is bullish on KO stock, rating it a “Strong Buy.” Out of the 22 analysts covering KO, 19 rate it as a "Strong Buy," one as a “Moderate buy,” and two as a “Hold.” The mean target price for KO is $76.05, which is 7.15% above current levels. Its high target price of $85 implies potential upside of 20% over the next 12 months.