/AI%20(artificial%20intelligence)/AI%20technology%20-%20by%20Wanan%20Yossingkum%20via%20iStock.jpg)

Artificial intelligence (AI) was the primary investment theme of 2025. Across the market, companies tied to AI infrastructure saw their valuations surge as hyperscalers and enterprises poured billions into data centers, chips, and supporting hardware. At the center of this boom is Nvidia (NVDA), whose processors continue to power the most advanced AI systems.

Nvidia maintained its solid growth streak in 2025, posting record quarterly results. Demand for its AI chips remained robust throughout 2025, and management highlighted that the momentum in its business will likely sustain in 2026. During the most recent quarterly conference call, Nvidia highlighted exceptionally strong shipments of its new Blackwell and Rubin platforms, with a $500 billion shipment opportunity through 2026.

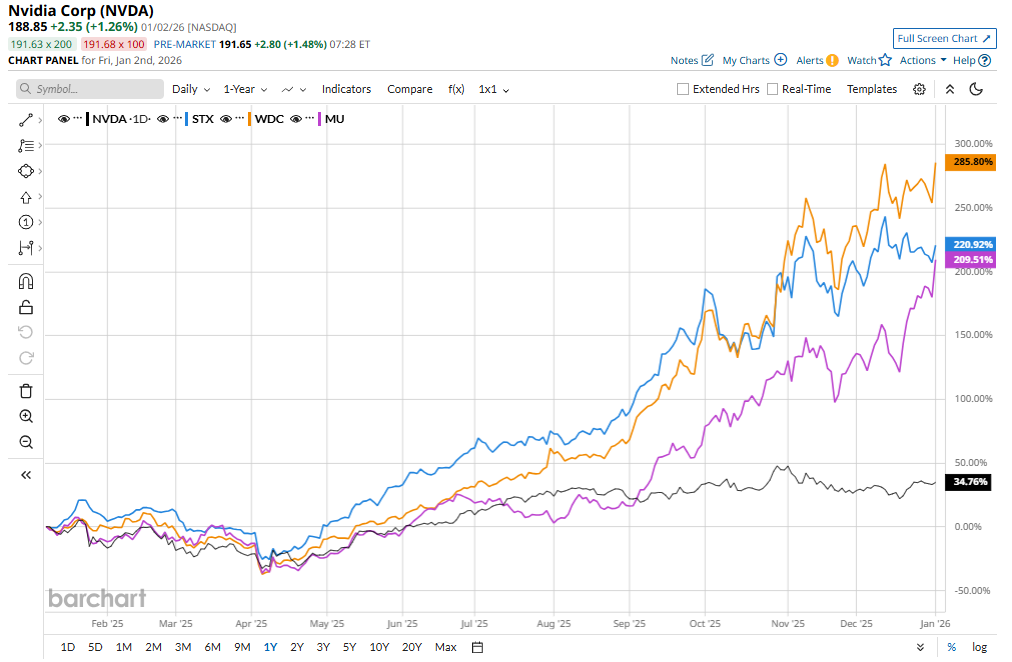

Despite Nvidia’s dominance, it wasn’t the best-performing stock in the S&P 500 Index ($SPX). NVDA shares rose about 36% in 2025, an impressive gain, but far from the top of the S&P. Several other AI-linked companies delivered far larger returns by benefiting from the AI buildout.

As AI models grow larger and data centers expand, the need for massive storage capacity has exploded. That trend sent Western Digital (WDC) and Seagate (STX) shares soaring by roughly 282% and 225%, respectively, in 2025.

Memory was another major bottleneck in AI infrastructure, and Micron (MU) capitalized on it. MU stock climbed about 236% in 2025 as demand surged for its high-performance, high-capacity memory used in AI servers and data centers.

What makes these outsized gains particularly interesting is that, despite crushing Nvidia’s 2025 returns, Western Digital, Seagate, and Micron still trade at valuations that look reasonable relative to their earnings growth potential. This implies that shares of these companies may still have room to run, making them worth a closer look for 2026.

Wall Street Is Bullish on WDC and STX

Wall Street analysts are optimistic about the prospects of WDC stock and STX stock despite their significant run in 2025. Analysts’ optimism stems from the ongoing investment in AI infrastructure, which will drive demand for Western Digital and Seagate’s products and solutions.

For Western Digital, the company is benefiting from a surge in demand for its nearline hard drives used in data centers. Looking ahead, the growing adoption of the company’s high-capacity ePMR drives will likely support its financials. Moreover, its major customers have already locked in multi-year supply agreements. Several large buyers have committed through fiscal 2026, and one hyperscaler has secured product into 2027, adding visibility to future growth.

Despite a strong rally, WDC stock still trades at a forward price-earnings ratio of just 24.16 times, a significantly low multiple considering its earnings growth potential. Analysts project its EPS to jump 57% in fiscal 2026 and increase by 55% in 2027. Its low valuation, strong growth prospects, and solid profitability make WDC stock an attractive AI investment in 2026.

Meanwhile, Seagate will continue to benefit from strong demand for its mass-capacity storage solutions. Notably, the high demand for its products and its build-to-order (BTO) manufacturing model should support both revenue and earnings growth in 2026. Moreover, Seagate’s emphasis on high-value, high-capacity products positions it well to deliver solid profitability.

Looking ahead, Seagate’s nearline production is already locked in under BTO contracts through 2026, with long-term supply agreements extending visibility into 2027. This backlog provides confidence that favorable demand conditions will persist.

While Seagate is growing fast, its valuation remains compelling. Its forward price-earnings multiple of 26.4 appears low as Wall Street expects its earnings to jump 43% in fiscal 2026, followed by another 38% increase in 2027.

Micron Stock Is Too Cheap to Ignore

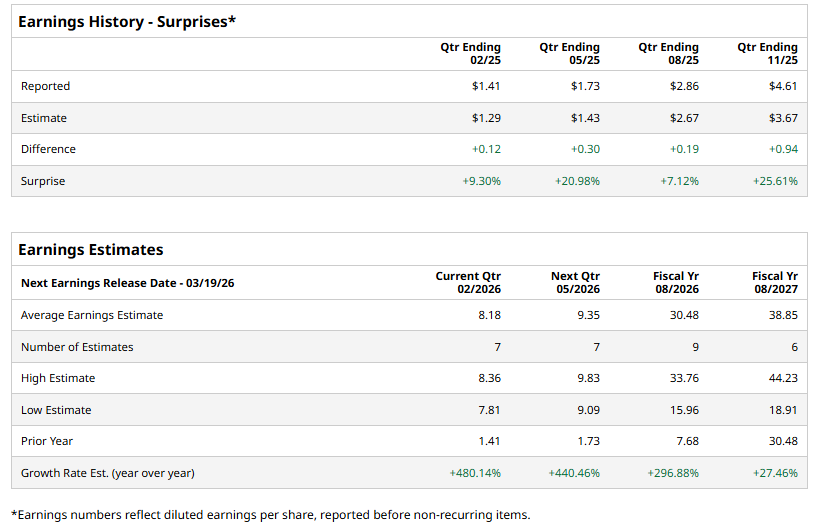

Micron is delivering solid financial results quarter after quarter as demand for its products accelerates. At the same time, tighter industry supply is pushing prices higher, a powerful tailwind for Micron’s profitability. Rising average selling prices and cost control are expanding margins and driving sharp growth in its bottom line.

A key growth driver is Micron’s leadership in high-bandwidth memory (HBM). The company has already locked in pricing and volumes for its 2026 HBM production, including next-generation HBM4. Management expects the HBM market to continue to grow, which in turn will boost its financials.

Looking ahead, Micron sees demand outstripping supply across both DRAM and NAND, supporting pricing well beyond 2026. Despite this solid growth outlook, Micron stock trades at 9.4 times its forward earnings. With analysts projecting EPS growth of 297% in fiscal 2026, Micron stock is too cheap to ignore.