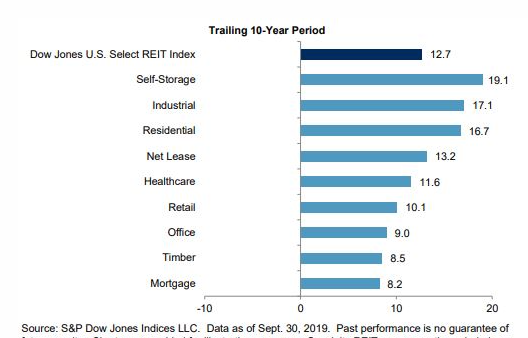

Equity real estate investment trusts (REITs) have outperformed mortgage REITs, as mortgage real estate investment trusts have posted annualized returns of 8.2% over the past 10 years.

While rising interest rates are not necessarily a catalyst for REITs, the average lease term of the underlying property is the key driver of interest rate sensitivity.

Short-term leases ranging from one to five years tend to outperform long-term leases ranging from five to 10 years during periods of rising interest rates. Another factor to watch out for is that real estate investment trusts tend to be more volatile than the S&P 500, as the Vanguard Real Estate Index Fund ETF (NYSE:VNQ) is down roughly 32% year-to-date.

Go To: Why The Fed Needs To 'Break The Labor Market' To Avoid A 'Wage-Price Spiral'

New York City REIT Inc. (NYSE:NYC) is offering a dividend yield of 12.16% or 40 cents per share annually, through quarterly payments, with an inconsistent track record of increasing its dividends.

New York City REIT is the leading “pure-play” publicly traded equity REIT focused on New York City real estate, and invests its assets in office properties located in the city's five boroughs. NYC’s $863 million portfolio is diversified across eight office and retail condominium assets located primarily in Manhattan.

During the second quarter, NYC’s top 10 tenants were 71% investment grade rated and have remaining lease terms of 9.6 years. The firm's portfolio occupancy of 85% with a weighted average with remaining lease terms of 7.1 years.

Necessity Retail REIT Inc. (NASDAQ:RTL) is offering a dividend yield of 14.11% or 85 cents per share annually, making quarterly payments, with an inconsistent track record of increasing its dividends.

Necessity Retail REIT operates more than 1,057 properties representing over 29.3 million rentable square feet in 48 states. Necessity Retail’s properties are located in strong suburban communities and are the brick-and-mortar locations that represent the last mile in retail, such as Dick’s Sporting Goods Inc (NYSE:DKS), Dollar General Corp (NYSE:DG) and Home Depot (NYSE:HD).

During the second quarter, Necessity Retail REITs portfolio occupancy rate was at 90.9%, with weighted average remaining lease terms of 7.2 years, and its total real estate investments are over $5.1 billion at cost.

Photo: Funtap via Shutterstock