Are you looking for some good summer reading? TheStreet has you covered with tax tips from some of the leading CPAs and tax experts across the country.

Make sure you bookmark this page, we'll be updating it with tas tips all summer. TheStreet's CPAs are answering frequently asked, and frequently searched tax questions.

Tax Questions Answered by CPAs and Tax Experts

1. "I don't earn a lot of money, do I really need to file my taxes?"

We hear this question a lot from Gen Z and millennials. The short answer is yes! Even if you don't meet the IRS's income threshold, you really should file your taxes.

"Not paying your taxes is one of the biggest mistakes that Gen Z and millennials make", according to Lisa Greene-Lewis, a certified public account (CPA) and tax expert for TurboTax.

Quotes | Biggest Mistakes Gen Z and Millennials Make on Their Taxes

Lisa Greene-Lewis, CPA and TurboTax Expert

Lisa Greene-Lewis, CPA and TurboTax Expert

"They could be missing out on the possibility if they had federal taxes withheld, to get that (money) back, as well as some education credits," according to Lewis.

2. "How do I organize my tax records?"

"Filing next year begins with being organized now, says Jeffrey Levine, CPA and tax pro from Buckingham Strategic Wealth Partners. "Having a place where you store everything related to your taxes is the most important thing'.

So what documents should you keep? Levine says you should keep copies of documents that are hard to obtain like tax returns, legal contracts, insurance claims, and proof of identity.

Recommended: Documents You Should Save for Tax Time

Organize Important Documents Now

What Documents Should You Keep?

Keep documents that are difficult to obtain, such as:

- Tax returns

- Legal contracts

- Insurance claims

- Proof of identity

How Long Should You Keep Your Records?

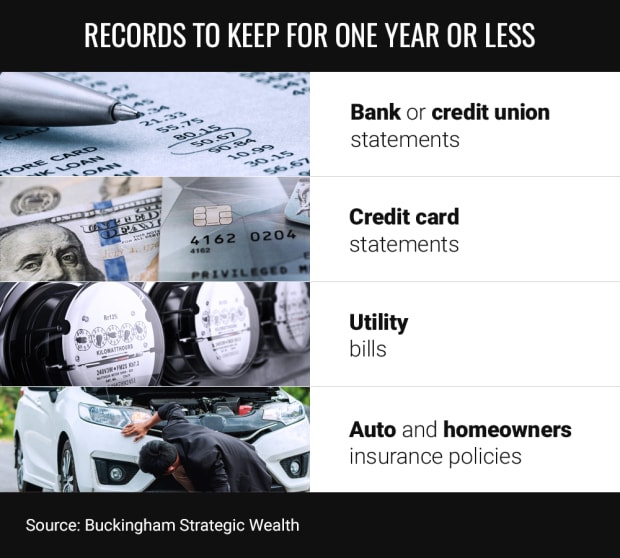

A good rule of thumb is to keep financial records and documents only as long as necessary. Here are some recommendations on how long to keep specific documents.

Records to keep for one year or less:

- Bank or credit union statements

- Credit card statements

- Utility bills

- Auto and homeowners insurance policies

Records to keep for more than a year:

- Tax returns and supporting documentation (keep for at least 3 years after filing the return)

- Mortgage contracts (keep until the mortgage is satisfied and you have proof of satisfaction)

- Property appraisals (keep for as long as you own that property)

- Annual retirement and investment statements (keep annual statements but discard monthly or quarterly reports)

- Receipts for major purchases and home improvements (keep for at least 3 years after the property is sold)

Records to keep indefinitely:

- Birth, death, and marriage certificates

- Adoption records

- Citizenship and military discharge papers

- Social Security card

'Those who are more organized will have an easier time in the future, and pay fewer taxes,' according to Levine.

Quotes| How to Get a Jump on 2023 Tax Season

Jeffrey Levine, Chief Planning Officer, Buckingham Strategic Wealth

TheStreet Recommends: Shred-It or Save It: A Guide on Organizing Important Documents

TurboTax Live experts look out for you. Expert help your way: get help as you go, or hand your taxes off. You can talk live to tax experts online for unlimited answers and advice OR, have a dedicated tax expert do your taxes for you, so you can be confident in your tax return. Enjoy up to an additional $20 off when you get started with TurboTax Live.

3. "What are estimated taxes?"

If you are a small business, you are likely familiar with estimated taxes. "Estimated tax is the method used to pay that is not subject to withholding," according to IRS. com.

CJ Miller, CFP®, RMA® is a financial planner with Sensible Money, explains that "estimated tax payments are required because the U.S. tax system is considered 'pay-as-you-go.'

"The government wants its money up front," Miller says, 'so they require that you make payments each quarter to cover the expected tax on any income made in that quarter. That is also why tax is withheld from your paycheck each pay period."

4. "Who pays the estimated taxes?"

"Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed," according to the IRS.com website.

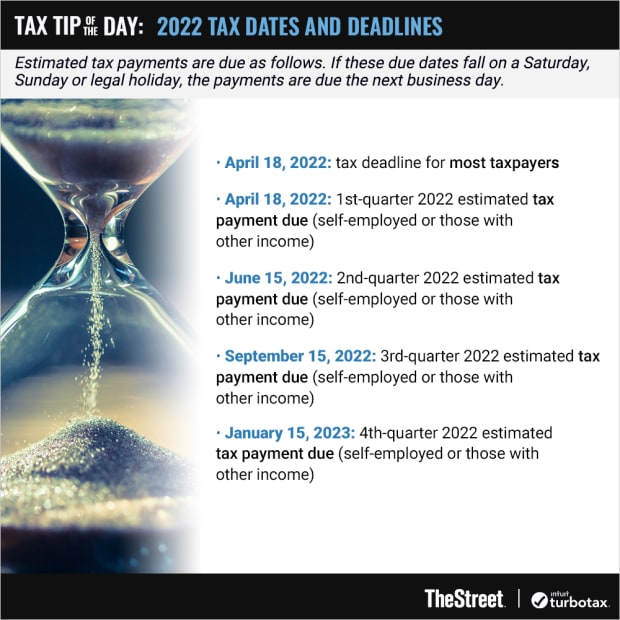

5. "When are quarterly estimated tax payments due?"

Here is the estimated tax payment schedule. Of course, if the due date falls on a weekend or a holiday, then the payment is due on the next business day.

- April 15

- June 15

- September 15

- January 15 of the following year

6. "Are my crypto investments taxed?"

If you are among the many now buying and selling cryptocurrency, then expect it to be taxed. "Virtual currency transactions are taxable by law just like transactions in any other property," according to the IRS.

So, when are your virtual transactions taxable? Lisa Greene-Lewis is a certified public account (CPA) and tax expert for TurboTax says "I often hear the question people don't even know when their transactions are taxable. You don't have a taxable event until you sell your stock or crypto"

Quotes | Cryptocurrency and Stock Advice for New Investors

Lisa Greene-Lewis, CPA and TurboTax Expert

Lisa Greene-Lewis, CPA and TurboTax Expert

"Also, depending on how long you hold your stocks before you sell them, that's also how you're taxed. If you hold your stock or crypto for over a year, then you have the benefit of those long-term capital gains, which are less, you know, you're taxed less," according to Greene-Lewis. "And then also remember if you had any losing stock or any crypto losses when you sold, which a lot of people are not having. But if you did, you can offset your gains with those losses. And then your losses can carry over to your ordinary income like, you know, your W-2 income or self-employment income, and that's up to $3,000."

TurboTax, TheStreet's official tax partner, shares a complete guide for new investors, including common tax forms and investment records you should keep.

7. "Are my home improvements tax deductible?"

"For most people when you're doing home improvements it's a personal expense and so it's not going to be deductible. Now, of course, every situation is different and that's why our tax system is so challenging because everything centers around facts and circumstances", says Levine during an interview with Retirement Daily's Robert Powell.

There is some good news. There are things that you do, that may not be deductible but can still provide you with a tax benefit. "For instance, energy-efficient improvements," says Levine. "If you put solar panels on your roof, or you replace your windows or doors with more energy-efficient options, can create credits for you."

Quotes| What Are Some Tax-Deductible Home Improvements?

Jeffrey Levine, Chief Planning Officer, Buckingham Strategic Wealth

Jeffrey Levine, Chief Planning Officer, Buckingham Strategic Wealth

Read more about capital improvements, improvements vs repairs, and more: Home Improvements and Your Taxes.

8. "I'm self-employed, can I get a tax break for my home?"

There are more than 9 million self-employed workers, according to the June numbers from the Bureau of Labor Statistics. So, it's no surprise that the self-employed are asking if they can get a tax break by claiming their home.

"When you're self-employed, first of all, you don't have taxes taken out on a regular basis, you know, as a withholding. So if you think you're going to owe $1,000 or more, you need to pay estimated taxes," says Lewis.

Quotes| Taxes & Remote Working: Deductions for Employees Working From Home

Lisa Greene-Lewis, CPA and TurboTax Expert

Lisa Greene-Lewis, CPA and TurboTax Expert

"But then on the flip side, there are a lot of deductions that you can take when you're self-employed as long as they're directly related to your business. So expenses like computer equipment or if you designed a website for your business, or office furniture and things for your office, remember that those things can be deductible and really help your tax situation."

Watch below for more deductions or read TurboTax's guide on home office tax deductions.

9. "I'm self-employed, what forms do I need?"

If you're self-employed, you are making money, get ready to fill out a number of self-employed forms.

"So they (self-employed) should be looking out for 1099-NEC, that's fairly new," according to Lewis. "It used to be the 1099-MISC, but now it's the 1099-NEC, and it reports any income of $600 or more that you made. Also, all of your income, as well as your deductible expenses, will be on a Schedule C. And that will be filed with your personal tax return."

Those forms can be found on the IRS.com website. We've saved you some searching, here they are:

You can learn more about self-employed tax obligations, forms to consider, and even how to file your annual return at the IRS Self-Employed Tax Center.

Recommended Read: Beginner's Tax Guide for the Self-Employed

10. "Is a Virtual Currency Transaction Taxed?"

We are now in a day and age where we have currency and virtual currency. Currency is that stuff you often keep in your pocket, a standard form of money that is used in each country.

Virtual currency, on the other hand, is a currency that acts as a substitute for real currency. Bitcoin, for instance, is a digital currency. It can eventually be converted into U.S. dollars.

So, can a virtual currency transaction have tax implications? According to the IRS, "Taxpayers transacting in virtual currency may have to report those transactions on their tax returns."

Recommended Read: Your Crypto Tax Guide

11. "Can I rent my home tax-free?"

Are you thinking about renting your home on Airbnb or VRBO? Under the right circumstances that rental could be tax-free, according to Jeffrey Levine, CPA and tax pro from Buckingham Strategic Wealth Partners.

Quotes| Rent Your Home Tax-Free With This Overlooked Tax Exception

Jeffrey Levine, Chief Planning Officer, Buckingham Strategic Wealth

Jeffrey Levine, Chief Planning Officer, Buckingham Strategic Wealth

"This might be your house where you live most of the time. And if that's the case then part of this will depend upon how much you rent out using Airbnb," says Levine. "If it's only for a short period of time, like two weeks or less, you can actually have that income be, get this Bob, tax-free. Two of my favorite words are tax-free."

12. "Do I have to pay taxes if I receive over $600 from Venmo transfers this year?"

The rules around what you have to claim as income have not changed, but the rules around reporting for person-to-person money transfer companies like Venmo and PayPal have. As of 2022, if you receive $600 or more via any of those platforms and those payments are classified as purchases or for Goods and Services, they are required to report it to the IRS using Form 1099-K, while also sending a copy to you. This should not present an issue since any money you receive as business income is taxable anyway, so it’s presumed that you were already planning to claim that income on your tax return. If you’re sending money to a friend to reimburse them for expenses, just make sure you classify that as a Friends and Family payment to avoid the reporting because the IRS will expect to see amounts reported on 1099-K forms included as income on your tax return, typically on Schedule A if you’re a sole practitioner or single-member LLC.

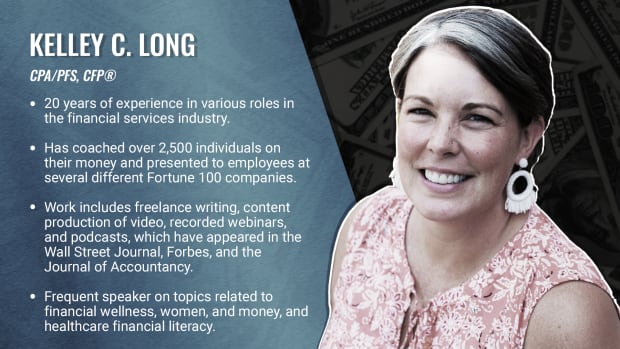

Panelist Bio| More About Our Tax Expert

Read more from our partners at TurboTax:

- 4 Crypto Tax Myths You Need to Know

- Do You Pay Taxes on Investments? What You Need to Know

- Tax Attorney vs. CPA: What's the Difference?

- Best Ways To Prepare and File Taxes

Editor's Note: The opinions expressed in this article are those of the authors. The content was reviewed for tax accuracy by a TurboTax CPA expert.

Zachary Faulds contributed to the writing of this article and produced the video and/or the graphics associated with it.