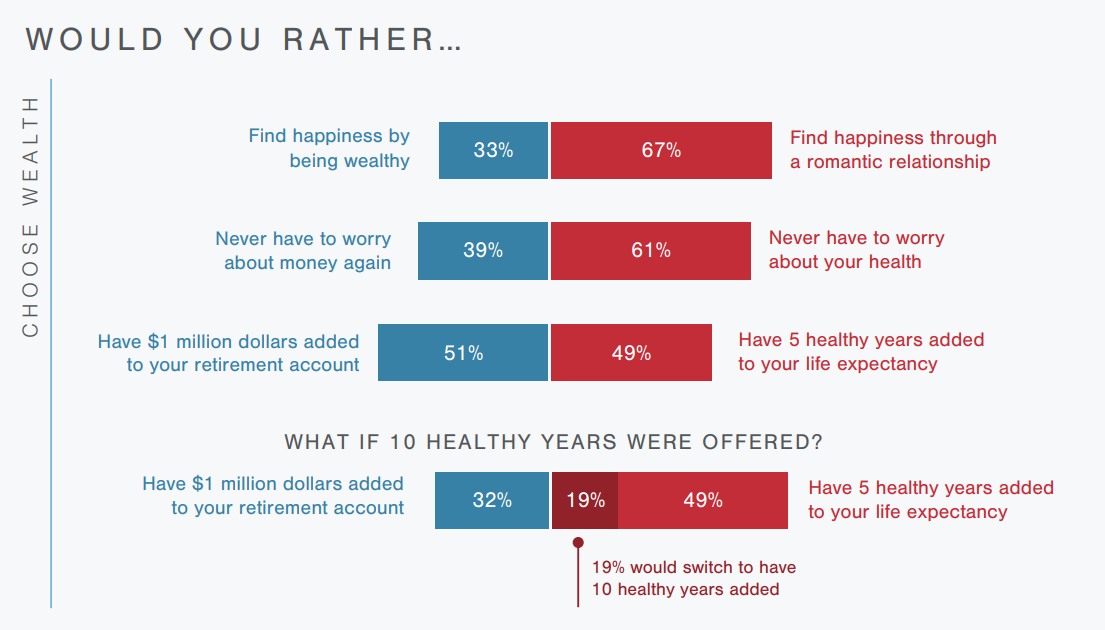

A recent survey asked Americans to consider a Faustian bargain: Do you want more money for retirement or more years of life? There's no demon waiting to tempt you at the crossroads, ala Robert Johnson, but about half of us would trade healthy years of life for a fatter 401(k). A 2024 Edelman report on Everyday Wealth in America, which highlights Americans' growing financial concerns, revealed that 51% would rather add a million dollars to their nest egg than have five healthy years added to their lives.

This desire for greater financial security has carried over to other areas, such as salaries, as 58% said they would need an annual income of at least $100,000 to live worry-free. And 25% thought it would take more than $200,000.

Read on for more findings from the survey and tips for what to do if you need to save more for retirement.

The silver tsunami

The “silver tsunami” or “peak 65” is coming in hard and fast, with an anticipated 4.1 million Americans turning 65 in 2024 and every year through 2027, according to a report from the Alliance for Lifetime Income. That number represents the greatest surge of retirement-age Americans in history. Pair that demographic wave with the past few years of inflation and the specter of Social Security running out of money in a few years, and you get intense anxiety about retirement.

“In our third year of conducting this research, we’re once again noticing that many Americans — even the affluent — aren’t feeling overly confident about the state of their finances,” Amin Dabit, head of wealth planning at Edelman Financial Engines, said. “Part of these worries stem from external pressures, like inflation or a turbulent election environment, while some are individual pressures, such as family responsibilities and mounting credit card debt.”

The type of retirement matters

The study also shows that Americans want a different type of retirement, with 37% saying they want a more active and adventurous retirement than previous generations.

Retirees are rethinking their priorities for life after work. Over 40% want more activity and 39% want more adventure in their later years. While paying for everyday expenses is always a priority, these desires often call for broader financial planning strategies. Unfortunately, only two-thirds of respondents felt somewhat confident about affording retirement in any form, while nearly one-third (32%) feared they may never be able to fully retire at all.

Other key financial challenges

Other financial challenges highlighted in the Everyday Wealth in America study include an uncertain (and expensive) housing market and caregiving responsibilities.

Almost half of homeowners under 50 said they feel trapped in their current home because of high interest rates. Some of this angst may have cooled, though, because the survey wrapped up in early July. Since then, mortgage rates have been falling, especially since the Fed cut interest rates in September.

As the cost of long-term care is out of reach for many, 37% of respondents say they feel an increased financial strain due to caregiving responsibilities.

Credit card debt

The survey found that more Americans feel at least some financial strain as credit card debt continues to be a significant obstacle. In fact, 44% of participants identified credit card debt as their biggest hurdle to building wealth. Another 49% reported carrying month-to-month debt, up from 39% just one year ago.

According to Federal Reserve data, credit card balances increased by $27 billion in the second quarter of 2024 to $1.14 trillion. Consumers' age also influences how much debt is carried on credit card accounts. According to a 2022 report (2023 data) by Experian, Generation X had the highest average credit card balance of $9,123. The generation with the lowest average credit card balance was Generation Z at $3,262. Millennials carried a balance of $6,521 and Baby Boomers had an average balance of $6,642.

Ways to save for retirement

Based on this survey alone, it’s clear many Americans are worried about retiring with enough money to live comfortably. So much so that they are willing to give up living longer. The good news is that there are things you can do at any age to retire well, maybe even early.

- Save as much as you can as early as you can. To understand how your retirement savings compare to your peers, read our articles on the average 401(k) balance by age and the average IRA balance by age. And get tips on how to be a 401(k) millionaire.

- Maximize your income. Work longer hours while young, seek promotions at work or take on a side hustle.

- Temper your spending. We all like nice things, and sometimes it can be challenging to walk away from something you really wan. To retire with money in your pocket may mean tightening your belt.

- Invest wisely. Retiring comfortably can be challenging without investing wisely in an employer’s retirement plan, individual retirement account (IRA), health savings account (HSA) or any other investment vehicle. Maxing out these accounts early on can help solidify your plans later.

- Work with a professional. The study also shows that 74% of people who work with a financial professional report less stress about money. Finding the right professional is important, so choose wisely.

About the study

Greenwald Research conducted the study for Edelman Financial Engines via an online survey of 3,008 Americans. Respondents were at at least 30 years old and more than a third were "affluent." The study ran from June 12 through July 3, 2024.