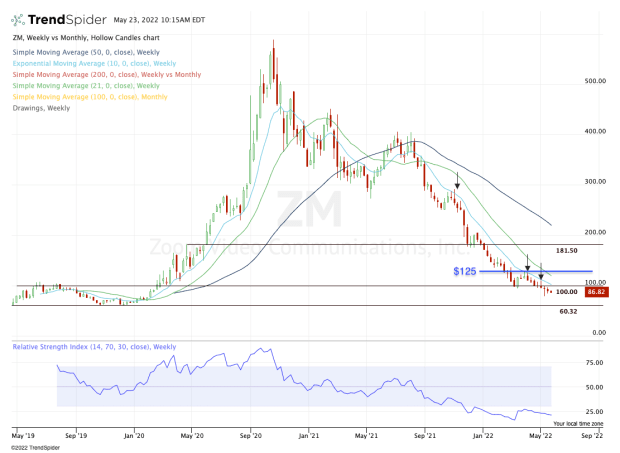

Once a Covid-19 darling, videoconferencing-tech specialist Zoom Video's (ZM) stock rose 850% from low to high in a span of 10 months.

Since then it's been a train wreck. The shares peaked in October 2020 and have now fallen 86% from the high.

In its recent stretch, the shares have declined in 10 of the past 11 months and in seven straight weeks. It has also declined in 13 of the past 15 weeks, in 19 of the past 22 and in 25 of the past 30.

Now the company is due to report earnings after the close on Monday, May 23. Will Zoom be one of the few growth stocks to rally on its results — or at least not go down — or will it cave like so many others and hit more new lows?

Trading Zoom Video Stock

Chart courtesy of TrendSpider.com

Zoom Video stock has been caught up in a painful run, with its stock price getting hit along with that of most other growth stocks. In particular, anything that seemed to benefit from Covid-19 seems to be experiencing even harsher selling pressure.

On the plus side, the levels are very clear.

If Zoom Video stock endures a bearish post-earnings reaction, then this month’s low and the 2022 low will be in play near $79. If this level breaks and is not reclaimed, that opens the door down to the $60 support level.

Keep in mind, this level has not been in play since the pre-Covid days.

On a bullish reaction, $100 is a key level to keep in mind. Not only is it a meaningful psychological level, but it’s also a support/resistance zone, and it's where the 10-week moving average comes into play. The 10-week has been active resistance, too — a trend that’s been in play for several quarters now.

If we can push through $100 and the 10-week, it will be incredibly meaningful for Zoom Video stock.

That opens the door up to the 21-week moving average, then the $125 area.