/Zimmer%20Biomet%20Holdings%20Inc%20phone%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

Warsaw, Indiana-based Zimmer Biomet Holdings, Inc. (ZBH) operates as a medical technology company. It designs, manufactures, and markets orthopedic reconstructive products. With a market cap of $17.6 billion, Zimmer Biomet serves orthopedic surgeons, neurosurgeons, hospitals, healthcare dealers, and more.

The medical device manufacturer has significantly underperformed the broader market over the past year. ZBH stock prices have plunged 16.2% on a YTD basis and 19.2% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 16.4% returns in 2025 and 14.1% gains over the past year.

Narrowing the focus, Zimmer has also underperformed the US Medical Devices Ishares ETF’s (IHI) 7.2% gains in 2025 and 3.5% uptick over the past 52 weeks.

Zimmer Biomet’s stock prices plunged 15.2% in a single trading session following the release of its mixed Q3 results on Nov. 5. The company’s organic sales improved by 5% on a constant currency basis, and overall sales observed a 3.6% increase from acquisition-related growth. Its net sales came in at $2 billion, up 9.7% year-over-year, including a positive impact of 1.1% from currency translation. Despite the forex gains, the company’s sales missed the Street’s expectations by 42 bps, making investors jittery. Nonetheless, Zimmer’s adjusted EPS grew 9.2% year-over-year to $1.90, beating the consensus estimates by 1.1%.

For the full fiscal 2025, ending in December, analysts expect ZBH to deliver an adjusted EPS of $8.17, up 2.1% year-over-year. On a positive note, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

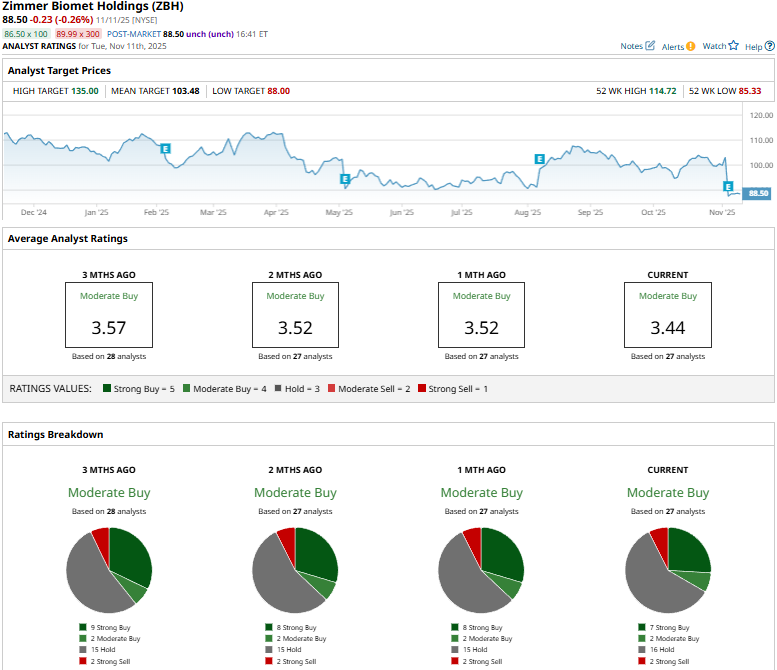

Among the 27 analysts covering the ZBH stock, the consensus rating is a “Moderate Buy.” That’s based on seven “Strong Buys,” two “Moderate Buys,” 16 “Holds,” and two “Strong Sells.”

This configuration is slightly less optimistic than a month ago, when eight analysts gave “Strong Buy” recommendations.

On Nov. 10, Canaccord Genuity analyst Caitlin Roberts reiterated a “Hold” rating on ZBH, but lowered the price target from $101 to $93.

Zimmer’s mean price target of $103.48 represents a 16.9% premium to current price levels. Meanwhile, the street-high target of $135 suggests a staggering 52.5% upside potential.