/Zebra%20Technologies%20Corp_%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)

Lincolnshire, Illinois-based Zebra Technologies Corporation (ZBRA) provides enterprise asset intelligence solutions in the automatic identification and data capture solutions industry worldwide. Valued at $11.7 billion by market cap, Zebra operates through Asset Intelligence & Tracking and Enterprise Visibility & Mobility segments.

Zebra Technologies has significantly underperformed the broader market over the past year. ZBRA stock has tanked 40.6% over the past 52 weeks and 40.9% on a YTD basis, compared to the S&P 500 Index’s ($SPX) 10.5% gains over the past year and 11.2% returns in 2025.

Narrowing the focus, Zebra has also underperformed the sector-focused Technology Select Sector SPDR Fund’s (XLK) 17.8% surge over the past 52 weeks and 17% gains on a YTD basis.

Despite reporting better-than-expected financials, Zebra Technologies’ stock price dropped 11.7% in the trading session following the release of its Q3 results on Oct. 28. The company’s organic sales for the quarter observed a notable increase, leading to a solid 5.2% year-over-year growth in net sales to $1.3 billion, beating the Street’s expectations by 71 bps. Further, its adjusted EPS increased 11.2% year-over-year to $3.88, surpassing the consensus estimates by 3.5%.

However, the company’s Q4 sales outlook significantly dampened investor confidence. Zebra expects its Q4 sales to grow by 8% to 11% year-over-year. However, this includes an 8.5% favorable impact from acquisitions and foreign currency translation.

For the full fiscal 2025, ending in December, analysts expect ZBRA to deliver an adjusted EPS of $15.83, up 17.1% year-over-year. The company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

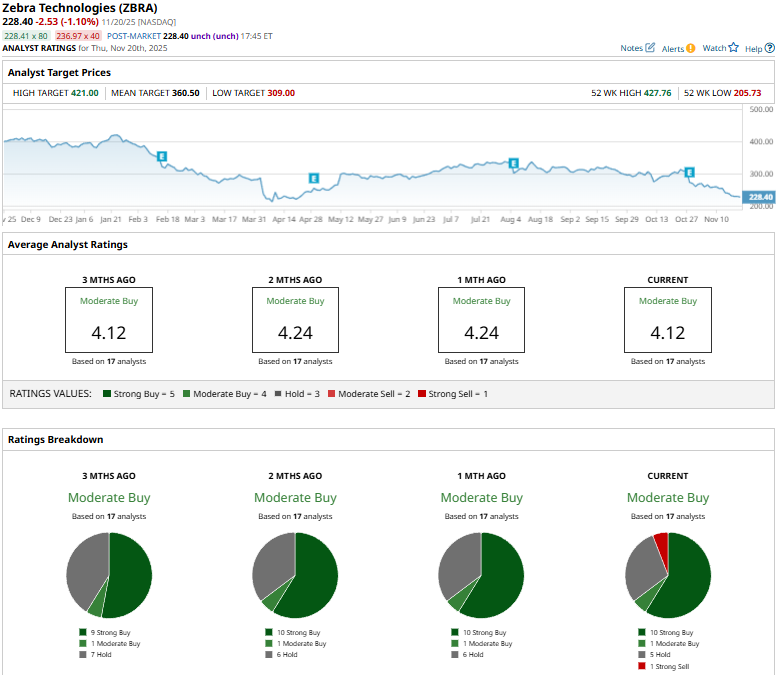

Among the 17 analysts covering the ZBRA stock, the consensus rating is a “Moderate Buy.” That’s based on 10 “Strong Buys,” one “Moderate Buy,” five “Holds,” and one “Strong Sell.”

This configuration is slightly less optimistic than a month ago, when none of the analysts covering ZBRA gave “Strong Sell” recommendations on the stock.

On Oct. 29, Truist Securities analyst Jamie Cook reiterated a “Hold” rating on ZBRA and lowered the price target from $350 to $331.

As of writing, ZBRA’s mean price target of $360.50 represents a 57.8% premium to current price levels. While the street-high target of $421 suggests a staggering 84.3% upside potential.