YouTube TV now has more than 8 million subscribers, according to a company disclosure Tuesday, making it the fourth largest pay TV operator in the U.S.

The revelation came in the annual letter that YouTube CEO Neal Mohan sends out to the platform's content-making community. In that missive, Mohan also said that more than 3 million YouTube channels are now generating advertising revenue, and that more than 1 billion hours of YouTube content are being viewed worldwide each day.

"We’re bringing everything viewers love about YouTube to the living room experience. And that includes sports. We just wrapped our first season of NFL Sunday Ticket, and it really shows the future of YouTube," Mohan wrote.

The NFL's out-of-market games package, which YouTube paid around $2 billion a season to wrestle away from DirecTV, does appear to have been a growth catalyst.

YouTube TV last reported a subscriber count in mid-2022, registering around 5 million paid users.

Now, only Charter (14.122 million pay TV subscribers), Comcast (14.106 million) and DirecTV (with just under 12 million subscribers across its combined platforms) have more scale.

As of the end of September, Dish Network reported 6.72 million remaining satellite TV customers and 2.12 million Sling TV vMVPD users. A count of "more than 8 million" subscribers renders YouTube TV , priced at $73 a month, larger in scale than any individual DirecTV or Dish pay TV platform ... and right around Dish's combined count.

Dish, which will report Q4 earnings later this month, lost 268,000 pay subscribers in the fourth quarter of 2022.

YouTube TV is far and away the largest virtual MVPD. No. 2 vMVPD Hulu + Live TV touted only around 4.6 million subscribers as of the end of September.

The horserace does matter -- with increased scale comes improved economics on content.

"We have long highlighted the success of YouTube TV in gradually coming to dominate the vMVPD business. Now it’s clear that the growth at YouTube TV is even stronger than we had anticipated," reads a letter sent Tuesday to investors from equity research company MoffettNathanson.

YouTube TV has benefitted from "spill-off," with connectivity-focused cable operators exiting less-profitable pay TV sending business the Google unit's way.

WideOpenWest, for example, said in November that 13% of its new customers are signing for YouTube TV, as well. And during its much-discussed two-week carriage war with Disney, Charter Communications sent football-bereft pay TV customers to YouTube TV, as well.

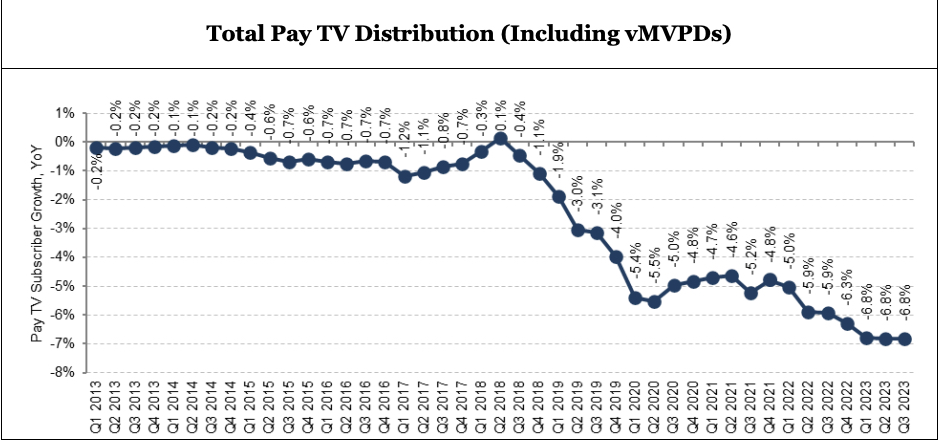

For their part, the analysts at MoffettNathanson wonder if the quickened growth of YouTube TV is enough to flatten the fast-accelerating rate of cord-cutting. This graphic suggests it might be.