Behind surging revenue and consumer attention for Alphabet’s YouTube is a shift in the physical location where much of the service’s viewing now takes place. Increasingly, the catch-all video repository is getting serious traction not from PCs and mobile phones, but from its presence on TV sets. And for that, YouTube has the pay TV industry at least partly to thank.

As of 2023 TV sets fed by cable set-top boxes and connected TV devices are said to account for more than one-third of total viewing of YouTube in the U.S., with that number steadily rising as viewing over alternative screens — mobile devices and desktop or laptop PCs — shrinks. Industry watcher eMarketer believes U.S. YouTube viewing over computers will slip to slightly under 13% of viewing time by 2024 compared with more than 16% in 2020. Mobile viewing, in turn, is projected to fall to 48.5% from 53.1% in 2020.

In contrast, the TV screen is where the growth is happening:

- TV has gone from 30.5% of U.S. YouTube viewing time in 2020 to 38.1% this year, and a projected 39.2% next year, per eMarketer;

- According to YouTube, viewers globally watch more than 700 million hours of YouTube content on a TV daily;

- On the advertising side, TV-set viewing accounted for 30% of total YouTube ad spending in the 2023 third quarter, a big jump from 20% a year earlier, per digital advertising management firm Tinuiti.

It all adds up to surging economics. In the 2023 third quarter, YouTube set a record: $7.85 billion in advertising revenue, putting the do-it-all video service on pace for more than $30 billion in annualized ad money. For comparison, YouTube’s third-quarter ad revenue, up 12.5% from the prior-year period, was more than the ad revenue generated in their respective latest fiscal quarters by Fox ($1 billion) Comcast’s NBCUniversal ($1.9 billion) or Disney’s ESPN collective ($3.3 billion).

Living-Room Presence

The numbers reflect how important the pivot to the living room has been for a service whose original purpose was almost entirely based on streaming to PCs. For YouTube and its corporate cousin Google, the TV set has been a powerful propellant, giving the video service real estate parity on the television screen alongside legacy television brands like ABC, ESPN, MTV and Fox News Channel. For millions of TV watchers, tuning into YouTube is now little different from summoning ESPN or Fox News to the screen, with one big exception: YouTube engrosses viewers in a more personalized, interactive experience compared with a linear television network. “Eyeballs are moving away from linear TV, and we are helping brands move beyond (the) traditional,” Google senior VP Phillip Schindler noted in a recent quarterly earnings review. “Obviously … connected TV is an important part of this strategy.”

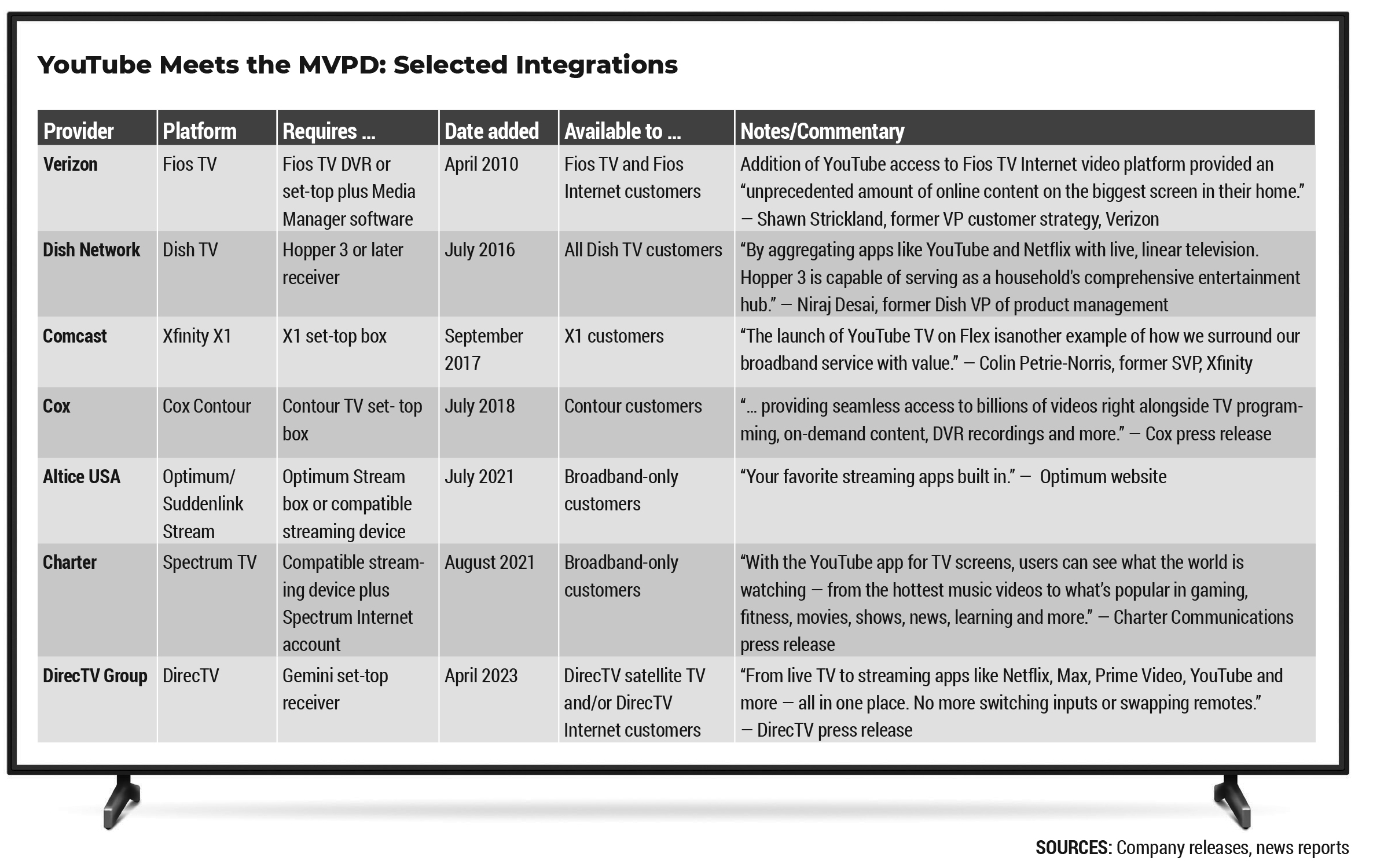

It's the pay television industry itself that played a big role in making it so. Pay TV providers like Dish Network, Comcast, Cox Communications, Charter Communications and others represent an important distribution avenue for YouTube, and a vital part of the broader “connected TV” ecosystem that has transformed YouTube’s viewing patterns.

YouTube introduced its app for TV screens in 2012, six years after Google acquired YouTube for $1.6 billion and described the service as a way “for people to watch and share original videos through a Web experience.” Today there are three ways to watch the service on a TV set:

- Through a connected TV platform like Roku, Chromecast or Amazon’s Fire TV;

- By casting YouTube from a mobile device to a TV set;

- Through a multichannel TV distributor such as Dish or Comcast.

It’s the third leg of that stool that helped YouTube gain its living room presence early on during the transition from PCs to TV sets. Although much of the attention has gone to connected TV platforms like Roku or Apple TV boxes, tens of millions of viewers are able to summon YouTube to the TV screen over a cable television or satellite television connection. For YouTube, the road to the living room has been paved by some of the same companies YouTube now competes with for attention, eyeballs and advertising money. (YouTube TV, the virtual pay TV service, also competes for cable customers, and partners with some operators, including WideOpenWest and Frontier Communications, as the video option for broadband subscribers.)

How this unlikely juxtaposition came to be relates to some of the early uncertainty and intrigue among multichannel video providers about exactly how to treat the unknown but rising force that was web-based video during its early ascension.

A prevailing presumption was that even as the television landscape began to be populated with lots of digital-first programmers, the legacy MVPD pipe would carry on as the primary conduit over which all sorts of “television” would flow. Thus began a grab-bag of initiatives to try to seize the high ground in the digital video revolution. In September 2015, for example, Verizon launched an ill-fated streaming service (optimized mostly for mobile viewing) called go90. That same month, Comcast launched a short-lived video service, Watchable, which aggregated “best of” programming from a new breed of digital-first programmers like Machinima (video gaming), Tastemade (cooking), and BuzzFeed (news and commentary).

Craig Parks, a digital media veteran who now heads content operations at the social media service Peppermint, led the content acquisition effort for Watchable. Parks figures he listened to close to 1,500 pitches from programmers eager to make the leap from the sprawl of Internet video to a place on the TV menu not far from the likes of HBO.

Except: One service Watchable didn’t offer was YouTube. Parks and his team were wary of opening the doors to YouTube, out of concern they might be introducing to Comcast’s Xfinity menu not just another niche program provider but a potentially competing platform for television entirely. “YouTube is a platform and search engine; we were a curated content site,” Parks recalled recently via an email. “To that end, we didn't see YouTube as a potential partner, but as competition.” As a consequence, YouTube remained off the original Watchable menu.

Instead, at the time, only one major U.S. pay TV provider had arranged to bring YouTube directly into the channel lineup: Verizon Communications’ Fios TV.

The wireline pay TV service, then with more than 3 million subscribers, broke the ice with an April 2010 arrangement to make YouTube available over TV sets used by Fios TV and Internet customers. The effort was somewhat cumbersome, requiring that customers first download specialized software, but it resulted in YouTube being available on the TV set using the same digital DVRs and remote controls that summoned familiar cable channels to the screen. In a press release, Verizon quoted an independent researcher, Steven Hawley of tvstrategies, who commented: “Rather than blurring the line between TV and the Internet, Verizon has moved the line to embrace them both, and has raised the bar against its competition.”

Maybe so, but with Verizon’s help, an important “first” had been realized. The Trojan Horse had breached the perimeter. YouTube was on TV.

At least it was in part of the country. Other MVPDs remained wary of what bringing the novel video service to the channel lineup might mean. It wasn’t until 2016 that Dish TV became the next major provider to pave the way for YouTube, adding the service to its advanced DVR boxes on Dish’s channel 371. Where Fios TV was confined to the northeastern U.S., Dish TV had a national footprint and, at the time, roughly 13 million customers. It was the first time YouTube could be watched on a big-screen TV, via a MVPD, anywhere in the U.S.

After that, industry attitudes changed. A little more than a year later, Comcast followed with the integration of YouTube into the company’s X1 digital video platform, which at the time was present in more than 11 million homes, or about half of Comcast’s total video subscriber base. Comcast not only added access to the YouTube app via voice command, but intermingled specific YouTube program titles into users’ browsing requests, where they appeared alongside more traditional fare. Cox Communications followed, introducing YouTube as a part of its Contour digital video service. By 2021, as both Charter Communications and Altice USA integrated YouTube into video services and devices targeting Internet households, YouTube had deeply infiltrated the U.S. MVPD marketplace. The capstone was the April 2023 arrangement with DirecTV that put YouTube on the same video menu that offered access to mainstay TV channels like CBS or CNN.

Connecting With CTV

Beyond the impact of YouTube’s arrangements with Fios TV and Dish, another reason rose up for MVPDs to consider adding YouTube: It was showing up on the TV screen anyway, courtesy of the rising category of “connected TV” devices ranging from Blu-ray Disc players and game consoles to newcomers on the multichannel TV scene like Roku and Apple TV, which made YouTube available as one of many apps that could be clicked and selected. YouTube’s owner Alphabet also stoked the movement by introducing add-on devices of its own, including the Chromecast line of devices manufactured by corporate cousin Google.

Leichtman Research Group estimated that in 2017, connected TV devices were present in about 41% of U.S. homes and growing fast. Now, with Verizon, Dish TV, Comcast and a parade of connected TV platforms offering YouTube, the pressure was building. If the Roku streaming box in the bedroom offered up YouTube, why shouldn’t the cable receiver in the living room?

Prominent cable companies decided that it should. By building YouTube access into their cable channel menus and newer streaming video platforms like Altice’s Optimum Stream, MVPDs were calculating that a “join ’em rather than beat ’em” strategy was the right approach for playing a role in a shifting video environment.

In the meantime, YouTube had begun to shape-shift its content persona. In 2010, when Verizon added YouTube to Fios TV, the YouTube service was still viewed mostly as a jumble of short-form video — everything from user-contributed shorts to music snippets to how-to videos.

Since then, the service has broadened its boundaries considerably, becoming a go-to home for sports highlights, full-length concerts, Saturday Night Live clips, documentaries, a new TikTok alternative known as “Shorts,” and an almost limitless range of programming ranging from the amateur to the mainstream.

In making YouTube easily available over living-room devices and menus, MVPDs played at least some role in propelling YouTube to its place of prominence in the video economy at large. There is little doubt that some share of YouTube’s advertising revenue comes from ad budgets that otherwise might have gone to the cable industry’s born-and-bred programmers: the likes of ESPN and USA Network.

There’s a secondary impact on the cable advertising ecosystem, too. YouTube isn’t just a competitor for national ad budgets. It’s an increasingly important player in the market for highly localized TV advertising — a category that once belonged almost entirely to cable companies. By incorporating geofencing techniques that can pinpoint the geographies and neighborhoods over which TV commercials appear, YouTube has encroached on this same territory. The streaming-video giant has even gone so far as to set up alliances around the country with local video production businesses that help retail clients like bicycle shops and banks produce commercials. This, too, was once a province of the cable industry, with local cable advertising operations setting up shop to produce commercials for these same clients.

When they began opening up access to online video services like Machinima or BuzzFeed, cable companies generally could remain confident that only a smallish portion of their own offerings might be threatened. Services like these appealed to relatively thin audience niches. Most TV viewing still accrued to mainstay channels like ESPN, USA Network or FX.

YouTube, though, is different. A service that began life by aggregating cheap, user-generated videos had morphed into something else. The sprawling video service was beginning to look more much like a cable TV collective in its own right: an entryway into almost every conceivable type of video content. Today, viewers who launch YouTube on the TV set are whisked into a world unto itself, a video universe that commands a disproportionate share of viewing time. What’s more, YouTube’s own sister service, the “virtual” MVPD called YouTube TV, is emerging as a go-to replacement for cable TV at large. A handful of wireline MVPDs now openly invite customers to select YouTube TV as an alternative to old-school cable channel lineups.

As for the original YouTube service, it continues to rise. In September, Nielsen pegged YouTube as the most-watched video service in the domestic streaming category, accounting for 9% of total streaming time. (Netflix, at No. 2, clocked in at 7.8%). One reason for the feat is that YouTube, rather than being confined to computers and phones, now shows up on the biggest screen in the home, where its viewership is growing fast — and where MVPDs themselves have helped it find its footing. “This industry basically chased the Silicon Valley dream all the way to its death,” Peppermint’s Parks said. “Self-inflicted.”