On Sunday evening, Benzinga asked its followers on Twitter what they’re buying at the open on Monday. From the replies Benzinga selected one ticker for technical analysis.

@stock_doctor, @Joetorch1, @skrappyd0, @TheQueenCrypro, @284principle and @Two_Bays_ is buying GameStop Corporation (NYSE:GME).

GameStop has seen an influx of insider buying over the past few days. Chairman Ryan Cohen added 100,000 additional shares, to increase his stake in the company to 11.9% on March 22. The day prior, Director Lawrence Cheng purchased 4,000 shares worth a total of about $383,360, and on March 24, Alain Attal acquired 1,500 shares at a price of $129.91 each, totaling just under $195,000, according to Benzinga Pro.

The insider buying, combined with renewed interest from retail traders, caused GameStop to surge about 60% higher between March 22 and Friday.

According to the latest statistics available, the number of GameStop’s shares that are held short has been increasing again. Of the 63.18 million share float, 12.35 million shares, meaning 26.62%, is held short. The number is up from 11.94 million in February.

See Also: GameStop NFT Marketplace Going Live Sends This Ethereum Layer 2 Token Soaring 46%

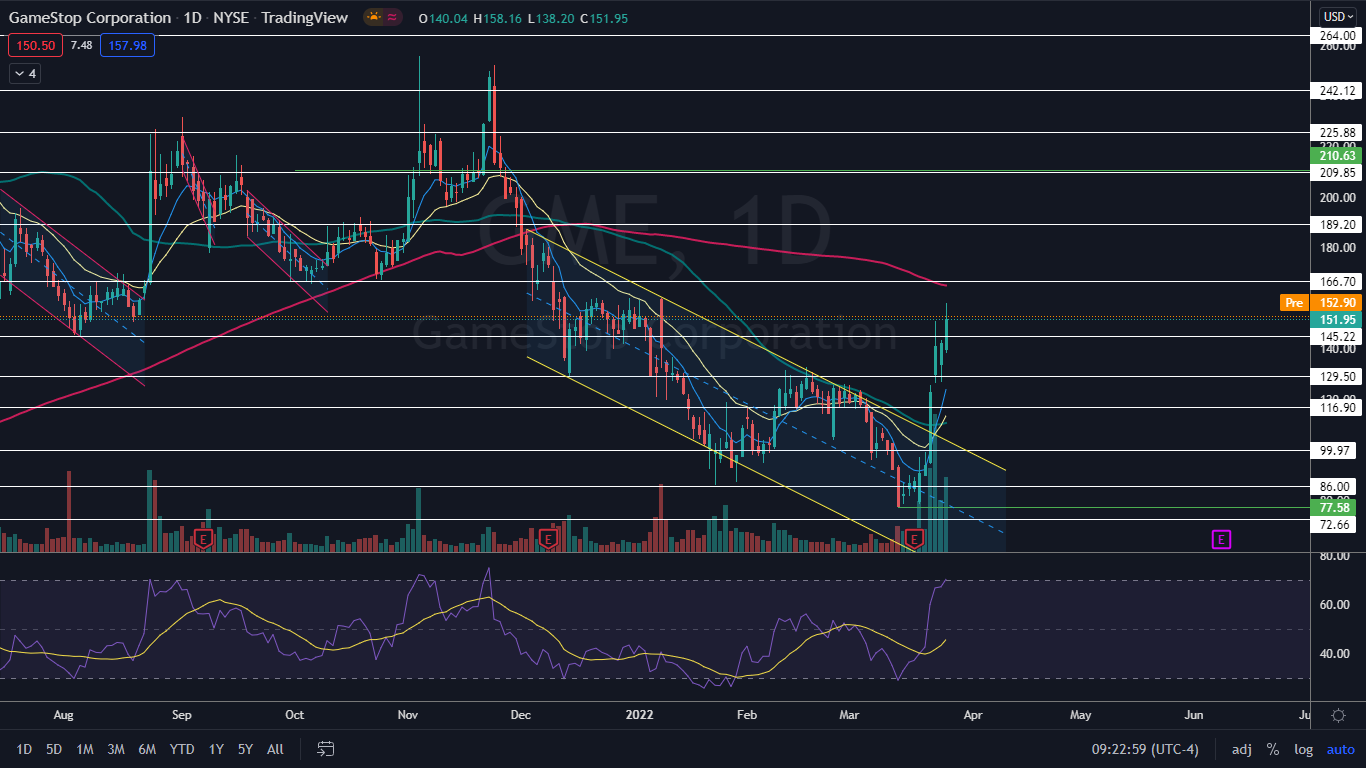

The GameStop Chart: On March 14 and March 18, GameStop printed a bullish double bottom pattern near the $77.58 level, which caused the stock to spike up toward the $100 level. On March 22, GameStop blasted through the level, which is an important psychological area, and broke up through the upper descending trendline of a falling channel pattern that had been holding the stock down since Dec. 2.

The break up through the falling channel came on higher-than-average volume, which indicated the pattern was recognized, and bullish momentum on the three trading days that followed caused GameStop to trade higher still, closing Friday’s session about the $150 level.

GameStop will eventually need to enter into a period of consolidation because it's becoming extended. The consolidation may come on Monday because on Friday, GameStop printed a candlestick on the daily chart that has an upper wick, which indicates there are profit takers just below the $160 level. Traders and investors can watch for a possible inside bar to develop on the daily chart.

If GameStop trades higher on Monday, the stock may find heavy resistance at the 200-day simple moving average, which is currently trending near the $165 level. If the stock isn’t able to fly through the area on its first attempt, consolation is likely to take place, which may set GameStop into a bull flag pattern.

GameStop’s relative strength index (RSI) is also indicating a period of consolidation is likely to come because it is measuring in at about the 70% level. When a stock’s RSI reaches the 70% level it becomes overbought, which can be a sell signal for technical traders.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

- Bulls want to see a period of consolidation take place to cool down the RSI and allow the eight-day exponential moving average to catch up to the share price. GameStop has resistance above at $166.70 and $189.20.

- Bears can wait to see if GameStop rejects at the 200-day SMA or watch for a volume climax, which could indicate bullish traders have become exhausted and will begin to sell their positions. GameStop has support below at $145.22 and $129.50.