On Thursday evening, Benzinga asked its followers on Twitter what they’re buying at the open on Friday. Benzinga selected one ticker from the replies for a technical analysis.

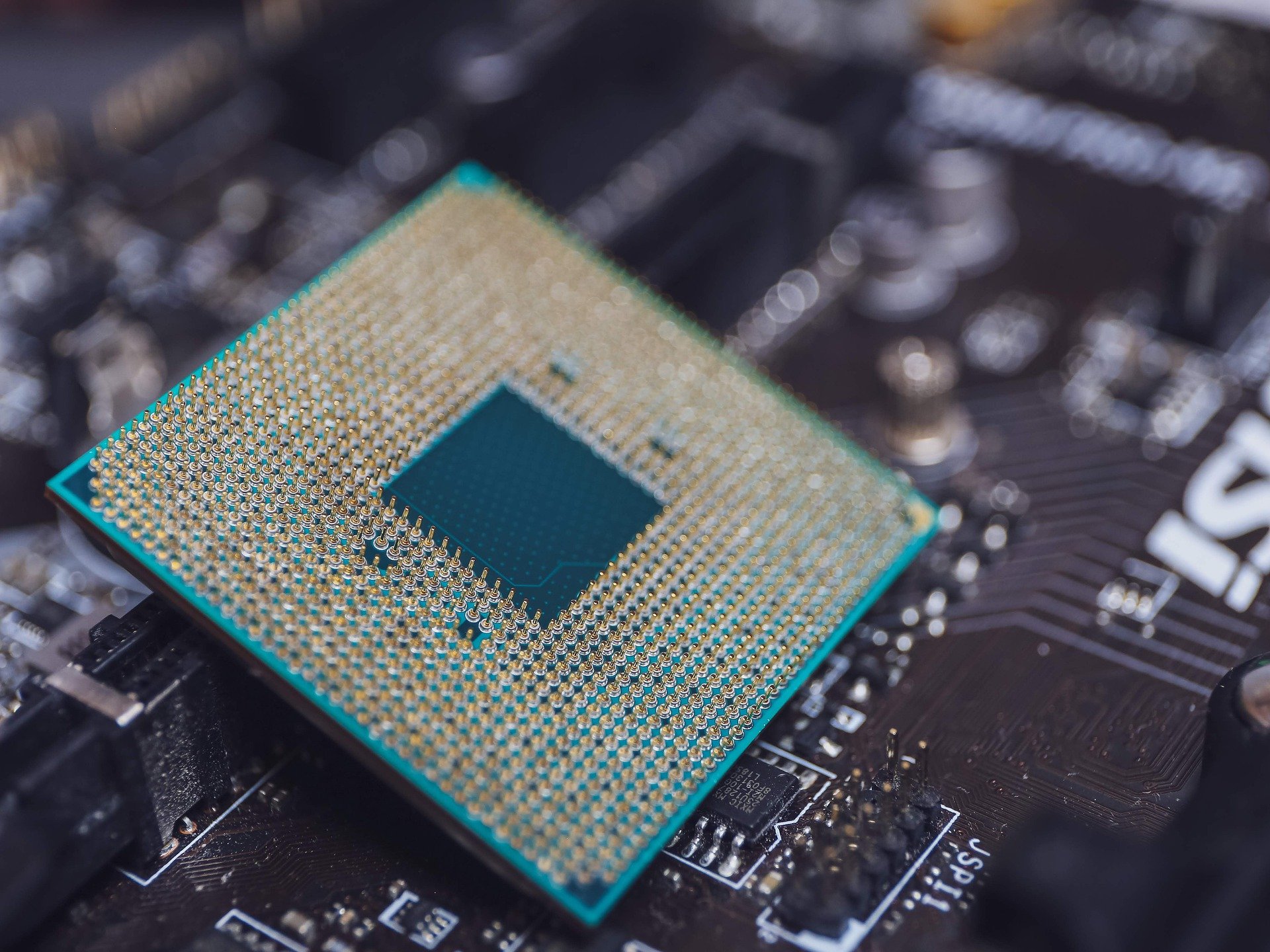

@josht543 and @Nena5804095 are buying Advanced Micro Devices, Inc (NASDAQ:AMD).

On Tuesday, AMD reported earnings per share of 92 cents on revenue of $4.826 billion, which beat the Street consensus of 76 cents on revenue of $4.52 billion.

The chipmaker also provided upbeat guidance for the first quarter and full year 2022.

Following the earnings beat and positive forecasts, a number of firms raised their price targets on AMD. Keybanc raised its price target to $165, Rosenblatt gave AMD a $200 price target and Raymond James and Mizuho raised their price targets to $160.

Even the lowest new price target indicates about 33% upside potential for AMD.

Related Link: 4 AMD Analysts Boost Price Targets Following Chipmaker's Stellar Q4, Predict Continued Share Gains

The AMD Chart: Heading into its earnings print, AMD broke up bullish from a falling wedge that had been holding the stock down since Dec. 28, when it hit a high of $156.73.

The stock then gapped up over 11% the day following the print but ran into a group of profit takers who caused AMD to close the trading day down 5.49% off the open.

On Thursday, AMD attempted to trade lower to fill the gap but was not able to fill it completely, which left a small range between $117.26 and $118.82 open. It is likely AMD will trade lower to completely fill that gap in the future.

AMD printed a gravestone doji candlestick on Thursday, which indicates lower prices may come on Friday.

If the stock falls lower, traders and investors can watch for AMD to print a possible higher low, which would confirm the stock will begin to trade in an uptrend. For bullish traders wishing to go long, a higher low could provide a solid entry point, but traders will want to watch for a reversal candlestick to indicate the higher low is in.

AMD is trading between the eight-day and 21-day exponential moving averages (EMAs), with the eight-day EMA trending below the 21-day, which indicates indecision. The stock is trading below the 50-day simple moving average, which indicates longer-term sentiment is bearish.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

- Bulls want to see AMD quickly close the lower gap, confirm a higher low above the $99 level and then for big bullish volume to come in and push the stock up above Wednesday’s high-of-day at $130.06. There is resistance above at $122.49 and $130.60.

- Bears want to see big bearish volume come into AMD to drop the stock back down into the falling channel. There is support below at $118.13 and $112.61.