On Sunday evening, Benzinga asked its followers on Twitter what they’re buying at the open on Monday. From the replies Benzinga selected one ticker for technical analysis.

@Williamdontkno1, @Natronrz and @getsumgetright are buying Clarus Therapeutics Holdings, Inc (NASDAQ:CRXT).

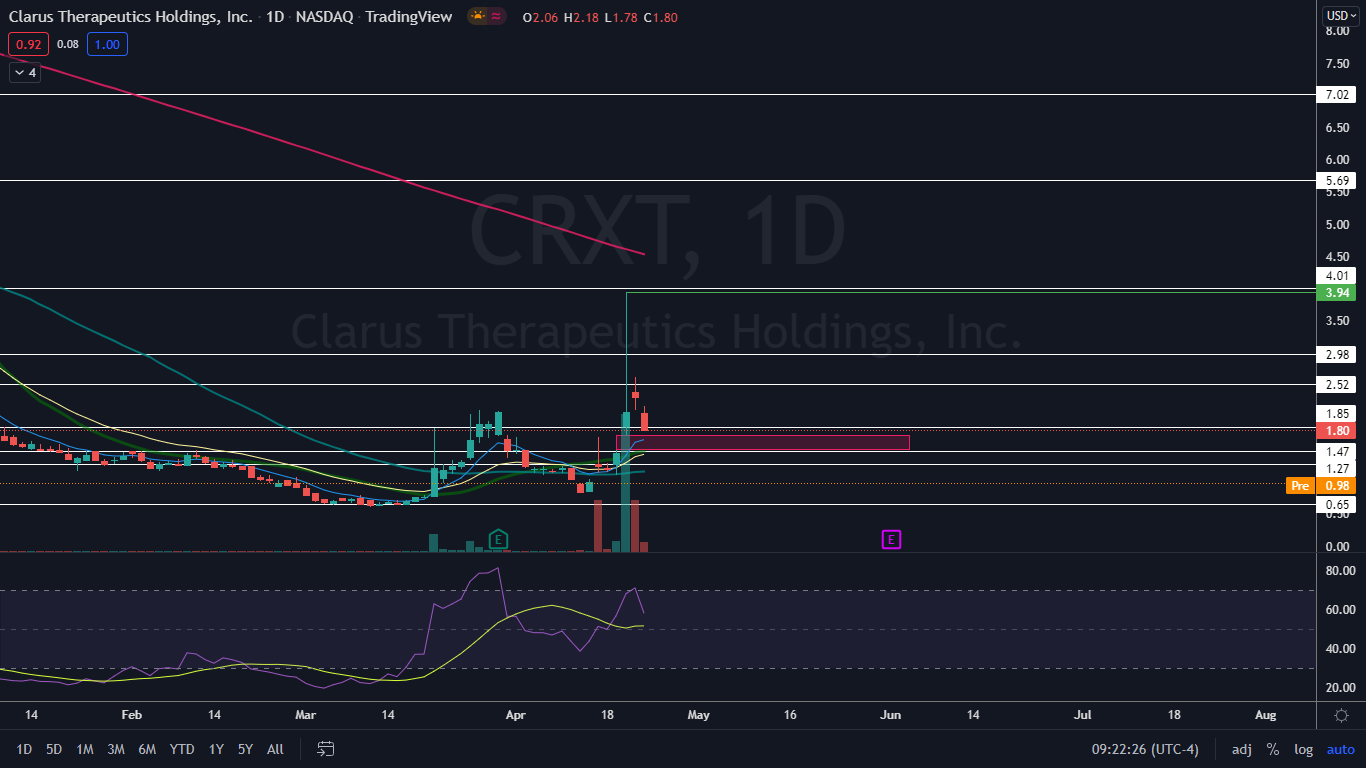

On April 19, Clarus announced it would present new data for its testosterone replacement therapy drug Jatenzo on Saturday at the Androgen Society 4th Annual Meeting. The stock surged 207% between April 19 and April 20 before topping out $3.94 and retracing about 54% to reach a low of $1.78 on Friday.

Due to Clarus’ underlying statistics, the stock has qualities that make it susceptible to high volatility and also make it a good candidate for a short squeeze. Clarus has just 1.17 million shares available for trading, of which 68.76% are held by institutions and insiders. Stocks with small floats are inherently volatile because when demand increases, it becomes difficult for buyers to be matched with sellers.

The percentage of Clarus’ float held short also increased drastically in March. As of the end of that month, 744,480 shares were held short compared to just 45,220 shares the month prior.

Volatility can move stocks both ways and due to this, Clarus can swing wildly in either direction and defy some technical indicators. A period of consolidation always follows high volatility, however, and Clarus looks set to enter into a period of stability in the short-term.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

The Clarus Chart: Clarus was trading down over 45% at one point in the premarket after closing Friday’s trading session down about 12%. The stock experienced a volume climax on April 20, which exhausted buyers and resulted in a high level of fear selling.

Technical traders may have seen the volume climax taking place because at 10:30 a.m., Clarus’ trading volume was measuring in at the highest level the stock had ever experienced. The high volume also caused Clarus’ relative strength index (RSI) to reach 71% on the daily chart, which set the stock into overbought territory.

There is a gap on Clarus’ chart between $1.50 and $1.72, which is below Friday’s closing price but above Monday’s premarket price. Gaps on charts are about 90% likely to fill, which indicates Clarus will trade into the empty range at some point in the future.

Bullish traders will want to watch for the stock to settle into a consolidation period of lower-than-average volume, which could indicate the stock is running out of sellers and then for big bullish volume to come in and push the stock back up into the gap.

Bearish traders want to see bearish momentum drive the stock back down under the psychologically important $1 level, which will make the area heavy resistance.

.png?w=600)