Investors with a lot of money to spend have taken a bearish stance on Workday (NASDAQ:WDAY).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with WDAY, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 38 uncommon options trades for Workday.

This isn't normal.

The overall sentiment of these big-money traders is split between 39% bullish and 47%, bearish.

Out of all of the special options we uncovered, 13 are puts, for a total amount of $790,520, and 25 are calls, for a total amount of $1,604,085.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $200.0 and $330.0 for Workday, spanning the last three months.

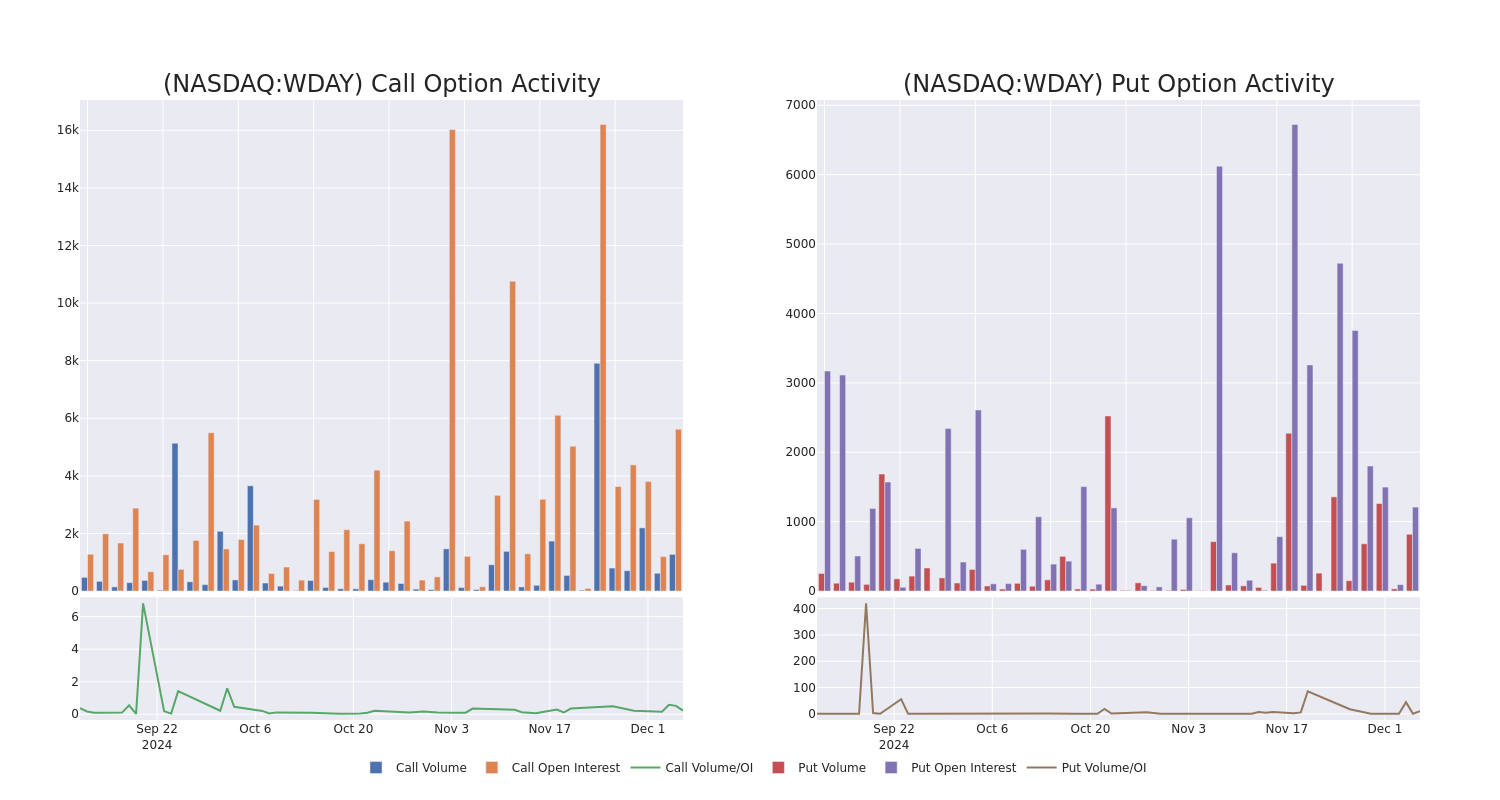

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Workday's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Workday's whale activity within a strike price range from $200.0 to $330.0 in the last 30 days.

Workday Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WDAY | CALL | SWEEP | BEARISH | 12/13/24 | $14.5 | $13.0 | $13.0 | $280.00 | $534.6K | 3.3K | 416 |

| WDAY | PUT | TRADE | BULLISH | 01/24/25 | $4.0 | $2.15 | $2.25 | $260.00 | $299.2K | 0 | 1.3K |

| WDAY | CALL | SWEEP | BEARISH | 12/13/24 | $4.6 | $4.2 | $4.25 | $280.00 | $128.4K | 3.3K | 1.8K |

| WDAY | CALL | SWEEP | BEARISH | 12/20/24 | $15.6 | $15.4 | $15.49 | $270.00 | $86.4K | 1.9K | 358 |

| WDAY | PUT | SWEEP | BULLISH | 06/20/25 | $28.3 | $27.1 | $27.12 | $290.00 | $81.3K | 20 | 30 |

About Workday

Workday is a software company that offers human capital management, or HCM, financial management, and business planning solutions. Known for being a cloud-only software provider, Workday was founded in 2005 and is headquartered in Pleasanton, California.

Having examined the options trading patterns of Workday, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Workday

- With a trading volume of 8,979,718, the price of WDAY is up by 5.67%, reaching $281.52.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 77 days from now.

What Analysts Are Saying About Workday

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $280.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * Consistent in their evaluation, an analyst from Loop Capital keeps a Hold rating on Workday with a target price of $242. * Reflecting concerns, an analyst from Piper Sandler lowers its rating to Neutral with a new price target of $270. * Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Workday, targeting a price of $305. * An analyst from B of A Securities persists with their Buy rating on Workday, maintaining a target price of $285. * In a cautious move, an analyst from Needham downgraded its rating to Buy, setting a price target of $300.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Workday options trades with real-time alerts from Benzinga Pro.