Friends and money: a dilemma many people find themselves in at one point in their lives. Should I lend my friend money? Should I pay for their meal? Should I buy them this or that without expecting to get my money back? Some experts say never to mix money and relationships, but sometimes, people still do it out of guilt.

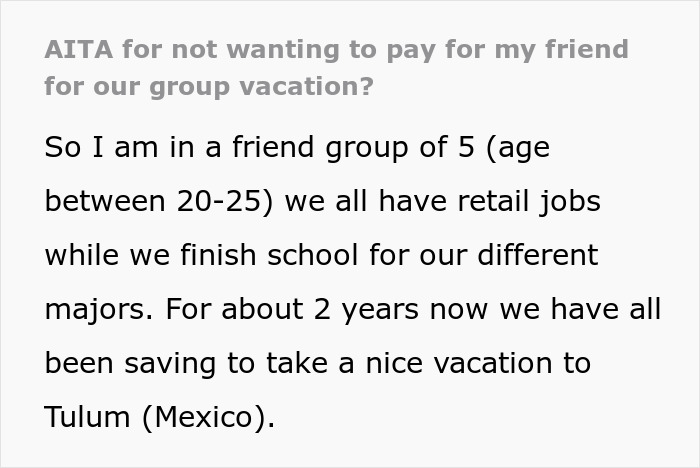

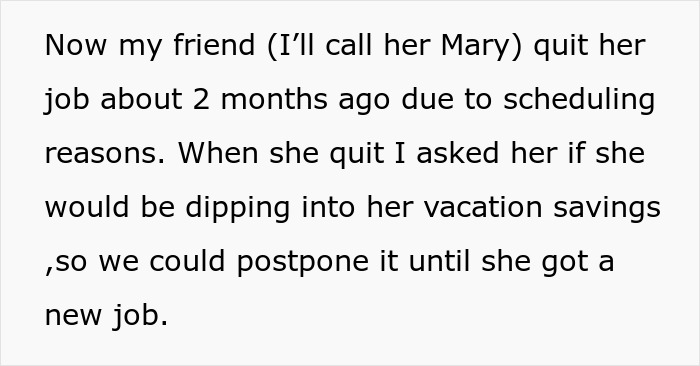

Like this woman who was asked to cover her friend’s travel expenses for a group vacation. The friend, who recently lost her job, did a poor job of managing her finances and had to rely on her friends to help pay for the trip. However, the author didn’t believe she was obligated to do so and was called selfish by the rest of the friend group. Wanting to find out whether her not covering her friend’s vacation expenses was a jerk move, she decided to consult with the Internet.

Traveling with friends is fun: you have company, you can feel safer, and you can even save on things like accommodation

Image credits: ShintarTatsiana / Envato Elements (not the actual photo)

That’s if the friend isn’t asking for you to pay for their plane ticket and hotel

Image credits: Nicole Geri / Unsplash (not the actual photo)

Image credits: Alexander Grey / Unsplash (not the actual photo)

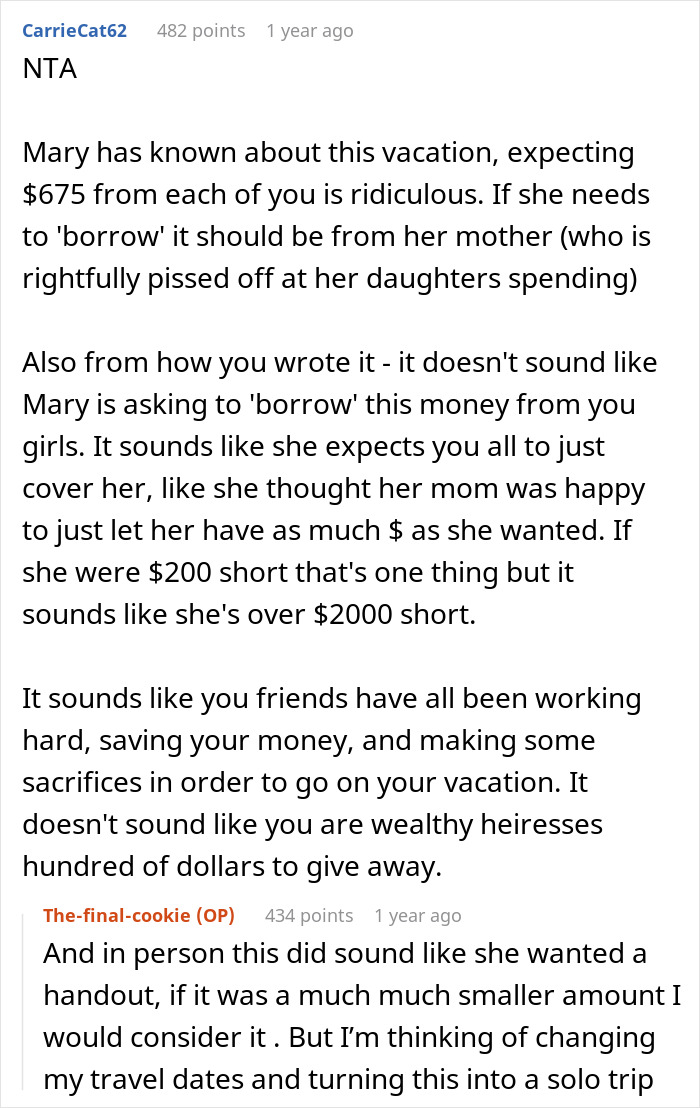

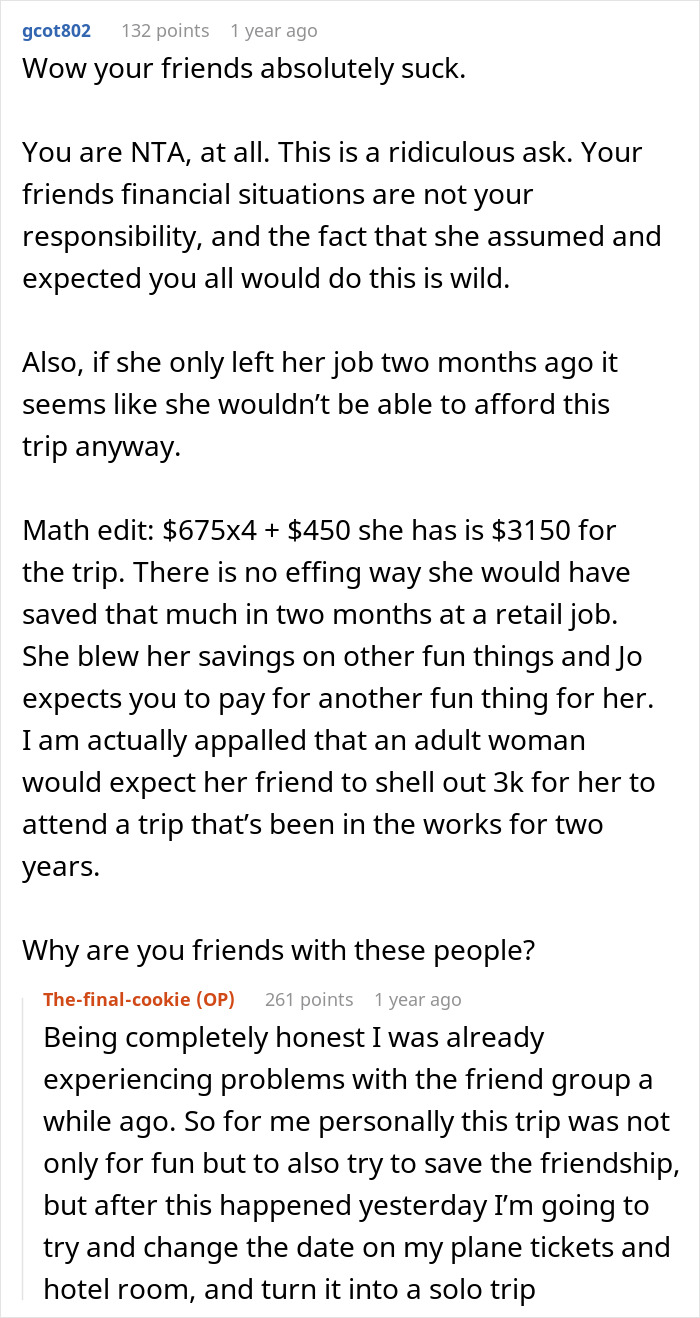

Image credits: The-final-cookie

People should tell friends beforehand if they can’t afford a trip or some element of it

Money and friendships don’t always mix. That’s because every person has a different stance on what’s appropriate or not when it comes to friends and money. Recently, Bustle asked their readers about the rules of money and friendship. Interestingly, it revealed that friends don’t shy away from talking openly about money matters.

Nearly 67% of the respondents said that their friend group is upfront about group trip costs. People believe it’s a must to discuss these things beforehand, before the Airbnb or a hotel is booked and before a dinner reservation is made. “If you can’t be a little bit vulnerable, are they even your friends?” one respondent posited.

One problem in this story seems to be the friends not agreeing to travel expenses ahead of time. According to Nerd Wallet, being upfront about what you won’t or can’t spend money on is crucial for surviving a group trip. The reality of a group vacation is that each person will likely want different things. Whether it’s about where to stay, what to eat, or what sights to see, you should always let your friends know if you can’t pay for something.

Tracking expenses during the trip is also important. Nowadays, it’s easy to pay your friends back for a smoothie or a museum ticket by using apps like Venmo. Others choose to track their expenses with apps like Splitwise and settle all expenses later. The bottom line is not to use one friend as a cash cow and expect them to cover costs without being asked.

Some tips on how to save up for a vacation on a budget

A vacation is like any other big expense. You might need to set some money aside each month to afford it. But that’s easier said than done, so here are some tips on how to save up for that vacation.

First of all, it’s important to start budgeting. Tracking your expenses on a spreadsheet or with the help of a budgeting app might help you see areas where you spend the most. Commit to spending only on basic expenses. You might need to sacrifice a night out or takeout every other evening, but remember all that money will go toward your trip.

Experts also advise avoiding making any flashy purchases. “I recommend postponing any other ‘big-ticket’ items. The vacation usually is its own big-ticket item, so you might want to push other big-ticket purchases (like a new car) into another calendar year,” Andy Smith, CFP, said. Going to concerts would probably fit this category as well.

Don’t expect to save up a lot of money over a month or two. Ted Rossman, industry analyst at Bankrate, explains how saving in small chunks can be more effective. If you want to save $2,000 over a year, you only have to put away $38 a month. If you don’t have that much time, you can opt for putting aside $167 a week. That way, you’ll have the $2k in three months.

If you want to save even more by setting aside a sum regularly, opening a high-yield account is an option. Kelly Johnson behind the travel blog “Snap Travel Magic” says it’s a great way to save. “Put 5% of each paycheck directly into the account,” she recommends. Ted Rossman says that naming the account something like “Hawaii 2024” will make you even more committed.

Then there are the small things, of course: cutting out all unnecessary expenses. Some people take on a side hustle to save up more, but not everyone can spare the extra time and mental energy. Other ways to get some extra cash might be to sell the stuff you don’t need (like clothes) in a garage sale or online. Also, consider if you really need all those subscriptions and pick one.

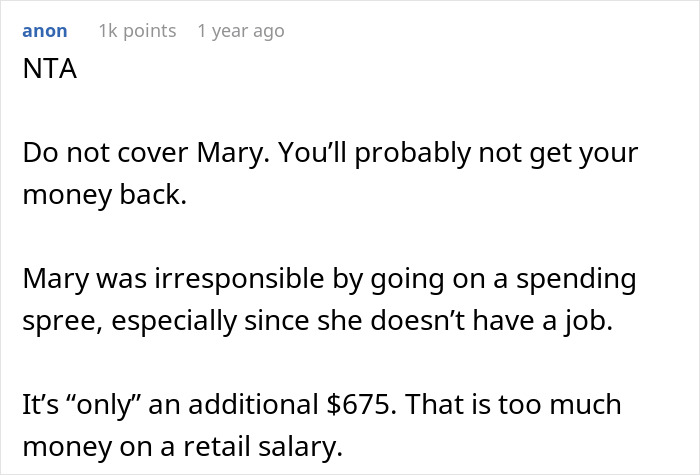

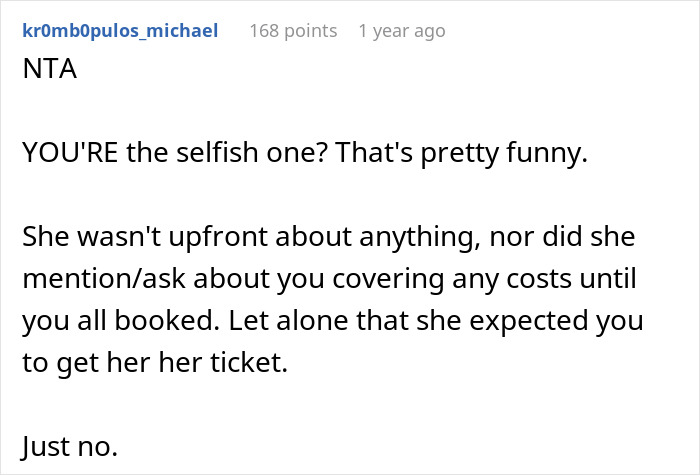

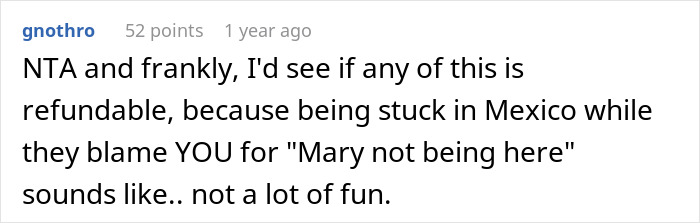

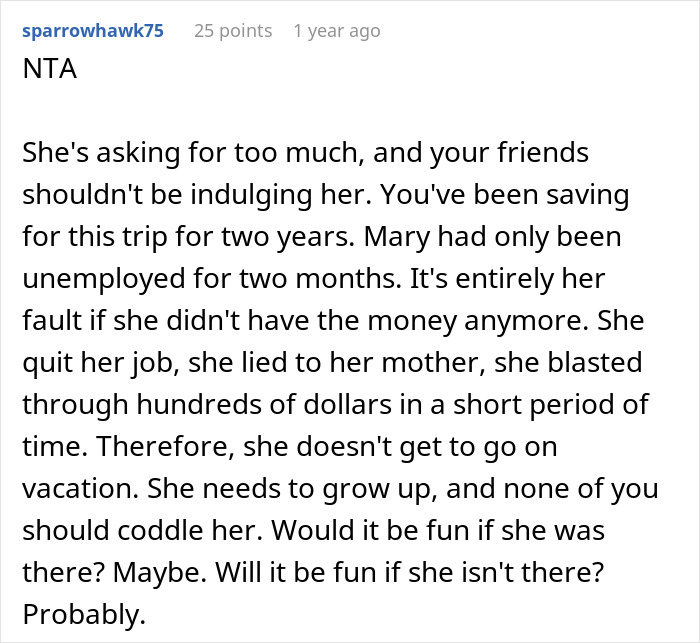

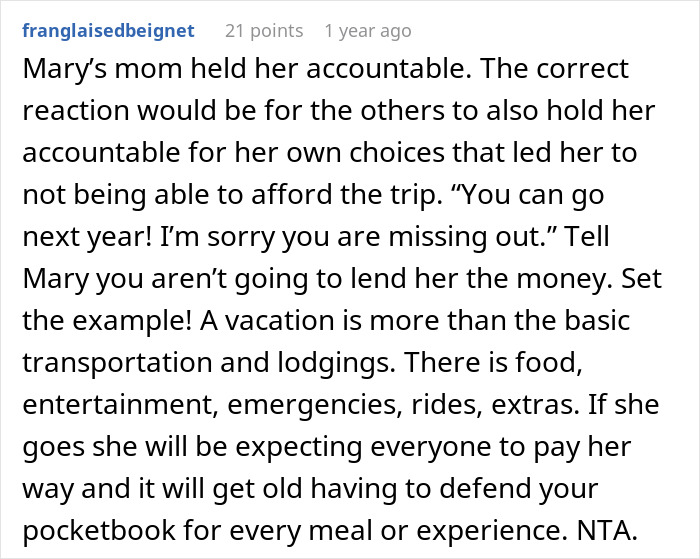

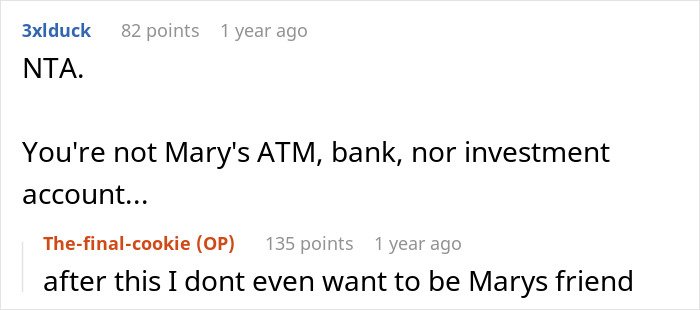

The woman told people how she was reconsidering the group trip because of her friends’ reactions

The consensus among people was that she shouldn’t feel guilty for saying ‘no’