Lending your family money is a nice idea right up until the point when it becomes clear that they might not be in a rush to pay you back. Things happen, but having a family member who is in debt to you start making massive financial mistakes while spending a lot more than you originally gave them might be cause for concern.

A rather well-off man sparked an online debate when he wondered if he was wrong for demanding that his sister return a $3K loan after she received a $30K inheritance. We reached out to the man in the story via private message and will update the article when he gets back to us.

Money and family sometimes don’t mix very well

Image credits: Karolina Kaboompics / Pexels (not the actual photo)

A man was angry that his sister would not pay back a $3K debt, despite receiving a large inheritance

Image credits: Karolina Kaboompics / Pexels (not the actual photo)

Image credits: Andrea Piacquadio / Pexels (not the actual photo)

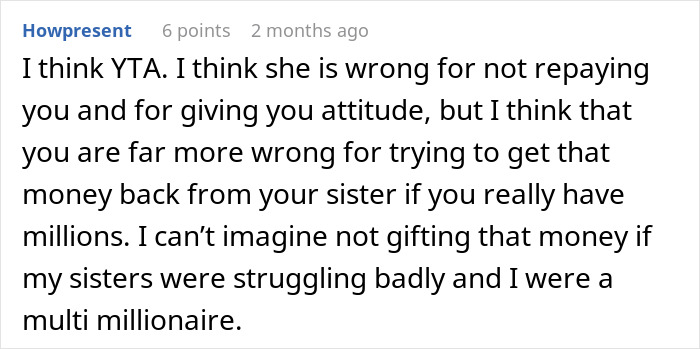

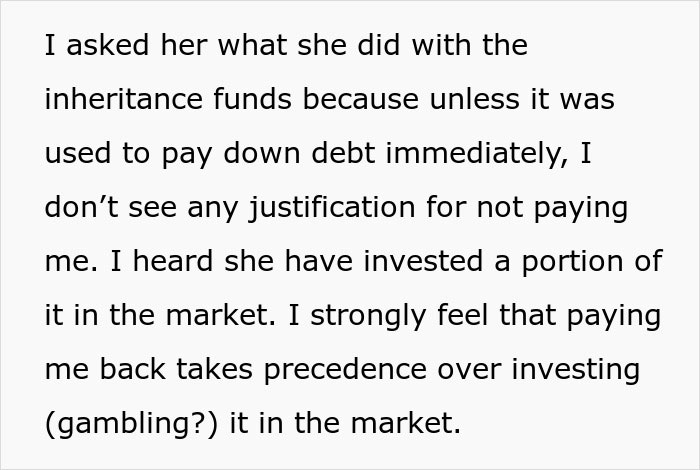

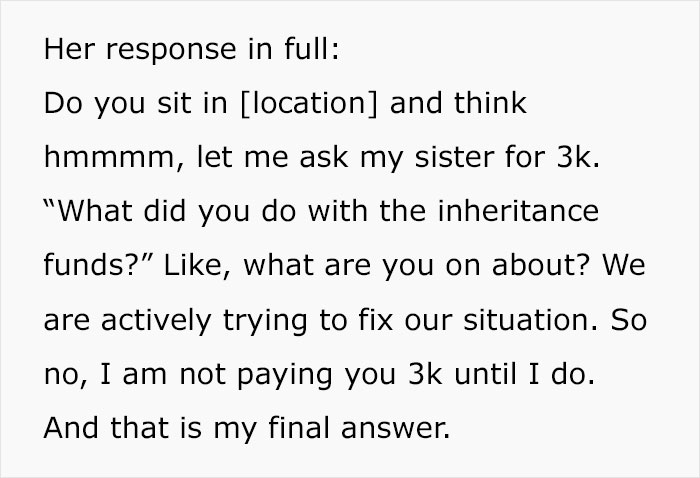

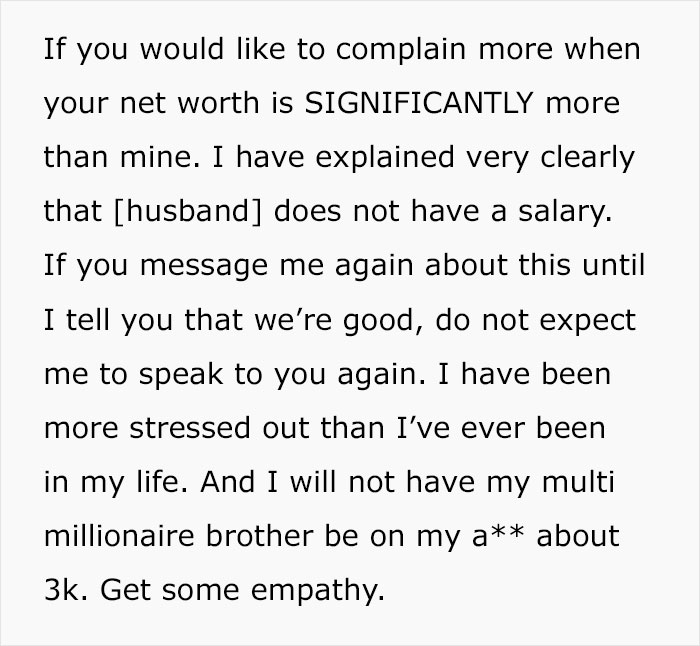

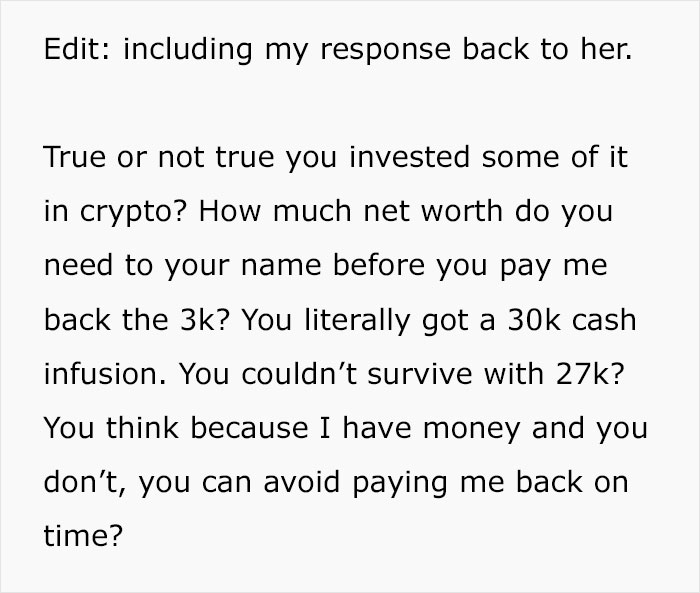

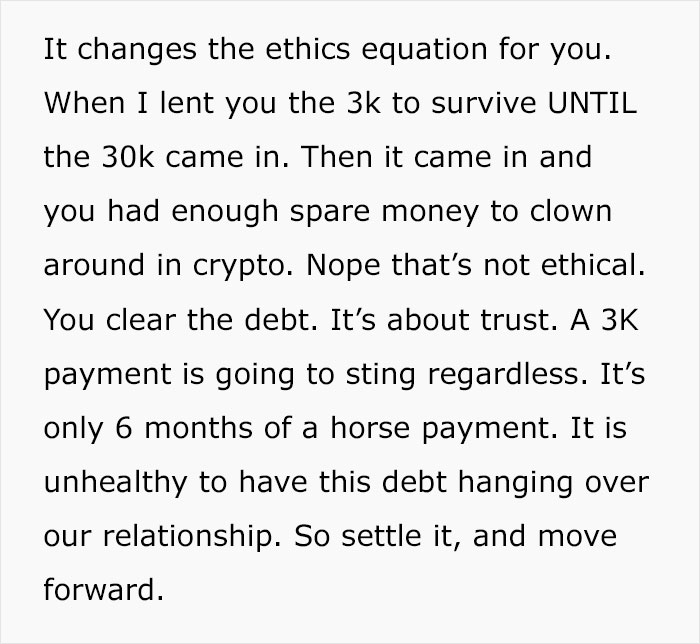

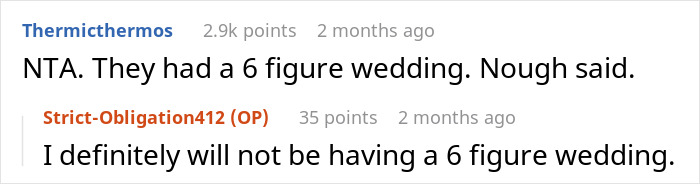

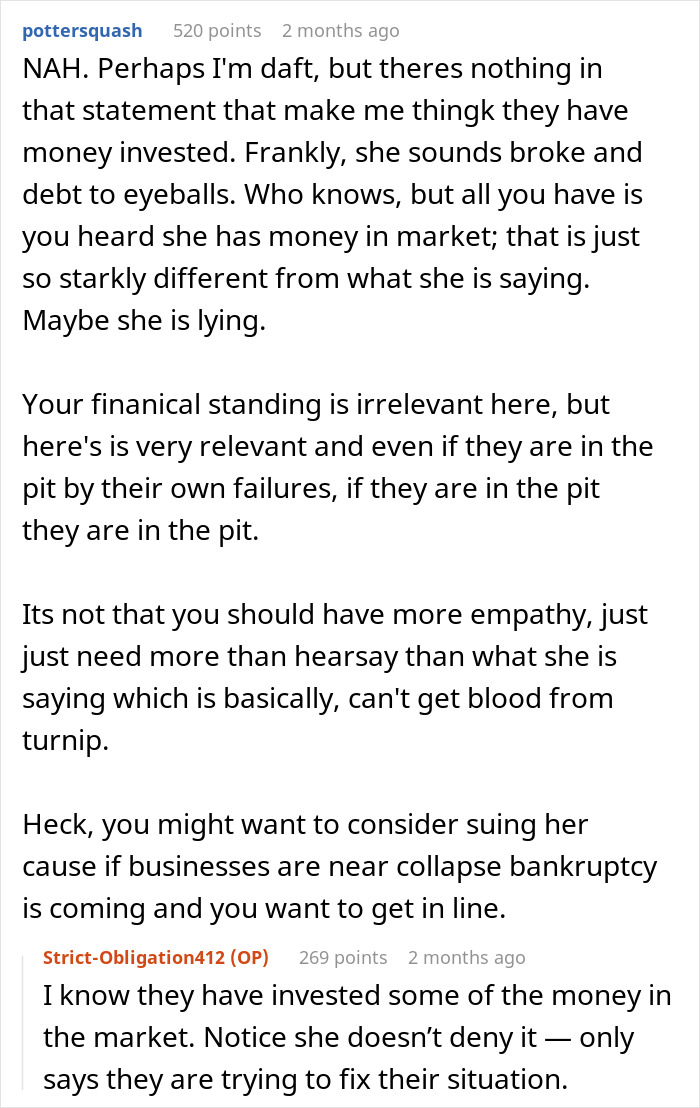

Image credits: Strict-Obligation412

Lending money to relatives is often pretty risky

Lending money to relatives is this strange juxtaposition of wanting to be there for your family, but also a massive risk, since the price of late payments is more than money. At least in the US, almost half of people who have given a relative money have ended up taking a loss due to partial or total lack of repayment.

There is a sort of silver lining to this. If you lend money, particularly serious money, to a relative and they don’t pay you back, you probably won’t end up repossessing their home. Banks and other financial institutions tend to be a lot more aggressive when it comes to getting their money back. This is one of the reasons many might consider borrowing from a family member even if they could probably qualify for a loan.

For example, even if you have very good credit, the paperwork and time needed to get the money in your bank account might not be quick enough if it’s a pressing matter. And when people make bad financial decisions, like this sister, it’s quite often a pressing matter. So if you just hand over some money to a relative with just a verbal agreement, you should understand what degrees of risk you are taking on.

Guilt and emotions are an inseparable part of mixing money and family

These loans are also complicated precisely because they aren’t “just business.” You can sob to your bank about wanting your dream wedding all you want, they are unlikely to give you anything. But, for example, a sibling tends to at least like you somewhat and might be moved by your arguments, even if it makes little sense to them financially.

Again, it’s not bad to help out family members in need, particularly if you can afford it. We all have times in our lives when we are particularly low. But it never hurts to take precautions. As with so many other things in life, it’s always best to get any deal, rule or promise in writing. The safest form might be a loan contract, but at least having them share what they need and when they intend to pay you back in an email is already a good starting point.

Importantly, some folks might not ask for money, but just ask to get access to your credit. Perhaps they want to use your card or even take out loans in your name. This is a terrible idea, unless you know beyond a shadow of a doubt that they will pay you back. Having bad credit is a major issue, building up good credit takes years. Similarly, co-signing on a loan or similar agreement might seem safe, but you have few ways to shield yourself from them deciding to rely on your income.

The risks of family loans run both ways

One side benefit of sending money to a relative is that it tends to incur less tax issues. In the US, for example, you can give eighteen thousand dollars a year as a gift. This number isn’t necessarily set in stone, as the IRS will often look at your entire tax history. So if you aren’t exceeding it constantly, you will be fine with giving a tad more, as long as you make sure to do your paperwork.

Unfortunately, taxes are a double-edged sword. For example, if you want to list our lack of family loan repayment as a loss, you will then have to register the loan in the first place. This might, in the long run, help you get your money back, but it also does mean that you will be putting real legal pressure on a relative. So it’s always important to ask yourself, how much are you willing to lose over this money.

In this story, it would appear that the man didn’t exactly need the money that much, he was more interested in the principle. It also seems that his sister is downright offended by this, so, paradoxically, the more he might pressure her, the more intransigent she might get. Ultimately, he might need to seek legal action, although fully destring a sibling relationship, even a not particularly great one for three thousand dollars seems like a steep price to pay.

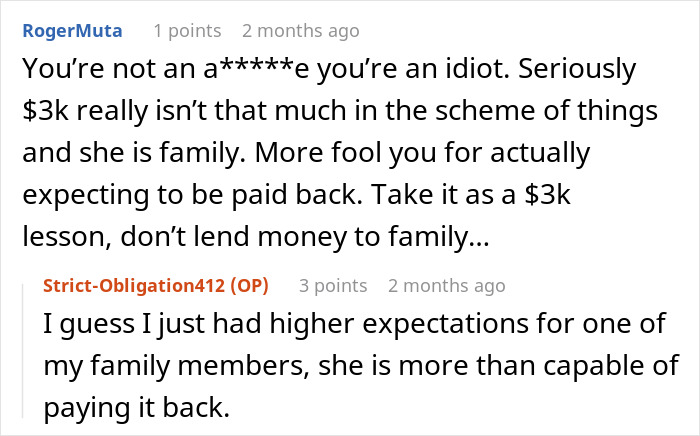

The brother chatted with some readers in the comments

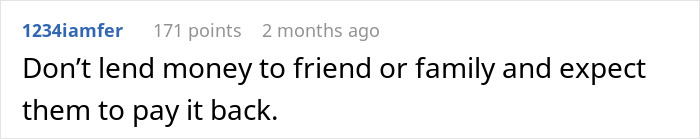

Many thought he was right to be angry

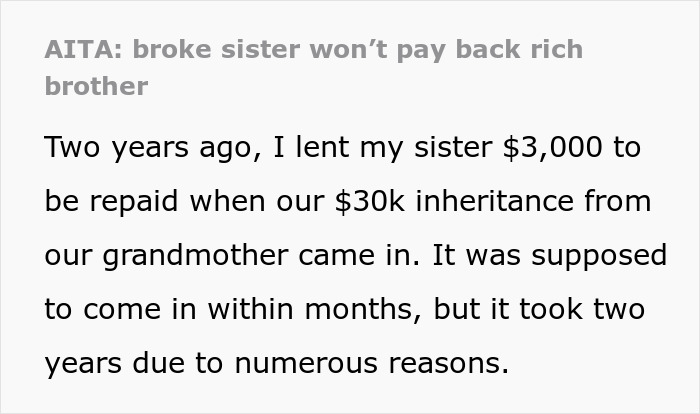

But some thought he was being dramatic, while others gave some suggestions