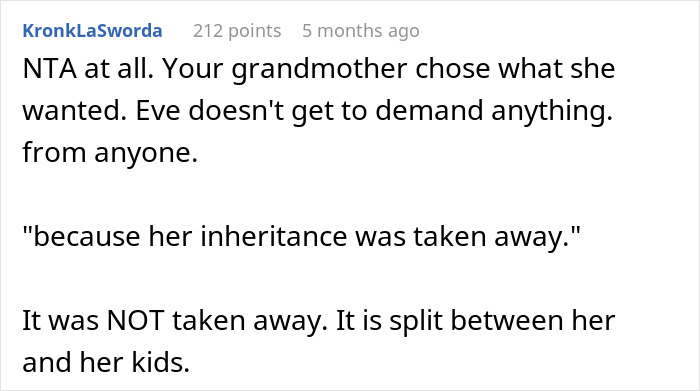

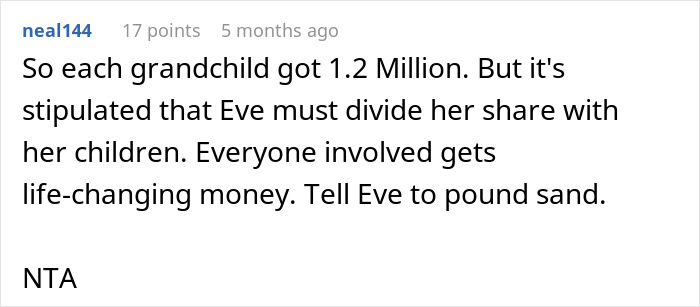

Dividing inheritance equally between heirs might seem like a default option. However, evenly splitting the estate may not make sense for all families. Given the circumstances, some may decide to leave the beneficiaries with what’s fair, even if they don’t particularly agree with it.

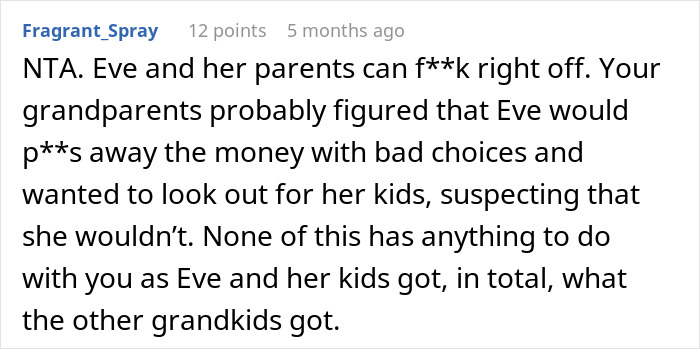

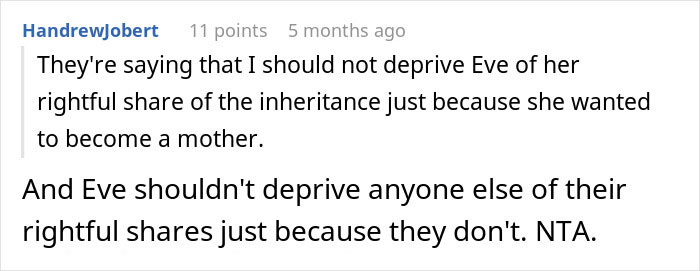

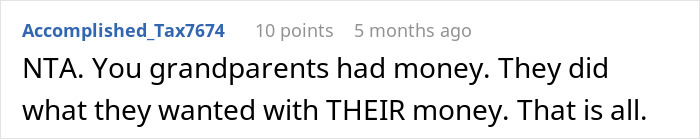

Just like what happened to this woman, who received a smaller part of the will as her late grandparents wished her to share it with her children. Majorly upset by this, she demanded that other grandchildren chip in, which didn’t end well.

Scroll down to find the full story and a conversation with a senior estate planner and shareholder, David Bross, who kindly agreed to give families some pointers on how to avoid disputes when splitting inheritance.

Splitting inheritance equally doesn’t make sense for all families

Image credits:YuriArcursPeopleimages (Not the actual photo)

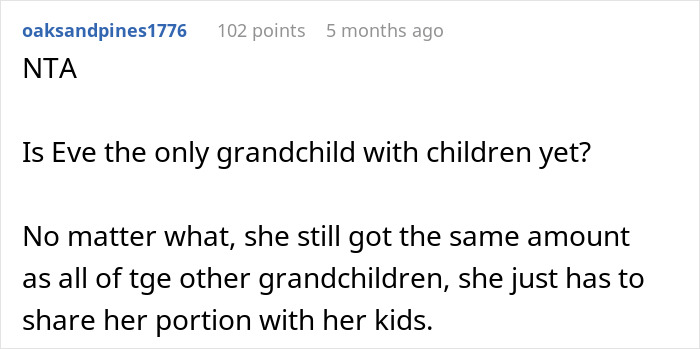

When this woman found out she was getting a smaller part of her grandparent’s inheritance, she demanded the rest of the cousins chip in

Image credits:Pressmaster (Not the actual photo)

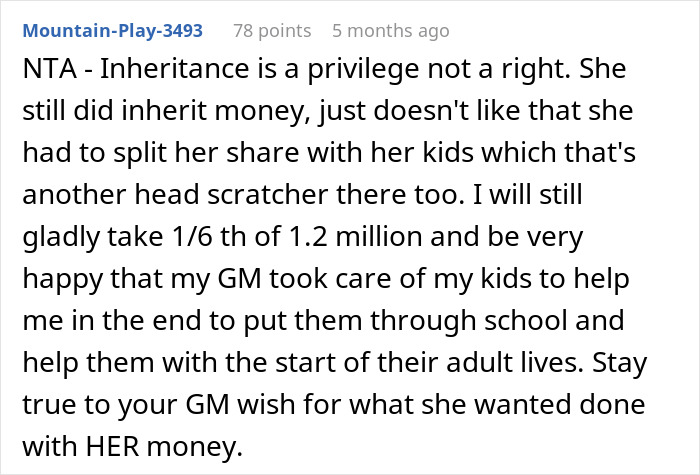

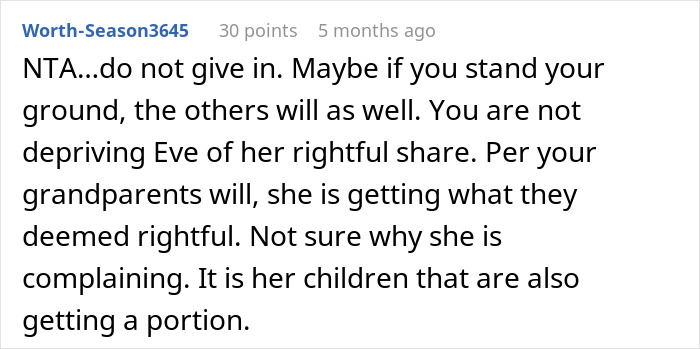

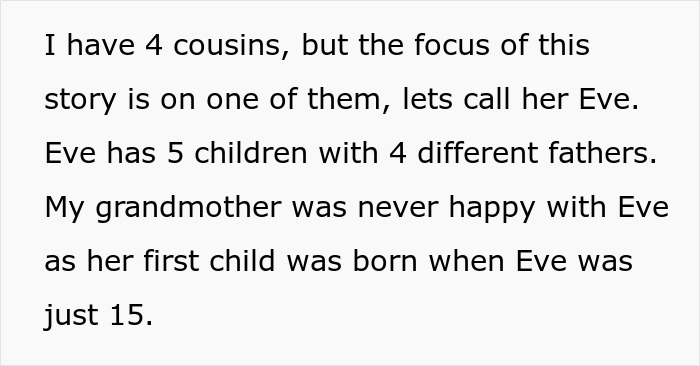

Image credits: anonymous

It makes sense for each heir to get an equal inheritance when all of them are in similar situations

Estate planning attorney Laura K. Meier says that it makes sense for each heir to get an equal inheritance when all of them have similar needs, are similarly situated in life, and have received similar financial support.

For instance, if beneficiaries don’t have disabilities or serious illnesses and have proven themselves to be responsible with money, it might be logical to divide assets equally. Even when the person feels that their family doesn’t deserve an equal inheritance, they might still divide it equally to avoid emotional and financial conflict.

The best way to decide how to split the possessions, according to Philip J. Ruce, estate planning director of Stone Arch Law Office, is to consider how likely it is that an heir will protest against the unequal inheritance.

“When there is actual or perceived inequality, the likelihood of someone looking for legal remedies increases substantially,” Ruce says. The testator has to decide if the risk of lawsuits is significant and thereafter worth it, as going through such legal issues not only is emotionally draining but can also cause the assets to end up in a different place than the owner hoped – “in lawyers’ pockets,” as Ruce notes.

Image credits:Pavel Danilyuk (Not the actual photo)

“The most important thing to remember is that it is your money, and you have a right to do with it what you choose”

A unique situation that might push a person to leave an unequal inheritance is if a family member is their caregiver and they want to compensate them for their devoted time. Or perhaps they were already given considerably more financial support during their lifetime, like, say, $30,000 for a wedding or a down payment for a house. In the former scenario, the heir might receive a bigger inheritance, while in the latter, a smaller one.

If a child who can’t take care of themselves is involved, the parent or their guardian may wish to leave most of their estate to them to ensure that they’re set when they’re no longer here. The disabled person might need support to meet basic living expenses and pay medical bills. Siblings shouldn’t be offended by such a decision, but it still might be beneficial to let the children know they’re receiving less money so it doesn’t come as a surprise after a loved one passes away.

Estate planning attorney Candice N. Aiston says that the overall guideline should be the preservation of family harmony and dynamics. “It is unbelievable how many families fall apart after the parents die because of how the estate is divided up,” she says.

To save the peace and prevent family disputes, senior estate planner and shareholder, David Bross recommends at least having the last will and testament in place. “This document will ensure that assets passing through probate are divided according to your wishes.

Second, we recommend that everyone review their estate plan every 3-5 years. Circumstances change and a periodic review will ensure your estate plan is consistent with your current wishes. Third, review beneficiary designations on all retirement plans, annuities, and life insurance. These assets are not part of the probate process, so they are not subject to the terms of your last will and testament. Often these designation are forgotten about and not reviewed, so they may name beneficiaries that are not consistent with the current estate plan.”

Image credits:Rhodi Lopez (Not the actual photo)

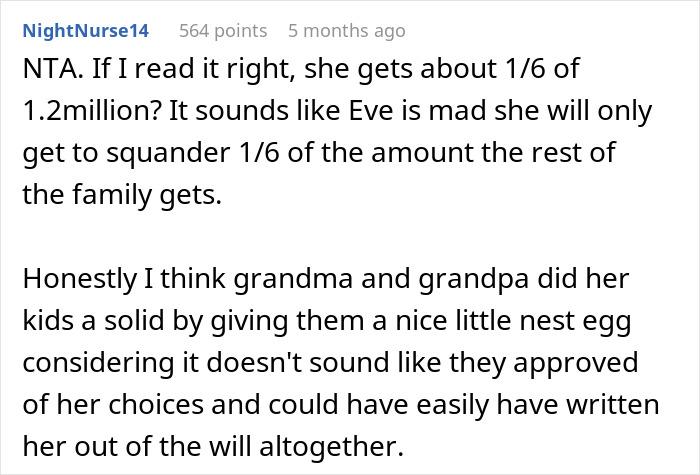

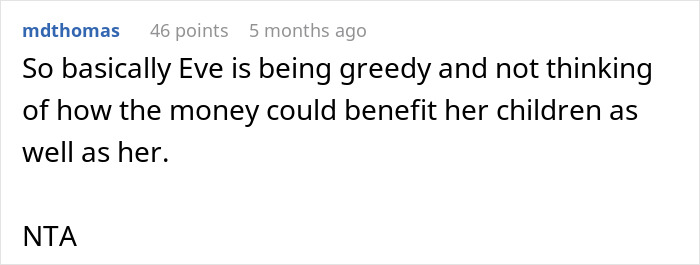

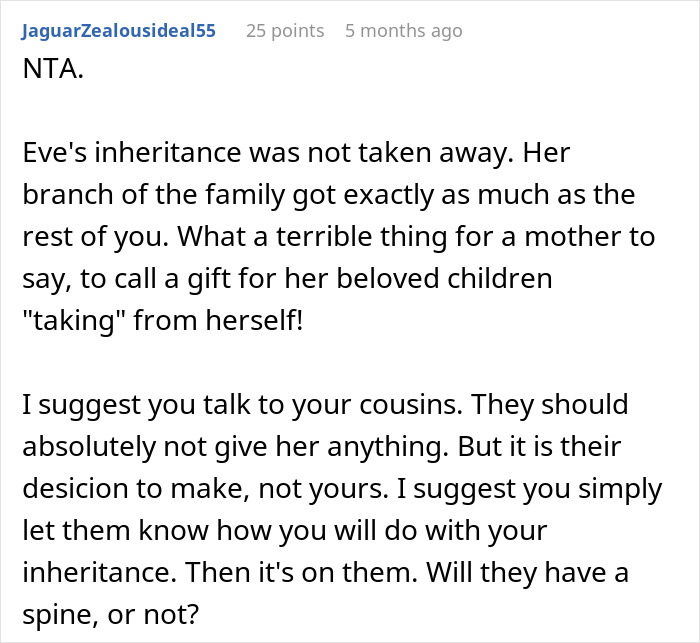

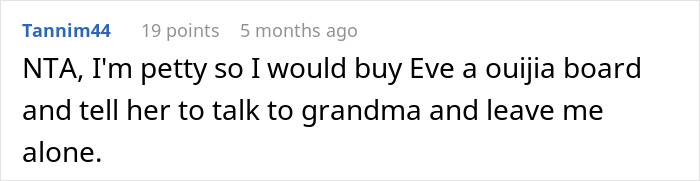

The readers decided that the author’s behavior was not wrong