Receiving an inheritance is always bittersweet. You would give anything to have the loved one that you lost back in your life again, but suddenly, you have some money that might lighten your financial load for a few months. And it’s completely up to you how you want to spend (or save) your inheritance. But according to one woman, if you have an older sister, she’s entitled to some of it too.

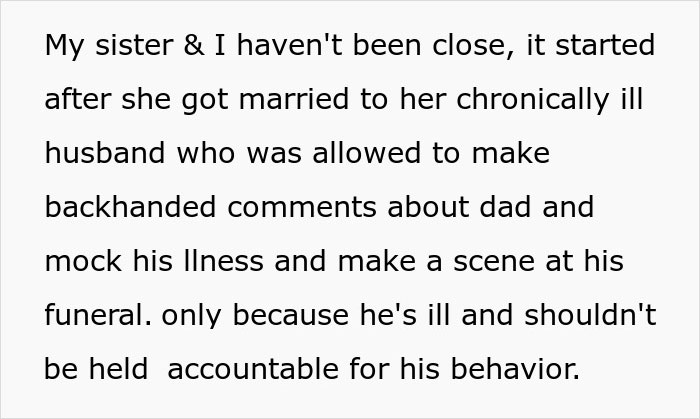

Below, you’ll find a story that was shared on the “Am I the [Jerk]?” subreddit, detailing the drama that went down between two sisters after one demanded that her sibling fund her husband’s surgery with their father’s money.

This woman received a substantial inheritance after losing her father

Image credits: Pavel Danilyuk / Pexels (not the actual photo)

But when her sister pressured her to share some of her funds, she refused to budge

Image credits: Karolina Kaboompics / Pexels (not the actual photo)

Image credits: Karolina Kaboompics / Pexels (not the actual photo)

Image credits: Home-Time-6077

Later, the woman responded to readers and provided some background information on the situation

Image credits: Karolina Kaboompics / Pexels (not the actual photo)

Most of us expect more inheritance than we’ll actually receive

Inheritance is something that most of us don’t like to think about until we absolutely have to. I can’t imagine ever receiving one because that would mean that I would be going through a tragic time in my life. But the reality is that not everyone leaves something behind for their children, spouse or relatives. According to Yahoo! Finance, a whopping 70-80% of households in the United States don’t receive any inheritance at all.

There is also often a discrepancy between how much people expect to receive from family members versus how much they actually inherit. Even those in the top 1% of the United States tend to anticipate being left over $900K, when they’re likely to receive a little over $700K in reality. After those in the top 10% of wealth, those in the next 40% report that they assume they’ll be left over $60K. But when their parents pass, they’ll probably only get around $46K.

And as for those in the bottom 50% of wealth in the U.S., most hope to receive over $29K in inheritance. In reality, however, they’ll be given less than $10K on average. Now, how much someone receives through inheritance depends on many factors, of course, including how many siblings they have, how much their parents earned, how many relatives leave them something, etc. But for some reason, it’s common for inheritance to come along with family drama.

Image credits: Ketut Subiyanto / Pexels (not the actual photo)

Divvying up inheritances often leads to conflicts within families

When it comes to why families fight over inheritance, Estate Planning notes that it’s common for conflicts to arise while everyone’s emotions are heightened. If you’re grieving the sudden loss of a loved one and you’re expected to plan a funeral and handle finances all at once, it’s perfectly normal to feel overwhelmed. And along with this stress and sadness can come irritability and acting out of character.

Inheritances might also drag ancient familial conflicts out of the closet. You might be reminded of how you always believed that Dad loved your sister more than you or that Mom favored her sons, and it’s easy to feel like things aren’t fair. Estate Planning shares that any of the anxieties we’re feeling after losing a loved one are likely to surface when splitting up inheritances.

Another reason why disputes might arise while dealing with inheritances are because of conflicts over physical assets, Willed notes on their site. Finances might have been explicitly divided up in a will, but especially if a death was unexpected, there might not be a solid plan for cars, family businesses, homes and other assets that children might want. Even if siblings didn’t seem interested in those items in the past, they might hold new weight now, as they can feel sentimental after losing a parent.

Image credits: Pavel Danilyuk / Pexels (not the actual photo)

You get to decide how to spend the money that you’ve inherited

If you happen to receive a large inheritance and you’re not sure what to do with it, it’s best to make a solid plan for where to put it or how to save it, so siblings and relatives don’t try to poach it from you. Investopedia recommends taking it slowly at first and not spending too much very quickly. Don’t make any big financial decisions while you’re grieving, as you might not be thinking properly, and remember that the money will still be there if you don’t touch it for a while.

It’s also wise to seek financial advice if necessary. You might have never seen this much money in your life, and you might have people pulling you in all sorts of different directions with it. A friend might be pressuring you to start a business with them while your sibling is begging you for money for surgery. Don’t hesitate to consult a financial planner who can help you navigate this time.

If you have any debts, it would be wise to pay those off first before focusing on spending the money elsewhere. And if you really don’t need the money at the moment, look into ways that you can wisely invest it. Your future self will thank you.

We would love to hear your thoughts on this situation in the comments below, pandas. Do you think this woman was right to keep her money to herself? Feel free to share, and then if you’re interested in checking out another Bored Panda article discussing inheritance drama, look no further than right here!

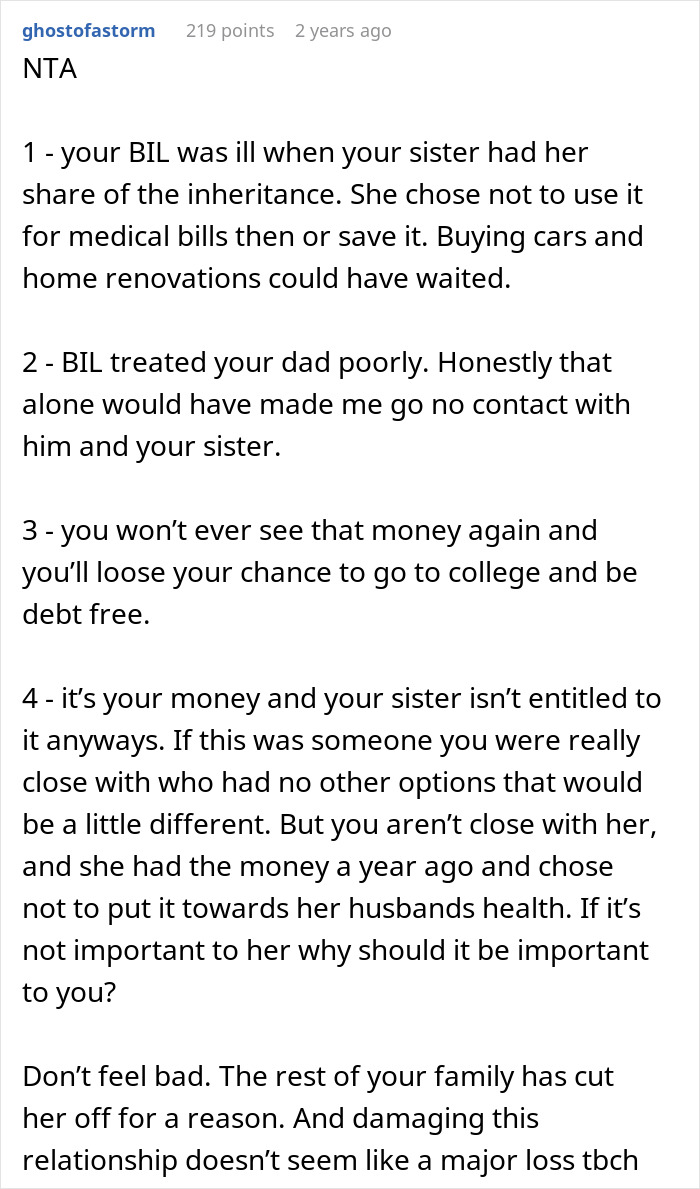

Many readers assured the woman that she has every right to keep her money

However, some thought it would be better to loan her sister the funds